As European markets navigate the complexities of AI-related valuation concerns and shifting interest rate expectations, the pan-European STOXX Europe 600 Index recently experienced a decline, reflecting broader sentiment challenges. Despite these headwinds, eurozone business activity continues to expand steadily, suggesting potential opportunities for discerning investors seeking value in underappreciated sectors. In this environment, identifying stocks with strong fundamentals and growth potential can be crucial for those looking to capitalize on Europe's hidden investment opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Dekpol | 61.42% | 9.03% | 14.54% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Evergent Investments | 3.63% | 11.27% | 22.67% | ★★★★★☆ |

| Sparta | NA | nan | nan | ★★★★★☆ |

| KABE Group AB (publ.) | 3.82% | 3.46% | 5.42% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 13.23% | 20.22% | 17.99% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Gimv (ENXTBR:GIMB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Gimv NV is a private equity and venture capital firm specializing in direct and fund of funds investments, with a market capitalization of €1.69 billion.

Operations: Gimv generates revenue primarily through its private equity and venture capital investments, focusing on direct and fund of funds strategies. The firm's market capitalization stands at €1.69 billion.

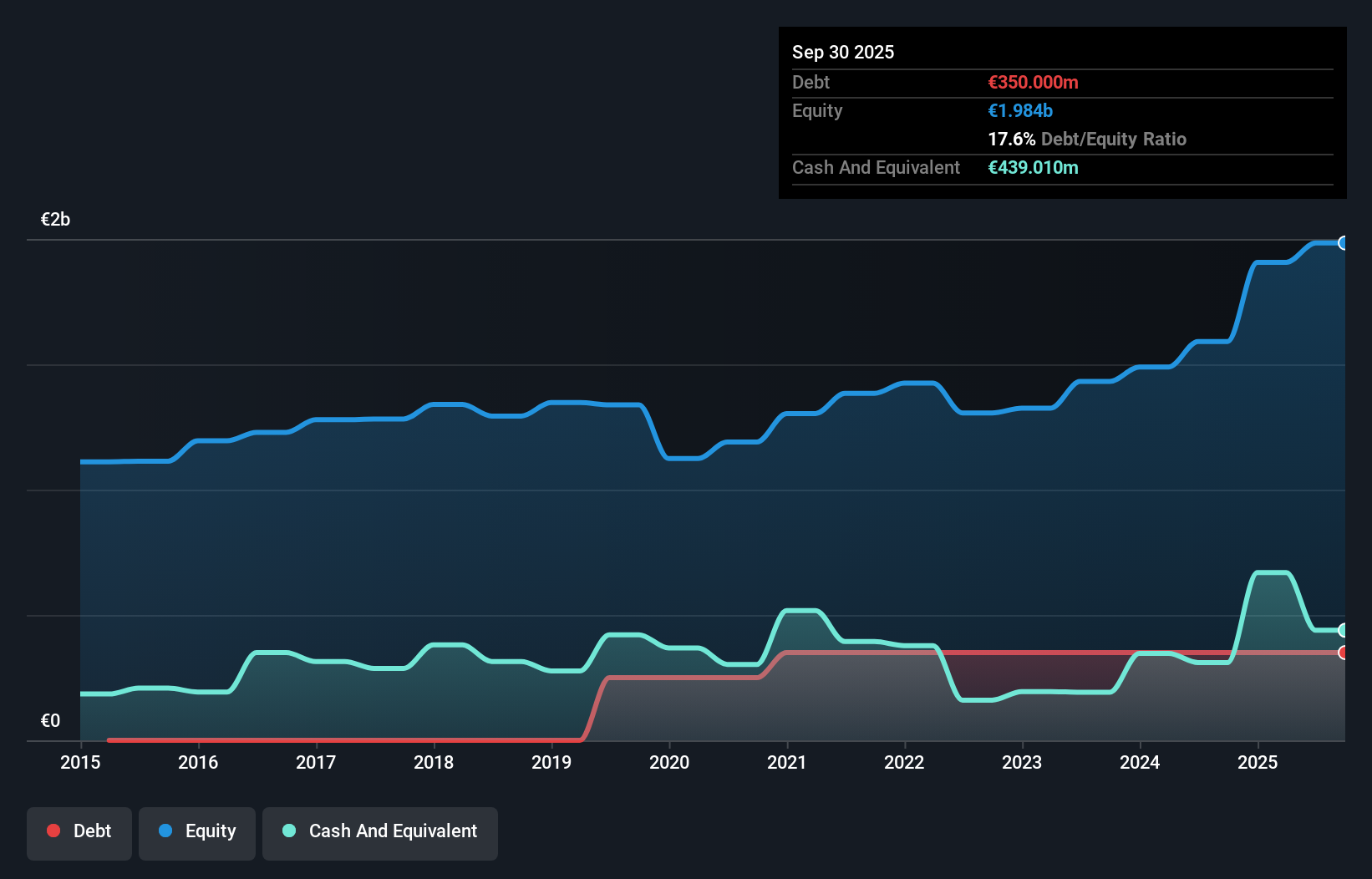

Gimv, a European investment company, presents an intriguing mix of financial metrics. It trades at 46.1% below its estimated fair value and boasts high-quality past earnings, indicating potential for value seekers. Despite having more cash than total debt and a reduced debt-to-equity ratio from 21% to 17.6% over five years, the firm faces challenges with negative earnings growth of -1.4%, contrasting the industry average of 10.5%. Recent half-year results show net income at €126.93 million (US$134 million), down from €144.87 million (US$153 million) last year, highlighting some performance pressures amidst otherwise solid fundamentals.

- Click to explore a detailed breakdown of our findings in Gimv's health report.

Gain insights into Gimv's past trends and performance with our Past report.

EPC Groupe (ENXTPA:EXPL)

Simply Wall St Value Rating: ★★★★★★

Overview: EPC Groupe is involved in the manufacture, storage, and distribution of explosives across Europe, Africa, Asia Pacific, and the Americas with a market capitalization of €505.19 million.

Operations: EPC Groupe generates revenue primarily from its Specialty Chemicals segment, which accounts for €513.62 million. The company's net profit margin trends are not disclosed in the available data, so further analysis would be needed to assess profitability.

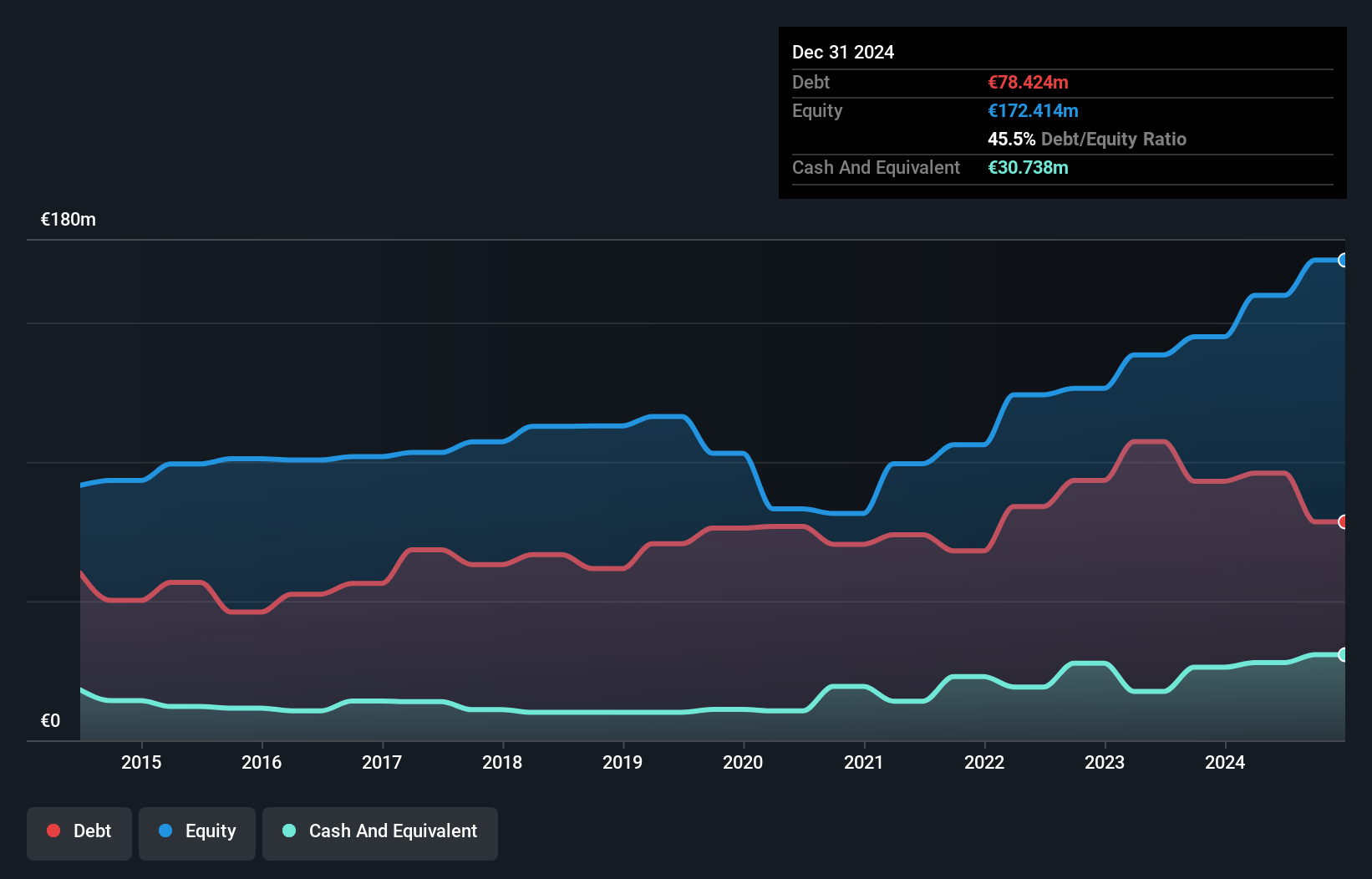

EPC Groupe, a notable player in the chemicals sector, has shown robust earnings growth of 15.5% over the past year, outpacing the industry average of 12.8%. The company's net debt to equity ratio stands at a satisfactory 39.8%, having improved from 92.4% five years ago to 54.6%. With interest payments well covered by EBIT at 4.3 times, EPC appears financially sound and is trading at an attractive valuation, reportedly 30.5% below its fair value estimate. Recent half-year results revealed sales of €260 million and net income of €13 million, alongside inclusion in the CAC All-Tradable Index, highlighting its growing market presence.

- Delve into the full analysis health report here for a deeper understanding of EPC Groupe.

Evaluate EPC Groupe's historical performance by accessing our past performance report.

Bonheur (OB:BONHR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Bonheur ASA operates in the renewable energy, wind service, and cruise sectors across various regions including the United Kingdom, Norway, Europe, Asia, the Americas, Africa, and internationally with a market capitalization of NOK9.34 billion.

Operations: The company's primary revenue streams are from Wind Service (NOK5.09 billion), Cruise (NOK3.78 billion), and Renewable Energy (NOK2.56 billion). The net profit margin presents an interesting trend, reflecting the financial efficiency of these operations across its diverse sectors.

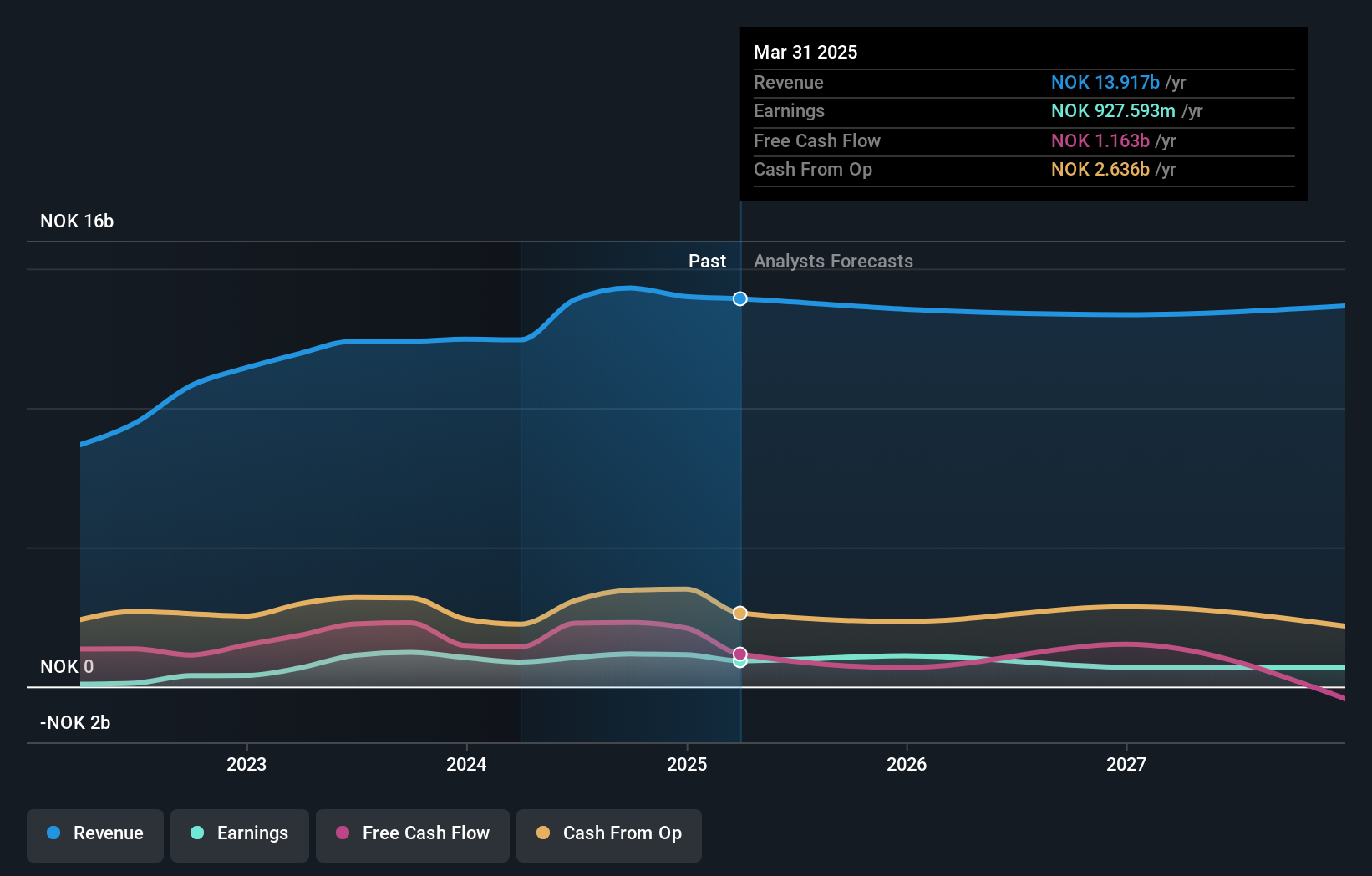

Bonheur, a dynamic player in the renewable energy sector, has shown impressive earnings growth of 19.5% over the past year, outpacing its industry peers. The company's net debt to equity ratio stands at a satisfactory 17.5%, indicating sound financial management and reduced leverage from 214.1% to 84.2% over five years. Despite challenges like potential revenue decline by an average of 7.2% annually for the next three years, Bonheur's interest payments are well covered with EBIT coverage at 9.2 times, reflecting strong operational efficiency and risk management strategies that bolster its long-term value proposition amidst market fluctuations.

Where To Now?

- Reveal the 311 hidden gems among our European Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EPC Groupe might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EXPL

EPC Groupe

Engages in the manufacture, storage, and distribution of explosives in Europe, Africa, Asia Pacific, and the Americas.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives