European Penny Stocks Under €2B Market Cap: 3 Hidden Gems To Watch

Reviewed by Simply Wall St

As the European markets experience a boost with the pan-European STOXX Europe 600 Index rising by 0.90% amid slowing inflation and easing ECB monetary policy, investors are exploring opportunities in less conventional areas. Though 'penny stocks' might sound like a relic from past trading days, they still offer relevant opportunities for those interested in smaller or newer companies. With strong financials, these stocks can provide a mix of affordability and growth potential, making them an intriguing option for investors seeking hidden value.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| KebNi (OM:KEBNI B) | SEK1.832 | SEK496.76M | ✅ 3 ⚠️ 4 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.66 | SEK274.45M | ✅ 4 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €3.18 | €67.07M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.65 | €17.39M | ✅ 2 ⚠️ 3 View Analysis > |

| Abak (WSE:ABK) | PLN4.20 | PLN11.32M | ✅ 2 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.415 | SEK2.31B | ✅ 4 ⚠️ 1 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.60 | SEK219.02M | ✅ 2 ⚠️ 2 View Analysis > |

| Euroland Société anonyme (ENXTPA:MLERO) | €3.26 | €9.49M | ✅ 2 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.20 | €303.74M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.976 | €32.68M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 446 stocks from our European Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Deceuninck (ENXTBR:DECB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Deceuninck NV is involved in the design, manufacture, recycling, and distribution of multi-material window, door, and building solutions across Europe, North America, Turkey, and other international markets with a market cap of €303.74 million.

Operations: The company's revenue is primarily generated from its Window and Door Systems segment at €759.81 million, followed by Home Protection at €40.48 million, and Outdoor Living at €26.70 million.

Market Cap: €303.74M

Deceuninck NV, with a market cap of €303.74 million, shows promising financial health for a penny stock. Its earnings have grown significantly by 46.6% over the past year, outpacing the industry average and its five-year growth rate of 5.1%. The company's interest payments are well covered by EBIT at 9.8x coverage, and its net debt to equity ratio is satisfactory at 16.7%. While Deceuninck's return on equity is low at 4.5%, it trades below fair value estimates by approximately 24.8%. Recent dividend announcements affirm a cash dividend of €0.056 per share payable in May 2025.

- Jump into the full analysis health report here for a deeper understanding of Deceuninck.

- Learn about Deceuninck's future growth trajectory here.

Metsä Board Oyj (HLSE:METSB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Metsä Board Oyj operates in the folding boxboard, fresh fibre linerboard, and market pulp sectors both in Finland and internationally, with a market cap of €1.24 billion.

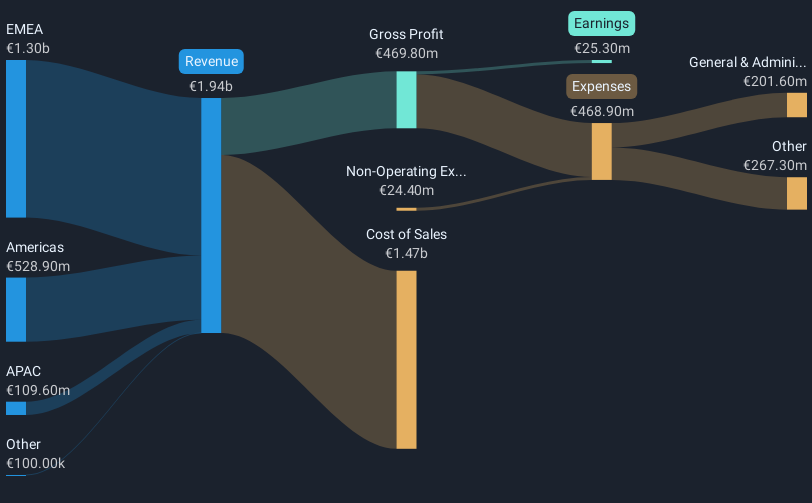

Operations: The company generates €1.94 billion in revenue from its operations in the folding boxboard, fresh fibre linerboard, and market pulp sectors.

Market Cap: €1.24B

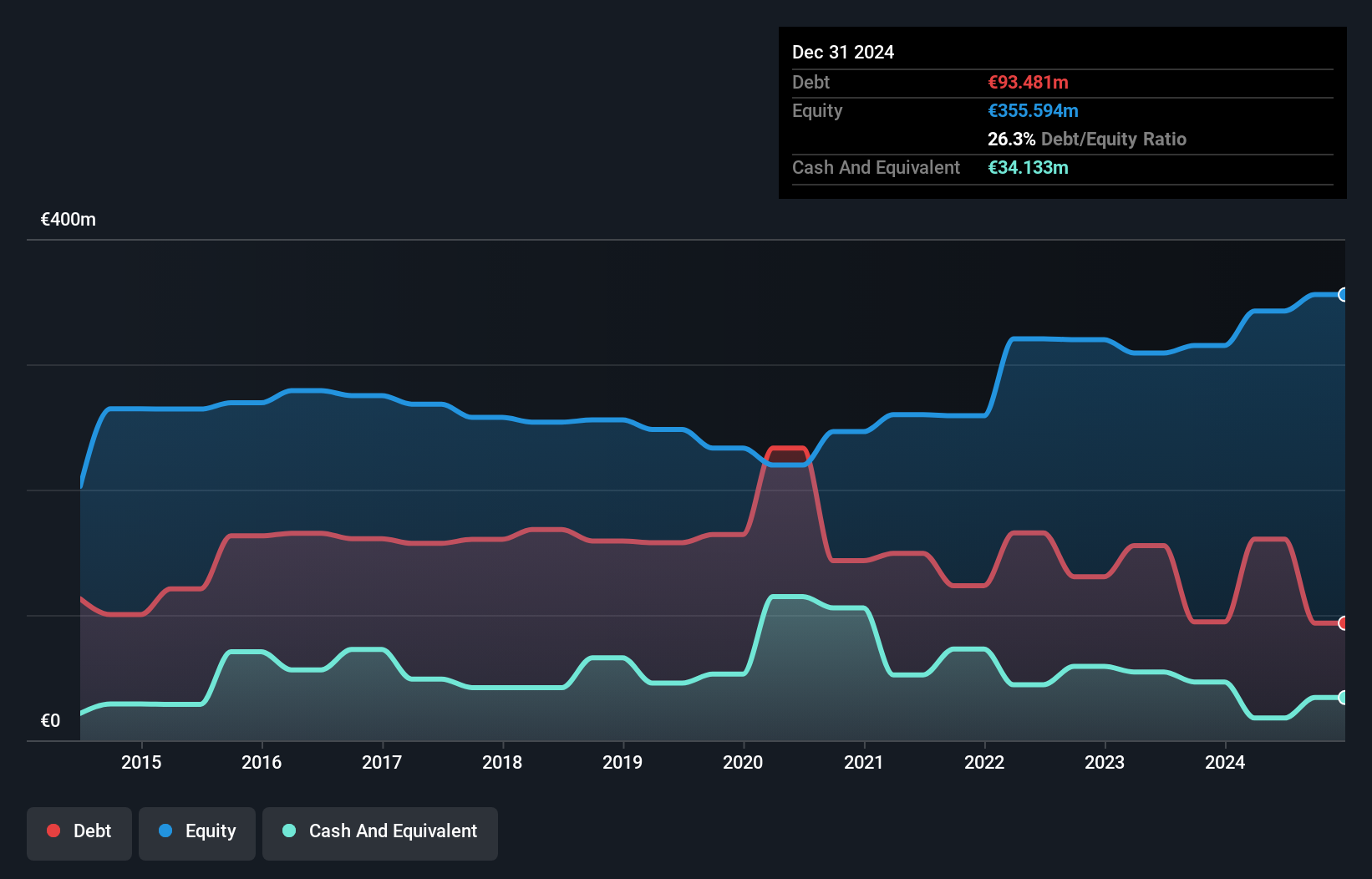

Metsä Board Oyj, with a market cap of €1.24 billion, presents a mixed profile for investors in the penny stock segment. The company's net debt to equity ratio is satisfactory at 20.6%, and its short-term assets exceed both short-term and long-term liabilities, indicating sound liquidity management. However, the return on equity remains low at 1%, and recent earnings show a net loss of €7 million compared to last year's profit. Despite negative earnings growth over the past year, Metsä Board trades significantly below estimated fair value and has recently issued green bonds worth €200 million to finance sustainable projects.

- Click to explore a detailed breakdown of our findings in Metsä Board Oyj's financial health report.

- Review our growth performance report to gain insights into Metsä Board Oyj's future.

Xbrane Biopharma (OM:XBRANE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Xbrane Biopharma AB is a biotechnology company focused on developing, manufacturing, and selling biosimilars, with a market capitalization of SEK413.69 million.

Operations: Xbrane Biopharma generates revenue from its Biosimilar Development segment, totaling SEK277.89 million.

Market Cap: SEK413.69M

Xbrane Biopharma, with a market cap of SEK413.69 million, offers an intriguing yet volatile opportunity in the penny stock landscape. Despite being unprofitable and facing increased volatility, Xbrane has shown significant revenue growth, reporting SEK93.24 million in Q1 2025 compared to SEK14.07 million a year prior. The company's recent follow-on equity offering of SEK200 million aims to bolster its cash runway beyond the current two months. While auditor concerns about its going concern status persist, strategic advancements like the FDA review for its biosimilar candidate could potentially influence future prospects if approvals are secured by October 2025.

- Click here to discover the nuances of Xbrane Biopharma with our detailed analytical financial health report.

- Explore Xbrane Biopharma's analyst forecasts in our growth report.

Make It Happen

- Take a closer look at our European Penny Stocks list of 446 companies by clicking here.

- Want To Explore Some Alternatives? AI is about to change healthcare. These 22 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:XBRANE

Xbrane Biopharma

A biotechnology company, engages in the development, manufacture, and sale of biosimilars.

High growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives