Anheuser-Busch InBev (ENXTBR:ABI) Profit Margin Rises to 12.2%, Reinforcing Bullish Valuation Narratives

Reviewed by Simply Wall St

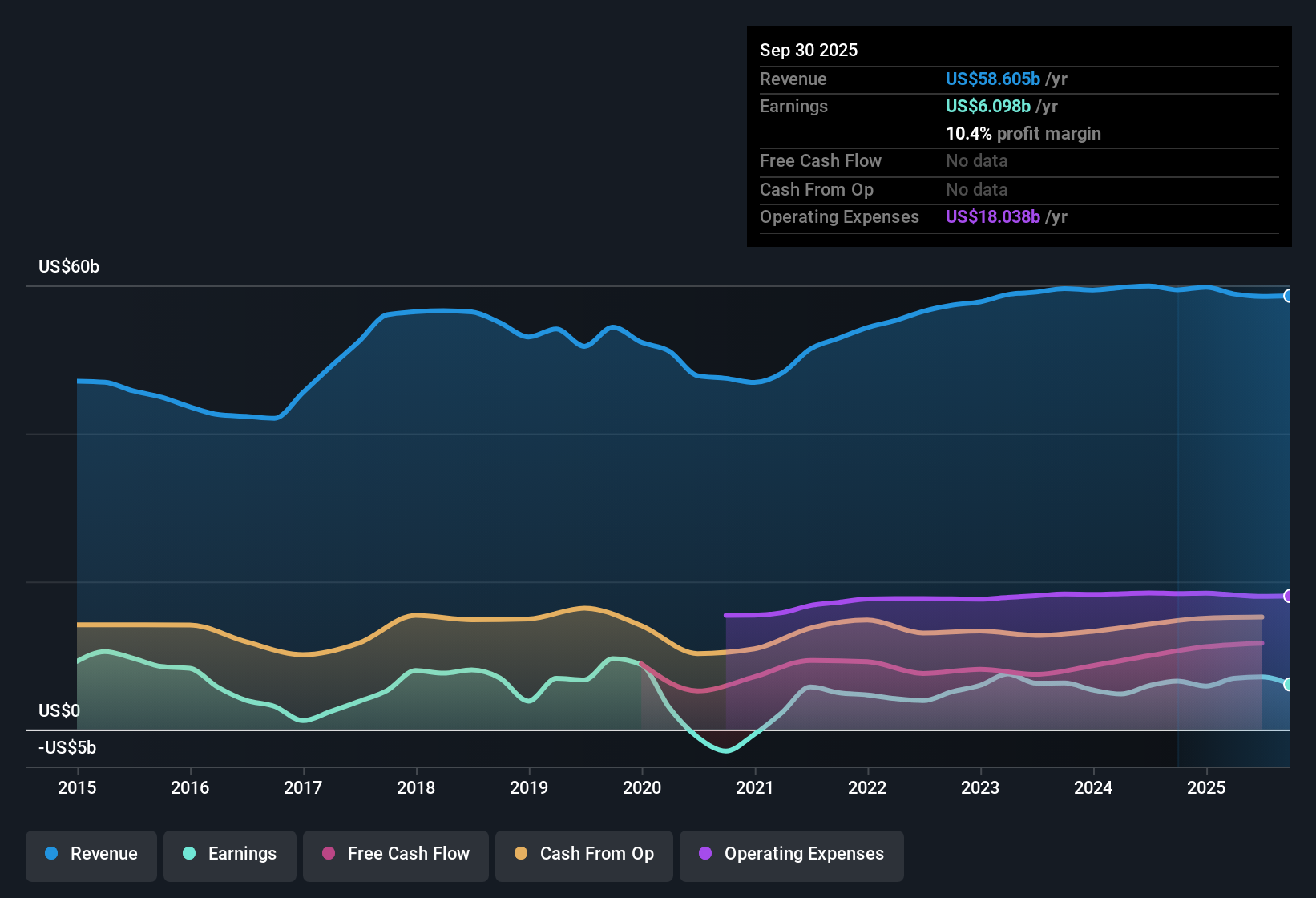

Anheuser-Busch InBev (ENXTBR:ABI) posted a net profit margin of 12.2% for the most recent period, a jump from last year’s 9.9%. Over the past five years, the company has averaged 24.5% annual earnings growth, with current-year earnings up 20%. Although this is not as rapid as previous years, it is still growing. With analysts forecasting another 10.03% per year in earnings growth and the stock trading well below consensus fair value estimates, investors are likely to see the current combination of sustained profitability and favorable valuation as key drivers in ABI’s latest report.

See our full analysis for Anheuser-Busch InBev.Now that we have the headline figures, let’s see how they compare to the bigger-picture narratives shaping investor sentiment around Anheuser-Busch InBev.

See what the community is saying about Anheuser-Busch InBev

Purple-chip Premiumization Outpaces Beer Volumes

- Premium and no- and low-alcohol brands, including megabrands like Corona and a 33% surge in non-alcoholic beer revenue, have led to higher revenue per hectoliter and margin expansion, even as some key emerging markets saw weaker volume growth.

- Analysts’ consensus view notes that premiumization, digital transformation, and innovation in alternatives are giving ABI an edge.

- They also flag ongoing demand softness in major emerging markets like China and Brazil, where volumes have yet to recover despite revenue gains.

- This mix shift towards premium and innovation supports the positive outlook for margin durability, but also exposes ABI to changing consumer preferences and market risk.

- Curious how these strategies could shape ABI’s long-term story? Discover the full Consensus Narrative for more context.📊 Read the full Anheuser-Busch InBev Consensus Narrative.

Cost Efficiencies Propel Margin Gains

- EBITDA margin increased by 116 basis points in Q2, a direct result of operational optimizations, disciplined resource allocation, and robust productivity initiatives, even with persistent cost and FX headwinds.

- Analysts’ consensus view highlights that digital and operational efficiency investments are helping to offset headwinds.

- This margin boost is material given the backdrop of only modest revenue growth (forecast at 5% annually) and ongoing cost pressures.

- Despite these gains, further upside depends on continued success in driving cost out and managing currency and commodity risk, which remains a watchpoint for analysts.

Valuation Discount Relative to DCF and Peers

- ABI’s current price-to-earnings ratio is 16.5x, below the peer group average of 22.6x, but nearly identical to the broader European beverage industry at 16.4x. DCF fair value is estimated at €141.31 per share versus a market price of €51.86, representing over a 60% discount on that basis.

- According to the analysts’ consensus view, the current share price trades 24.5% below the analyst price target of €68.68, suggesting the market is still skeptical about the sustainability of margin and revenue trends.

- They emphasize that consensus price targets reflect an expectation that margins will climb to 14.3% and earnings per share will reach $5.09 by 2028.

- With financial leverage still over 3x net debt to EBITDA, it remains an open debate whether ABI can close the valuation gap without a bigger improvement in its balance sheet.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Anheuser-Busch InBev on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something others might not? In just a few minutes, you can bring your perspective to life and share your narrative on the results. Do it your way

A great starting point for your Anheuser-Busch InBev research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite margin improvements, ABI’s substantial financial leverage and ongoing debate over its balance sheet strength remain obstacles to closing its valuation gap.

If you want to prioritize companies with healthier balance sheets and less leverage risk, check out solid balance sheet and fundamentals stocks screener (1984 results) built to weather headwinds in any market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:ABI

Anheuser-Busch InBev

Produces, distributes, exports, markets, and sells beer in North America, Middle Americas, South America, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with proven track record.

Market Insights

Community Narratives