Does Technology One (ASX:TNE) Deserve A Spot On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Technology One (ASX:TNE). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Technology One with the means to add long-term value to shareholders.

Check out our latest analysis for Technology One

How Quickly Is Technology One Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Shareholders will be happy to know that Technology One's EPS has grown 34% each year, compound, over three years. So it's not surprising to see the company trades on a very high multiple of (past) earnings.

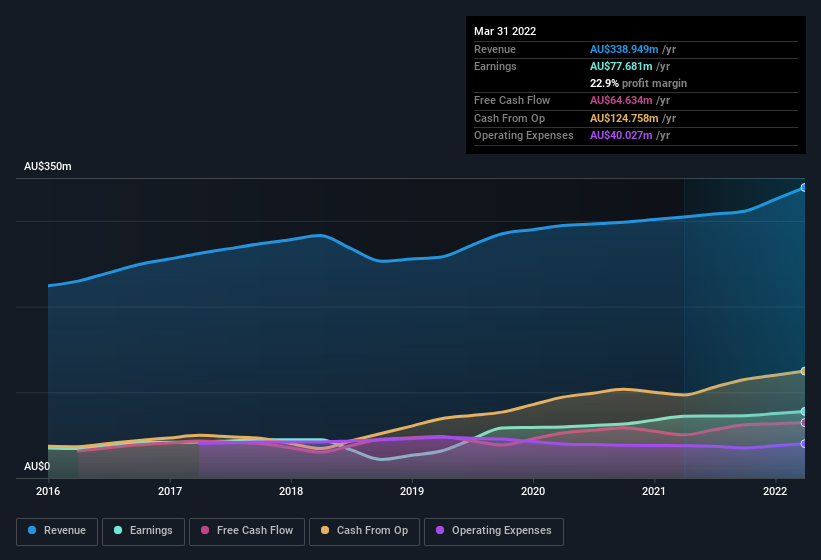

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Technology One maintained stable EBIT margins over the last year, all while growing revenue 11% to AU$339m. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Technology One's future profits.

Are Technology One Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Technology One top brass are certainly in sync, not having sold any shares, over the last year. But the real excitement comes from the AU$249k that Non-Executive Chair & Lead Independent Director Patrick Redmond O'Sullivan spent buying shares (at an average price of about AU$10.27). Strong buying like that could be a sign of opportunity.

On top of the insider buying, it's good to see that Technology One insiders have a valuable investment in the business. We note that their impressive stake in the company is worth AU$614m. That equates to 14% of the company, making insiders powerful and aligned with other shareholders. Very encouraging.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because Technology One's CEO, Edward Chung, is paid at a relatively modest level when compared to other CEOs for companies of this size. The median total compensation for CEOs of companies similar in size to Technology One, with market caps between AU$3.0b and AU$9.5b, is around AU$3.5m.

Technology One offered total compensation worth AU$2.3m to its CEO in the year to September 2022. That comes in below the average for similar sized companies and seems pretty reasonable. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is Technology One Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Technology One's strong EPS growth. Better still, insiders own a large chunk of the company and one has even been buying more shares. Astute investors will want to keep this stock on watch. Of course, profit growth is one thing but it's even better if Technology One is receiving high returns on equity, since that should imply it can keep growing without much need for capital. Click on this link to see how it is faring against the average in its industry.

Keen growth investors love to see insider buying. Thankfully, Technology One isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Technology One might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:TNE

Technology One

Develops, markets, sells, implements, and supports integrated enterprise business software solutions in Australia and internationally.

Flawless balance sheet with reasonable growth potential.