Technology One (ASX:TNE): Assessing Valuation Following Strong Full-Year Earnings Growth

Reviewed by Simply Wall St

Technology One (ASX:TNE) has just released its full-year earnings report, drawing increased investor interest. The results show a rise in both revenue and net income compared to the prior year, prompting closer analysis.

See our latest analysis for Technology One.

After Technology One’s latest earnings update, investor sentiment shifted sharply with the share price dropping 17.2% in a single day and falling 24.6% over the last month. Despite this short-term volatility, the stock’s 1-year total shareholder return remains positive. Long-term holders have seen a powerful 243% total return over five years, which serves as a testament to the company’s growth story even as near-term momentum fades.

If you’re rethinking what else could drive strong long-term returns, now is a perfect moment to broaden your horizon and discover fast growing stocks with high insider ownership

With shares now trading well below analyst price targets even after another year of double-digit revenue and profit growth, the key question is whether Technology One is undervalued or if the market has already factored in much of its future potential. Could this dip signal a buying opportunity, or is everything already priced in?

Most Popular Narrative: 22% Undervalued

With Technology One last closing at A$29.26, the most popular narrative suggests the fair value sits much higher, highlighting a sizeable gap between recent market pessimism and the assumed growth trajectory. This contrast has drawn attention to the core financial dynamics underpinning the company’s future.

The market may be excessively pricing in rapid, sustained ARR (annual recurring revenue) and margin expansion due to strong SaaS+ adoption, underestimating the risk of intensifying competition and regulatory headwinds that could slow customer wins, elongate sales cycles, or pressure pricing, ultimately impacting future revenue growth and margins.

Want to know the story behind this high-value estimate? The narrative relies on bold assumptions about future sales momentum, margin expansion, and a premium profit multiple. Intrigued by which ambitious forecasts and competitive forces make or break this valuation? The secret to Technology One’s valuation lies deeper. See which projections drive this gap.

Result: Fair Value of $37.51 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory changes or a surge in competitive offerings could quickly undermine current growth assumptions and reshape the company's long-term outlook.

Find out about the key risks to this Technology One narrative.

Another View: Multiples Paint a Pricier Picture

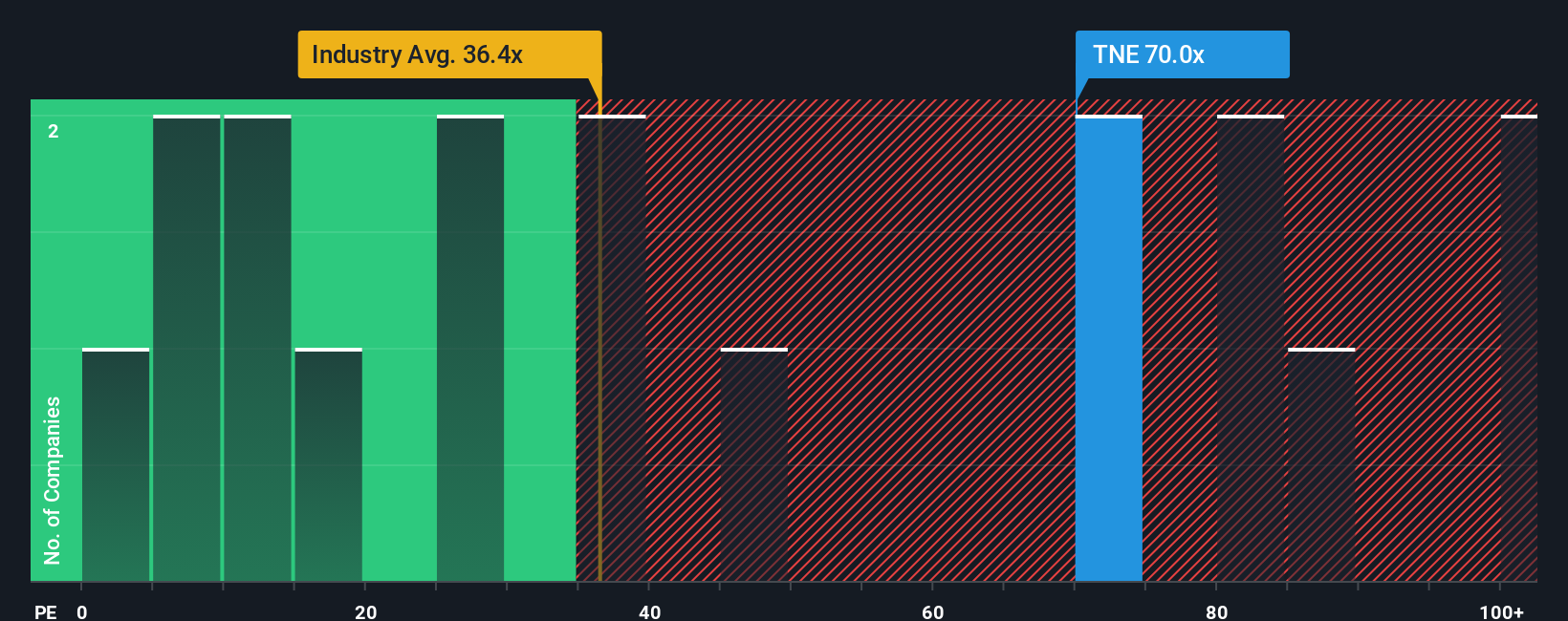

Taking a look at market valuation ratios, Technology One trades at 69.4 times earnings. This stands sharply above the industry average of 37.1 times and also well ahead of its fair ratio of 37.1. Such a premium suggests investors are betting heavily on future growth, or perhaps they are overlooking valuation risks.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Technology One for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 894 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Technology One Narrative

If you have a different perspective or want to dig into the numbers yourself, you can build a custom take in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Technology One.

Looking for more investment ideas?

Don’t let opportunity pass you by. Put your capital to work with smart stock picks that can energize your portfolio and help you stay ahead of the market.

- Catch the next surge in tech breakthroughs by checking out these 27 AI penny stocks, where artificial intelligence is driving bold new growth stories.

- Tap into reliable cash flows and long-term income by browsing these 18 dividend stocks with yields > 3%, a curated list of strong dividend stocks yielding over 3%.

- Ride early-stage momentum and high-upside potential with these 3580 penny stocks with strong financials, spotlighting value-packed companies that could be tomorrow’s big winners.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Technology One might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TNE

Technology One

Engages in the development, marketing, sale, implementation, and support of integrated enterprise business software solutions in Australia and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives