- Singapore

- /

- Real Estate

- /

- SGX:H13

Asian Undervalued Small Caps With Insider Action To Consider

Reviewed by Simply Wall St

Amidst concerns over inflated AI stock valuations and broader market volatility, the Asian markets are experiencing a complex economic landscape. As investors navigate these challenges, identifying small-cap stocks with potential insider action can offer unique opportunities for those seeking to diversify their portfolios in this dynamic region.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.4x | 1.0x | 28.83% | ★★★★★★ |

| East West Banking | 3.0x | 0.7x | 21.48% | ★★★★★☆ |

| Civmec | 16.5x | 0.9x | 47.17% | ★★★★☆☆ |

| Centurion | 3.9x | 3.2x | -58.57% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 44.57% | ★★★★☆☆ |

| Nickel Asia | 12.2x | 1.9x | 15.43% | ★★★☆☆☆ |

| Nam Cheong | 4.5x | 1.7x | -109.64% | ★★★☆☆☆ |

| Ever Sunshine Services Group | 6.8x | 0.4x | -443.80% | ★★★☆☆☆ |

| PSC | 9.9x | 0.4x | 19.25% | ★★★☆☆☆ |

| Chinasoft International | 22.8x | 0.7x | -1246.83% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Virgin Australia Holdings (ASX:VGN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Virgin Australia Holdings operates as a major Australian airline offering domestic and international passenger services, with a market capitalization of A$2.34 billion.

Operations: The company generates revenue primarily from its Airlines and Velocity segments, with the Airlines segment contributing A$5.58 billion. The gross profit margin has shown a notable trend, peaking at 30.33% as of June 2024. Operating expenses include significant allocations to sales and marketing, which reached A$421.4 million in recent periods.

PE: 4.6x

Virgin Australia Holdings, recently added to the S&P/ASX Small Ordinaries, 300, and All Ordinaries Indexes on September 22, 2025, presents a compelling case for investors exploring smaller stocks in Asia. Despite reporting a net income of A$478.5 million for the year ending June 30, down from A$545.4 million previously, insider confidence has been evident with share purchases throughout the past year. While its high debt level poses risks due to reliance on external borrowing without customer deposits as a buffer, these challenges are counterbalanced by strategic index inclusions and potential growth avenues in an evolving market landscape.

- Get an in-depth perspective on Virgin Australia Holdings' performance by reading our valuation report here.

Gain insights into Virgin Australia Holdings' past trends and performance with our Past report.

D&L Industries (PSE:DNL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: D&L Industries operates as a diversified manufacturer in the Philippines, focusing on food ingredients, oleochemicals, resins, powder coatings, colorants and plastic additives, and aerosols with a market cap of approximately ₱64.08 billion.

Operations: The primary revenue streams for the company include Food Ingredients and Oleochemicals, Resins and Powder Coatings, contributing significantly to its overall sales. Over recent periods, there has been a noticeable trend in gross profit margin, peaking at 21.39% in mid-2019 before experiencing fluctuations and reaching 12.99% by late 2025. Operating expenses have consistently impacted net income margins, which have shown a gradual decline from over 10% in early periods to around 4.73% by the latest quarter of 2025.

PE: 10.8x

D&L Industries, a small-cap player in Asia, shows potential for growth with earnings projected to rise 18.48% annually. Despite relying on external borrowing, the company reported solid revenue of PHP 14.7 billion for Q3 2025, up from PHP 10.5 billion the previous year. Net income also increased to PHP 554 million from PHP 493 million year-on-year. Insider confidence is evident as insiders have been purchasing shares consistently since early this year, suggesting optimism about future performance despite funding risks.

- Click to explore a detailed breakdown of our findings in D&L Industries' valuation report.

Examine D&L Industries' past performance report to understand how it has performed in the past.

Ho Bee Land (SGX:H13)

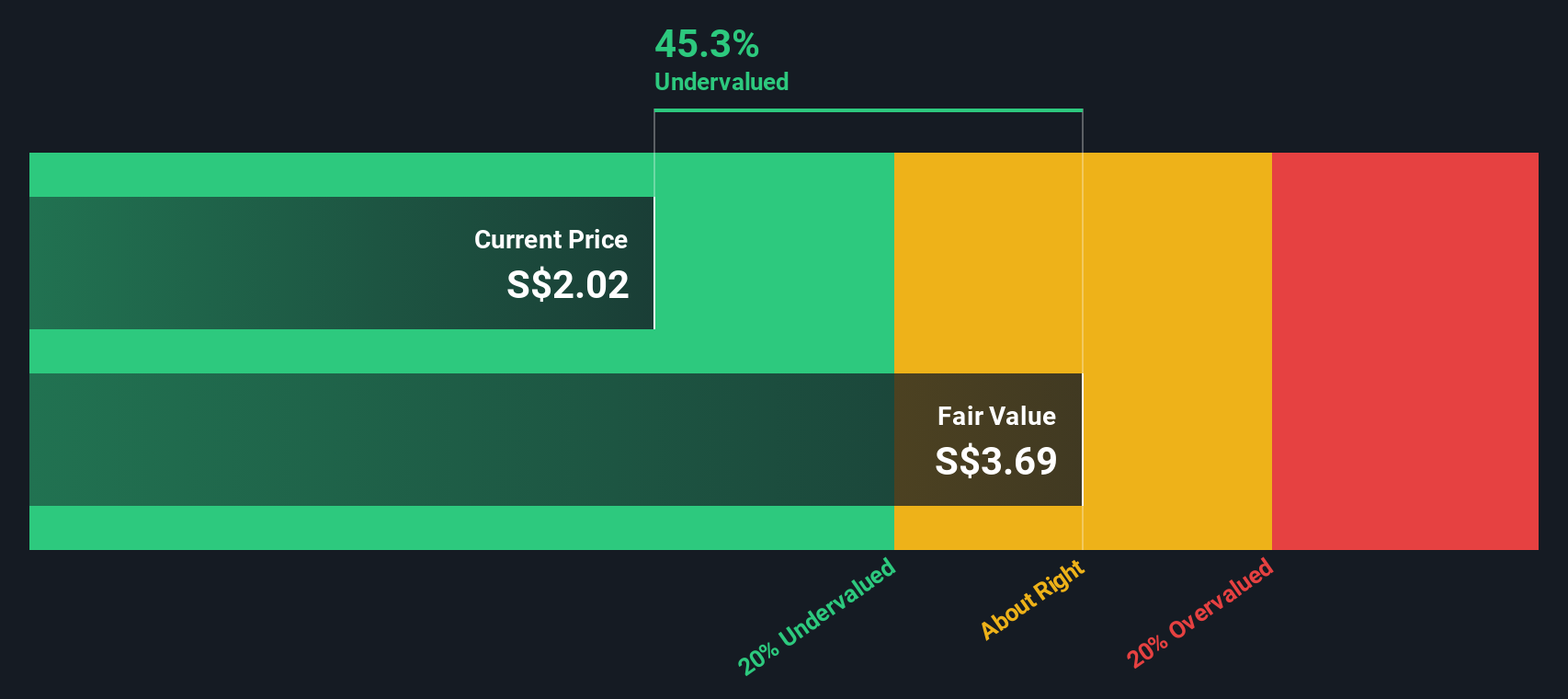

Simply Wall St Value Rating: ★★★★★☆

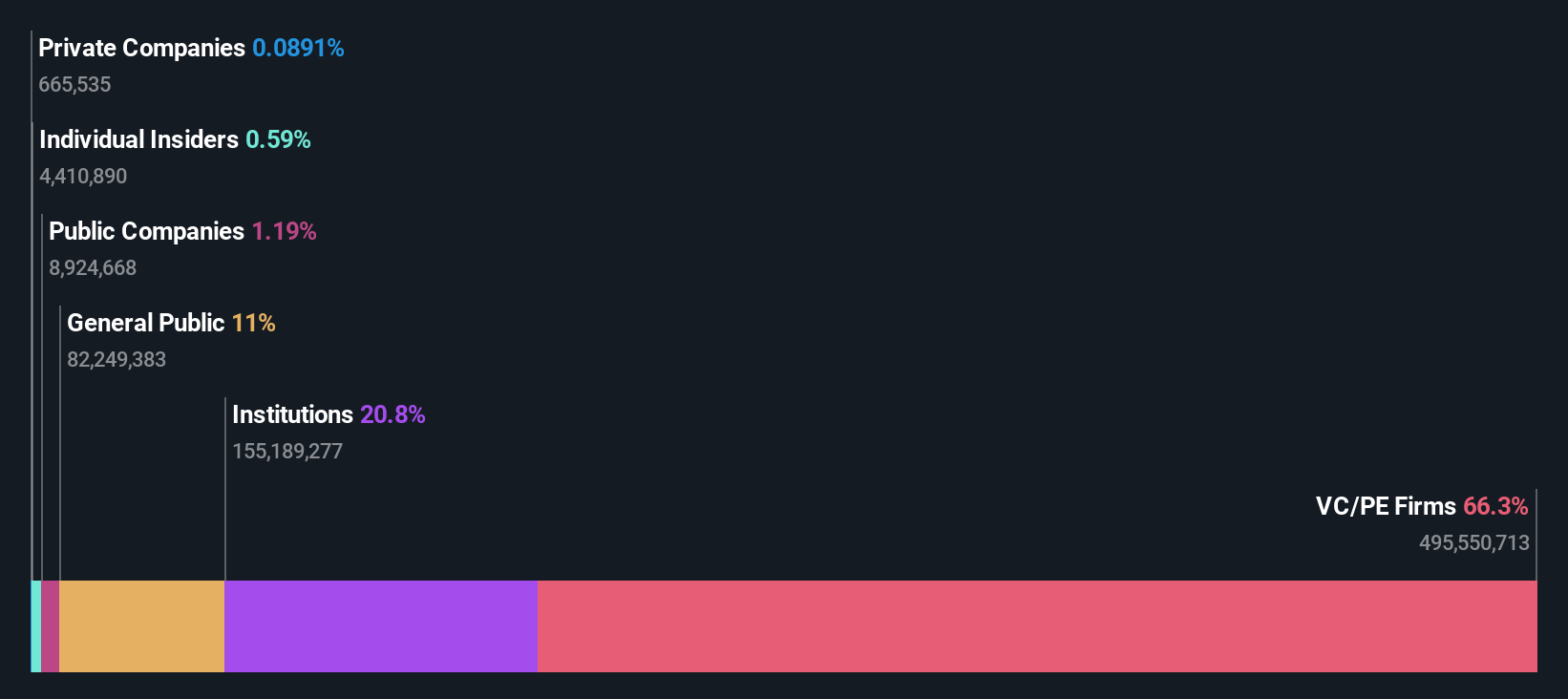

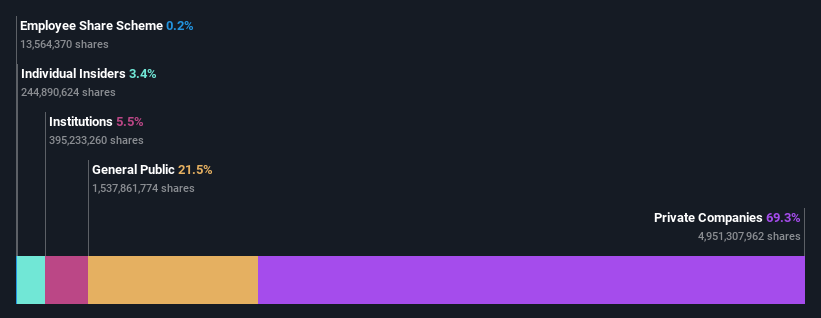

Overview: Ho Bee Land is a real estate company engaged in property investment and development, with a market cap of S$2.48 billion.

Operations: Ho Bee Land derives its revenue primarily from property investment and development, with the former contributing slightly more. The company has experienced fluctuations in its gross profit margin, which reached a low of 56.72% and a high of 99.48% over the reviewed periods. Operating expenses are consistently within a range that includes general and administrative costs, impacting overall profitability. Notably, the net income margin has varied significantly due to non-operating expenses affecting net results in recent periods.

PE: 9.5x

Ho Bee Land, a smaller player in Asia's real estate sector, has recently caught attention due to insider confidence. Executive Chairman Thian Poh Chua purchased 143,500 shares for approximately S$248,972 between September and November 2025. This move suggests belief in the company's potential despite challenges like reliance on external borrowing and forecasted earnings decline of 5.9% annually over the next three years. As they prepare to release Q3 results today, investors are keenly observing potential shifts in performance or strategy.

- Navigate through the intricacies of Ho Bee Land with our comprehensive valuation report here.

Understand Ho Bee Land's track record by examining our Past report.

Where To Now?

- Get an in-depth perspective on all 46 Undervalued Asian Small Caps With Insider Buying by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ho Bee Land might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:H13

Undervalued with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success