Does Qantas (ASX:QAN) Have the Leadership and Cost Discipline to Navigate Fuel Price Pressures?

Reviewed by Sasha Jovanovic

- The Qantas Group recently announced the appointment of Alison Watkins as an independent Non-Executive Director, highlighting her extensive leadership experience across the sectors of manufacturing, financial services, and consumer goods.

- This move comes as Qantas also flagged slower domestic revenue growth and rising fuel costs, reflecting ongoing operational pressures in the airline industry.

- We'll now look at how rising fuel costs and moderated domestic revenue guidance influence Qantas Airways' investment narrative.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Qantas Airways Investment Narrative Recap

To be a Qantas Airways shareholder, you need to believe that the company’s mix of operational efficiency, strong brand, and loyalty programs can withstand ongoing industry pressures. The recent update about slower domestic revenue growth and rising fuel costs does not materially alter the biggest near-term catalyst, gains from fleet renewal, or the key risk, which remains heightened cost pressures from both fuel prices and evolving labor legislation.

Among recent announcements, the addition of Alison Watkins to Qantas’s board stands out as highly relevant. Board renewal comes at a time when robust governance could enhance confidence in management’s strategy to address cost increases and sustain progress on major catalysts, including the accelerated fleet upgrade and loyalty program growth.

In contrast, while the push for margin improvement is front of mind, investors should also be aware of...

Read the full narrative on Qantas Airways (it's free!)

Qantas Airways' narrative projects A$28.1 billion revenue and A$2.1 billion earnings by 2028. This requires 5.7% yearly revenue growth and an increase of A$0.5 billion in earnings from the current A$1.6 billion.

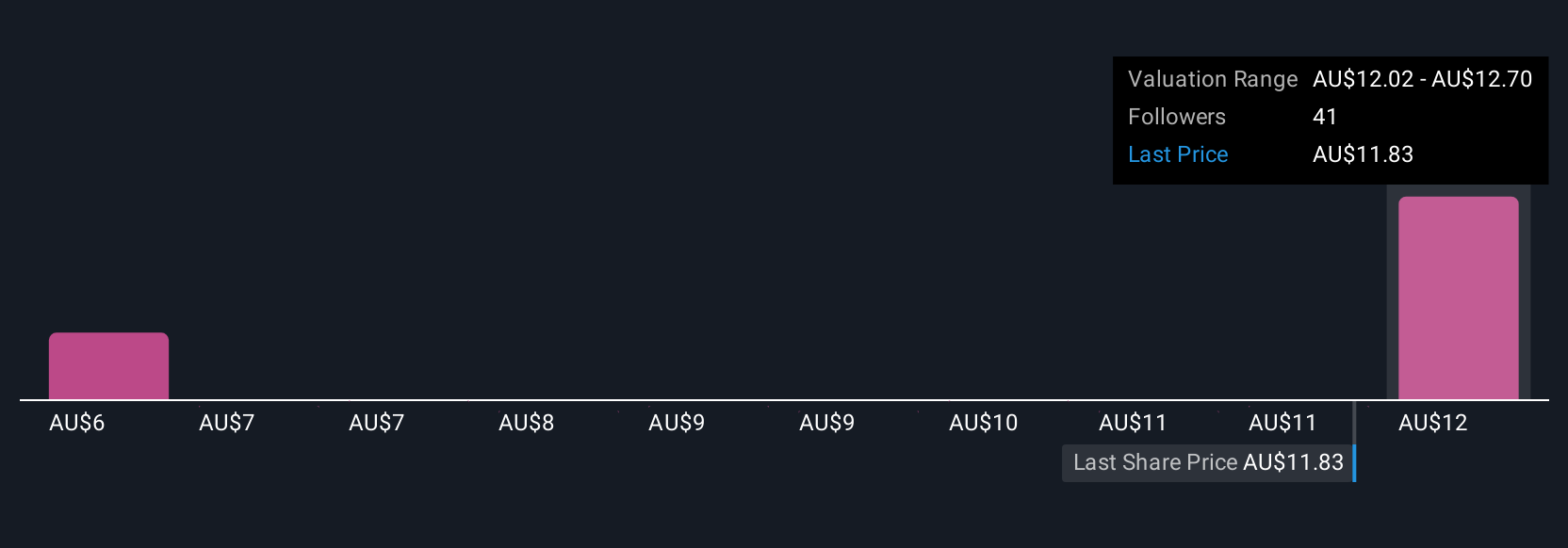

Uncover how Qantas Airways' forecasts yield a A$12.55 fair value, a 29% upside to its current price.

Exploring Other Perspectives

Ten Simply Wall St Community members valued Qantas Airways between A$7.27 and A$12.55 per share ahead of this update. While fuel cost risks now weigh more heavily, it’s clear your view could differ widely from others in the market.

Explore 10 other fair value estimates on Qantas Airways - why the stock might be worth 25% less than the current price!

Build Your Own Qantas Airways Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Qantas Airways research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Qantas Airways research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Qantas Airways' overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qantas Airways might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:QAN

Qantas Airways

Provides air transportation services in Australia and internationally.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives