We're Hopeful That Sovereign Cloud Holdings (ASX:SOV) Will Use Its Cash Wisely

We can readily understand why investors are attracted to unprofitable companies. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

Given this risk, we thought we'd take a look at whether Sovereign Cloud Holdings (ASX:SOV) shareholders should be worried about its cash burn. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

See our latest analysis for Sovereign Cloud Holdings

When Might Sovereign Cloud Holdings Run Out Of Money?

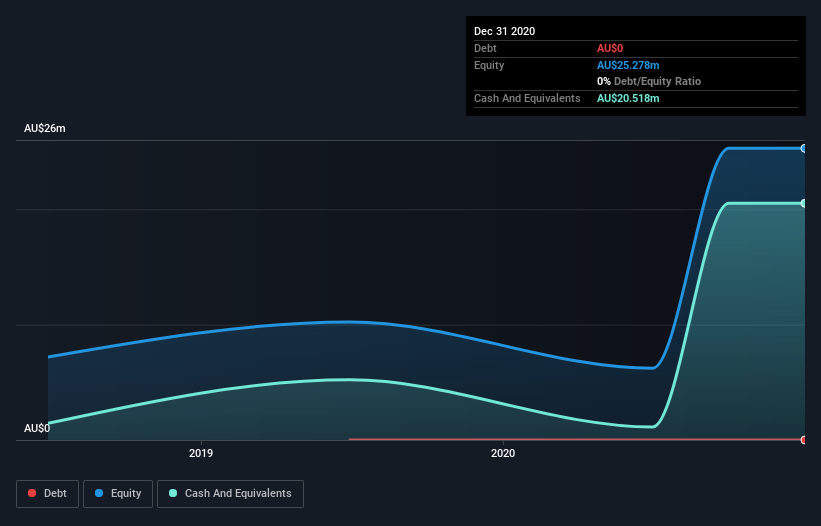

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. When Sovereign Cloud Holdings last reported its balance sheet in December 2020, it had zero debt and cash worth AU$21m. In the last year, its cash burn was AU$8.8m. Therefore, from December 2020 it had 2.3 years of cash runway. Arguably, that's a prudent and sensible length of runway to have. The image below shows how its cash balance has been changing over the last few years.

How Is Sovereign Cloud Holdings' Cash Burn Changing Over Time?

In our view, Sovereign Cloud Holdings doesn't yet produce significant amounts of operating revenue, since it reported just AU$2.1m in the last twelve months. Therefore, for the purposes of this analysis we'll focus on how the cash burn is tracking. As it happens, the company's cash burn reduced by 6.8% over the last year, which suggests that management are maintaining a fairly steady rate of business development, albeit with a slight decrease in spending. Of course, we've only taken a quick look at the stock's growth metrics, here. You can take a look at how Sovereign Cloud Holdings is growing revenue over time by checking this visualization of past revenue growth.

How Hard Would It Be For Sovereign Cloud Holdings To Raise More Cash For Growth?

Even though it has reduced its cash burn recently, shareholders should still consider how easy it would be for Sovereign Cloud Holdings to raise more cash in the future. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Sovereign Cloud Holdings has a market capitalisation of AU$68m and burnt through AU$8.8m last year, which is 13% of the company's market value. Given that situation, it's fair to say the company wouldn't have much trouble raising more cash for growth, but shareholders would be somewhat diluted.

Is Sovereign Cloud Holdings' Cash Burn A Worry?

The good news is that in our view Sovereign Cloud Holdings' cash burn situation gives shareholders real reason for optimism. Not only was its cash burn relative to its market cap quite good, but its cash runway was a real positive. Considering all the factors discussed in this article, we're not overly concerned about the company's cash burn, although we do think shareholders should keep an eye on how it develops. Readers need to have a sound understanding of business risks before investing in a stock, and we've spotted 3 warning signs for Sovereign Cloud Holdings that potential shareholders should take into account before putting money into a stock.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

When trading Sovereign Cloud Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:CYB

AUCyber

Provides cloud solutions and cyber security services for organizations and government agencies in Australia.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success