Assessing SiteMinder’s (ASX:SDR) Valuation After Analyst & Investor Day Updates

Reviewed by Kshitija Bhandaru

SiteMinder (ASX:SDR) hosted its Analyst and Investor Day recently, offering a closer look at management’s outlook and strategic vision. These events typically spark curiosity about how the company is planning its next phase of growth.

See our latest analysis for SiteMinder.

Following SiteMinder’s recent Analyst and Investor Day, investor interest has shown subtle signs of building. The stock’s share price has held above A$7.70 and posted a modest positive momentum over the past three months. The 1-year total shareholder return also remains in positive territory, suggesting the market is cautiously optimistic about both management’s roadmap and the company’s long-term prospects.

If SiteMinder’s strategic update has you thinking more broadly, this is a perfect moment to discover fast growing stocks with high insider ownership

With strong returns and positive management signals on display, it is worth asking whether SiteMinder’s shares still offer room for upside or if the company’s future growth is already fully reflected in the stock price.

Price-to-Sales of 9.6x: Is it justified?

SiteMinder’s shares currently trade at a price-to-sales ratio of 9.6x, which positions them far above the sector average and suggests lofty growth expectations are already priced in.

The price-to-sales ratio compares the company's market capitalization to its annual revenue. This is a popular valuation tool when companies are not yet profitable. For a high-growth software company like SiteMinder, the ratio can reflect investor optimism regarding future topline expansion, even if current earnings remain negative.

At 9.6x, SiteMinder's price-to-sales multiple stands well above the Australian Software industry average of 3.8x and the calculated fair price-to-sales ratio of 4.9x. This substantial premium highlights both the confidence in SiteMinder’s growth trajectory and the elevated expectations the market has attached to the business. If future results fall short of these high hopes, the share price could face headwinds as the market adjusts its view.

Explore the SWS fair ratio for SiteMinder

Result: Price-to-Sales of 9.6x (OVERVALUED)

However, slowing revenue growth or missed analyst expectations could quickly challenge current optimism and put pressure on SiteMinder’s elevated valuation multiples.

Find out about the key risks to this SiteMinder narrative.

Another View: What Does the SWS DCF Model Say?

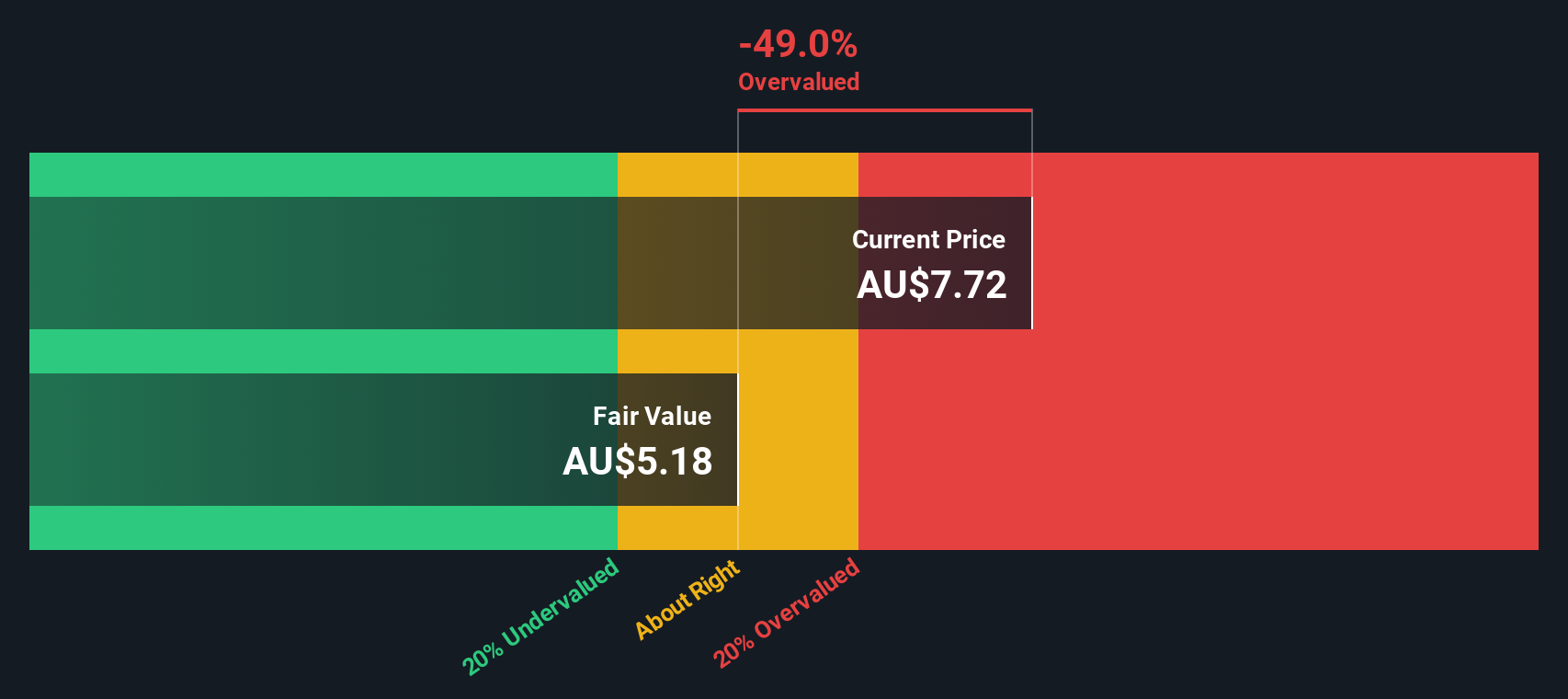

For a different lens on value, our DCF model estimates SiteMinder’s fair value at A$5.18 per share, which is well below its recent price of A$7.72. This suggests the market is pricing in big expectations and leaves little room for disappointment. Could there be more risk here than the multiples suggest?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out SiteMinder for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own SiteMinder Narrative

If you have your own perspective on SiteMinder or want to dig deeper into the numbers, you can create your own analysis in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding SiteMinder.

Looking for more investment ideas?

Capitalize on fresh market opportunities using the Simply Wall Street Screener. These ideas could help you uncover your next standout investment before others catch on.

- Capture growth potential with these 900 undervalued stocks based on cash flows, uncovering companies trading below intrinsic value and primed for upside.

- Unlock future income streams by checking out these 19 dividend stocks with yields > 3%, a collection of stocks offering robust yields over 3%.

- Ride the innovation wave and position yourself early in the market with these 26 quantum computing stocks, focused on quantum computing breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SDR

SiteMinder

Provides software and online licensing solutions in the Asia Pacific, Europe, the Middle East, Africa, and the Americas.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives