- Australia

- /

- Infrastructure

- /

- ASX:QUB

Qube Holdings (ASX:QUB) Valuation in Focus After Higher Sales, Revenue and Dividend Boost in Latest Earnings

Reviewed by Simply Wall St

Most Popular Narrative: 0.5% Undervalued

According to community narrative, Qube Holdings is viewed as trading just below its estimated fair value, suggesting a modest undervaluation based on expected future performance.

The expected increase in TEU volume at the IMEX terminal at Moorebank, driven by new customers and the relocation of the Minto operations, could contribute to future revenue growth. The continued strength and expansion in Qube's Forestry and Energy businesses, including growth from renewables and scope expansion with existing customers, is anticipated to positively impact earnings.

What’s fueling this near-fair value status? The company has laid out a bold roadmap for growth and margin expansion from new operations. Are these strategies effective enough to influence long-term earnings projections, or does the current share price already reflect their impact? The full narrative provides the key numbers and turning points that could shape Qube Holdings’ valuation in the coming years.

Result: Fair Value of $4.32 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent headwinds in the automotive market or delays at new terminals could present challenges for Qube Holdings as it works to meet its growth expectations.

Find out about the key risks to this Qube Holdings narrative.Another View: Market-Based Comparison

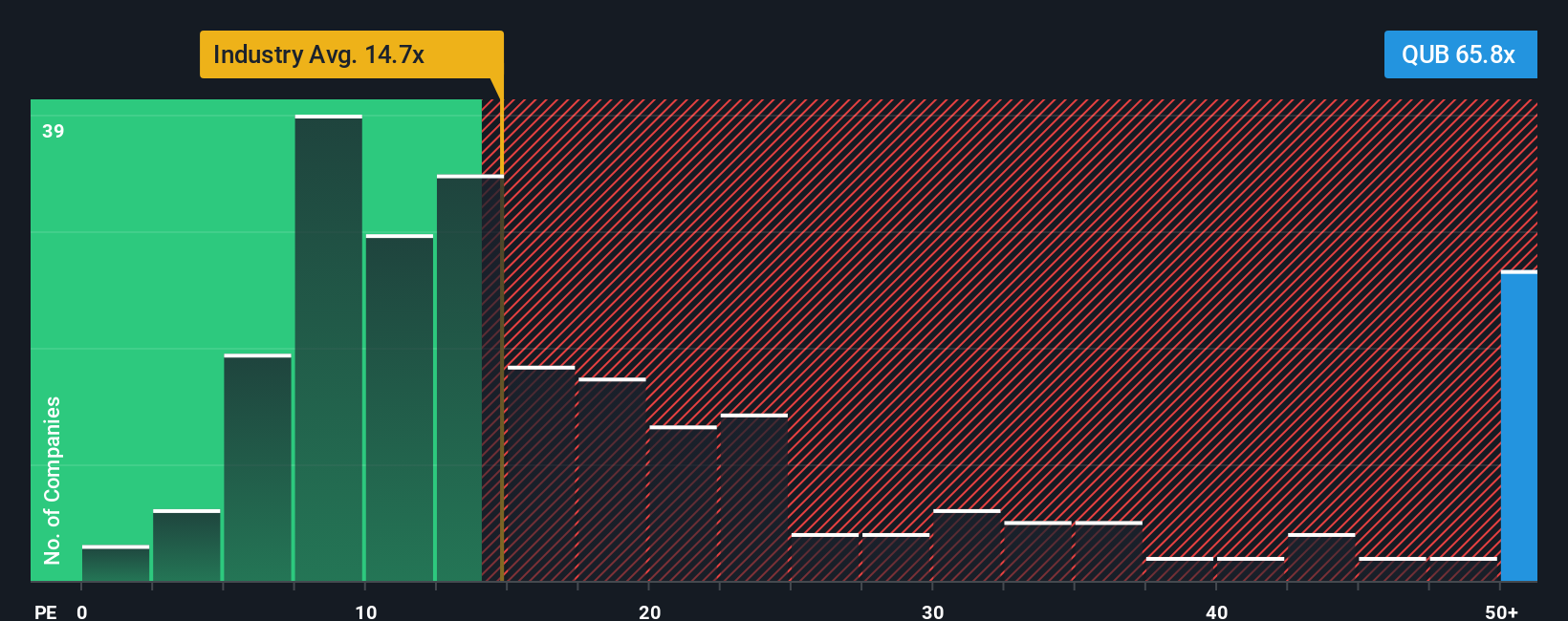

While the earlier valuation suggests that Qube Holdings may be undervalued, comparing its share price with other companies in the same industry reveals a different perspective. Is the market anticipating even stronger performance from Qube, or could this optimism be excessive?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Qube Holdings Narrative

If you find yourself reaching different conclusions or would like to interpret the data through your own lens, you're invited to develop your own perspective in just a few minutes and do it your way.

A great starting point for your Qube Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Now is the perfect time to uncover fresh opportunities that could give your portfolio an edge. Don’t let great stocks slip through your fingers. Use these unique screens to stay ahead of the crowd and find companies that fit your strategy.

- Tap into the income potential from leading companies consistently paying attractive yields by checking out dividend stocks with yields > 3%.

- Seek out healthcare pioneers at the intersection of medicine and artificial intelligence with healthcare AI stocks.

- Chase the next undervalued gem backed by strong cash flow analysis using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qube Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:QUB

Qube Holdings

Provides import and export logistics services in Australia, New Zealand, and Southeast Asia.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives