Stock Analysis

High Growth Tech Stocks in Australia for December 2024

Reviewed by Simply Wall St

Amidst a slight downturn in the ASX200, which has seen a 1% decrease to 8,084 points with sectors like Discretionary and Financials underperforming, the Australian market is witnessing selective resilience in areas such as Utilities and Energy. In this environment of mixed sector performance, identifying high growth tech stocks requires focusing on companies that demonstrate robust potential through innovation and adaptability to capitalize on emerging opportunities despite broader market challenges.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.38% | 26.16% | ★★★★★☆ |

| Pureprofile | 14.31% | 71.53% | ★★★★★☆ |

| Adherium | 86.80% | 73.66% | ★★★★★★ |

| Telix Pharmaceuticals | 21.55% | 38.32% | ★★★★★★ |

| ImExHS | 20.47% | 111.20% | ★★★★★★ |

| AVA Risk Group | 25.54% | 77.32% | ★★★★★★ |

| Pointerra | 56.62% | 126.45% | ★★★★★★ |

| Wrkr | 37.21% | 98.46% | ★★★★★★ |

| Opthea | 52.71% | 63.26% | ★★★★★★ |

| SiteMinder | 18.83% | 60.52% | ★★★★★☆ |

Click here to see the full list of 62 stocks from our ASX High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Life360 (ASX:360)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Life360, Inc. operates a technology platform for locating people, pets, and things across various regions including North America, Europe, the Middle East, Africa, and internationally with a market cap of approximately A$5 billion.

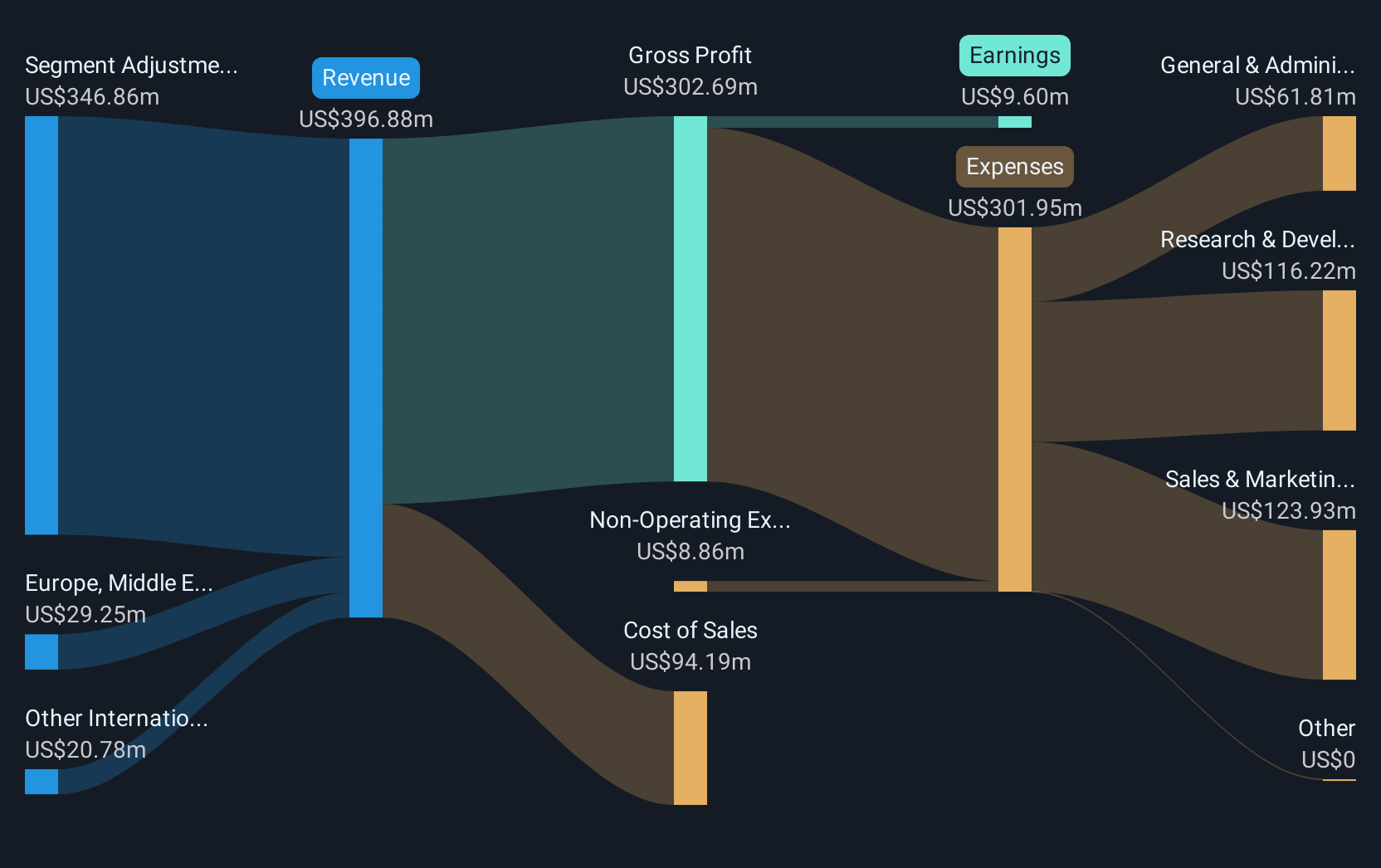

Operations: The company generates revenue primarily through its software and programming segment, amounting to $342.92 million. Its technology platform is designed for locating people, pets, and things across multiple regions.

Life360, a player in the tech sector, is navigating its path towards profitability with an expected profit growth of 67.39% annually. Despite a recent adjustment in its 2024 revenue guidance to $368 million from a higher initial forecast, reflecting challenges in hardware sales, the firm maintains robust growth in core subscription revenues at over 25% year-over-year. This resilience is underscored by a significant turnaround in Q3 performance where net income reached $7.69 million against a loss the previous year, showcasing effective cost management and operational efficiency. With R&D expenses consistently fueling innovation—evident from their strategic focus on enhancing user engagement and safety features—Life360's commitment to development could well position it for sustained growth amidst competitive pressures and shifting market demands.

- Take a closer look at Life360's potential here in our health report.

Explore historical data to track Life360's performance over time in our Past section.

Audinate Group (ASX:AD8)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Audinate Group Limited develops and sells digital audio visual (AV) networking solutions in Australia and internationally, with a market cap of A$603.40 million.

Operations: Audinate Group generates revenue primarily from Contract Electronics Manufacturing Services, amounting to A$91.48 million. The company's focus is on providing digital audio visual networking solutions across various markets globally.

Audinate Group, amid a dynamic tech landscape, is shaping its future with a notable 10.8% annual revenue growth and an impressive 25% surge in earnings. The recent executive reshuffle, introducing Chris Rollinson as CFO, enhances its strategic capabilities, reflecting a robust governance structure poised for scalable operations. This transition aligns with their substantial investment in R&D which consistently supports innovation and competitive edge in the digital audio networking sector. As they navigate through evolving market demands with strengthened leadership and continuous technological advancement, Audinate's trajectory suggests a strong potential for sustained growth within the high-tech arena of Australia.

- Click here to discover the nuances of Audinate Group with our detailed analytical health report.

Review our historical performance report to gain insights into Audinate Group's's past performance.

RPMGlobal Holdings (ASX:RUL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RPMGlobal Holdings Limited is an Australian company that develops and provides mining software solutions across various regions including Asia, the Americas, Africa, and Europe, with a market capitalization of A$657.84 million.

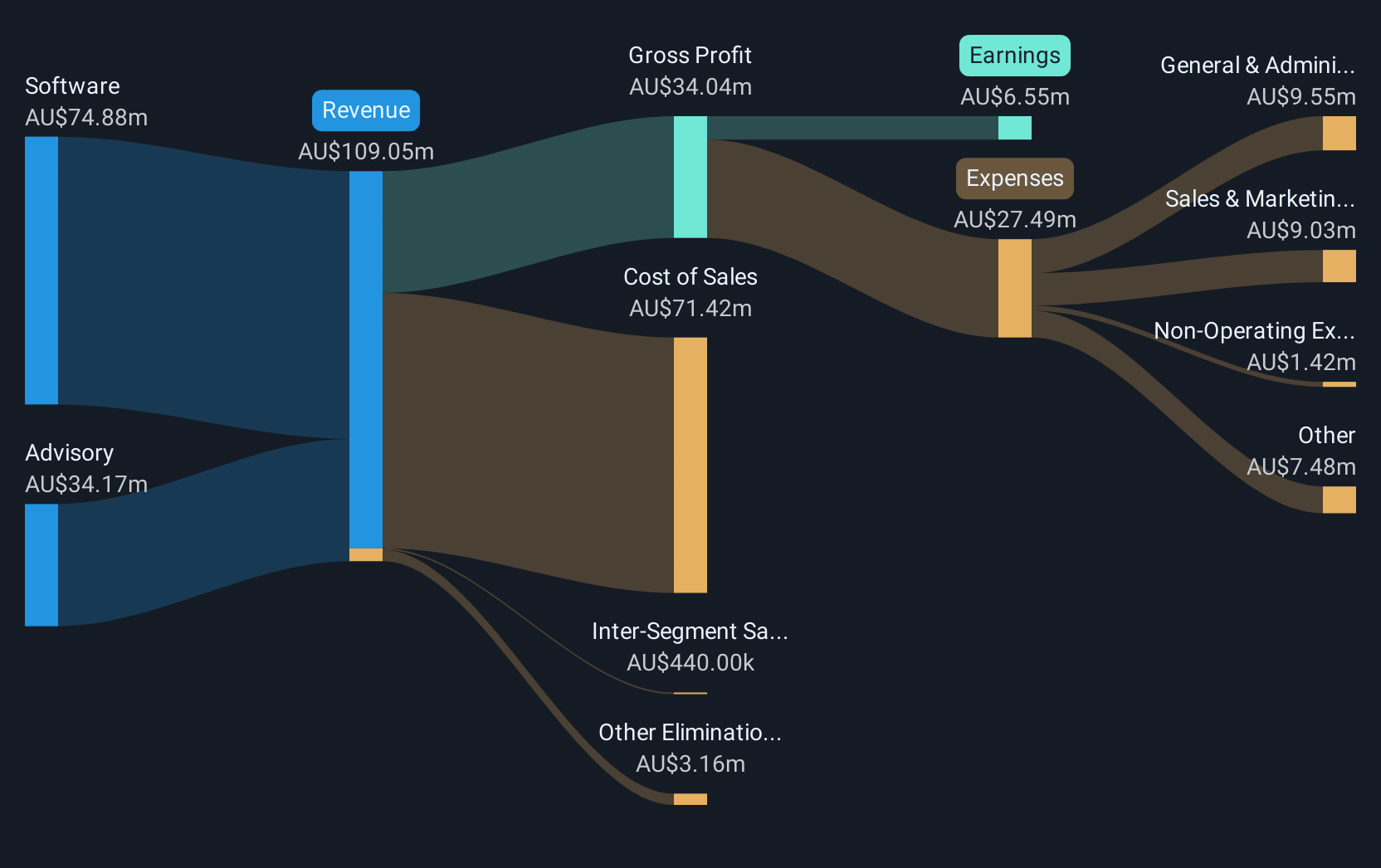

Operations: RPMGlobal Holdings generates revenue primarily from its Software segment, contributing A$72.67 million, and its Advisory services, which add A$31.41 million to the total revenue. The company operates extensively across multiple continents, offering specialized software solutions tailored for the mining industry.

RPMGlobal Holdings, amid its participation in the ACG Mine Closure Conference and reaffirming its 2025 revenue targets of $120-$125 million, underscores a strategic focus poised for growth. With a significant 134.6% earnings surge outpacing the software industry's average, RPMGlobal not only demonstrates robust financial health but also a commitment to innovation as seen in its R&D investments. This approach is complemented by an expected annual revenue growth rate of 10.4%, which although not the highest in high-tech sectors, still outstrips broader market averages. Such dynamics suggest RPMGlobal is effectively navigating market challenges while laying down solid groundwork for future technological advancements and financial performance within Australia's tech landscape.

Summing It All Up

- Embark on your investment journey to our 62 ASX High Growth Tech and AI Stocks selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:360

Life360

Operates a technology platform to locate people, pets, and things in North America, Europe, the Middle East, Africa, and internationally.