- Australia

- /

- Renewable Energy

- /

- ASX:GNX

Did You Manage To Avoid Genex Power's (ASX:GNX) 30% Share Price Drop?

For many investors, the main point of stock picking is to generate higher returns than the overall market. But if you try your hand at stock picking, your risk returning less than the market. We regret to report that long term Genex Power Limited (ASX:GNX) shareholders have had that experience, with the share price dropping 30% in three years, versus a market return of about 40%. On top of that, the share price has dropped a further 26% in a month.

View our latest analysis for Genex Power

Given that Genex Power didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over three years, Genex Power grew revenue at 79% per year. That is faster than most pre-profit companies. While its revenue increased, the share price dropped at a rate of 11% per year. That seems like an unlucky result for holders. It seems likely that actual growth fell short of shareholders' expectations. Still, with high hopes now tempered, now might prove to be an opportunity to buy.

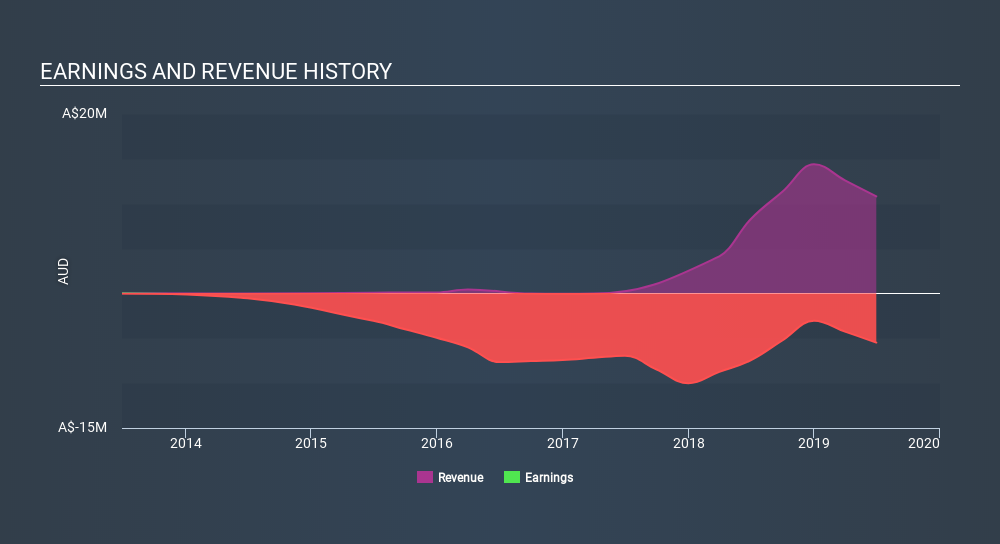

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Genex Power shareholders are down 19% for the year, but the broader market is up 24%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. The three-year loss of 11% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:GNX

Genex Power

Develops and commercializes renewable energy generation and storage projects in Australia.

Limited growth very low.

Market Insights

Community Narratives