Stock Analysis

High Growth Tech Stocks in Australia to Watch This September 2024

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has risen 2.1%, driven by gains in every sector, and over the past 12 months, it is up 13%. In this thriving environment where earnings are expected to grow by 12% per annum over the next few years, identifying high growth tech stocks with strong fundamentals and innovative potential becomes crucial for investors.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 22.32% | 27.42% | ★★★★★★ |

| Pureprofile | 14.94% | 80.73% | ★★★★★☆ |

| DUG Technology | 10.90% | 31.83% | ★★★★★☆ |

| ImExHS | 20.47% | 111.20% | ★★★★★★ |

| AVA Risk Group | 32.56% | 118.83% | ★★★★★★ |

| Careteq | 37.17% | 126.21% | ★★★★★☆ |

| Pointerra | 56.62% | 126.45% | ★★★★★★ |

| Wrkr | 36.31% | 100.29% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| SiteMinder | 19.39% | 60.31% | ★★★★★☆ |

Click here to see the full list of 63 stocks from our ASX High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Life360 (ASX:360)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Life360, Inc. operates a technology platform designed to locate people, pets, and things across various regions including North America, Europe, the Middle East, Africa, and internationally with a market cap of A$3.83 billion.

Operations: The company's primary revenue stream comes from its Software & Programming segment, which generated $328.68 million. The platform focuses on location-based services for people, pets, and things across multiple regions globally.

Life360's recent unveiling of an advanced Tile Bluetooth tracker range underscores its commitment to enhancing family safety through technology, a move that could bolster user engagement and retention. With features like extended range and louder rings, these trackers integrate seamlessly with the Life360 app, augmenting the company's ecosystem with practical solutions for everyday challenges. This innovation arrives amid a 15.7% annual revenue growth forecast, outpacing the Australian market's 5.4%. Moreover, earnings are projected to surge by 68.5% annually, signaling robust future prospects despite current unprofitability. The company’s focus on R&D is evident from its strategic product expansions and partnerships aimed at diversifying revenue streams and enhancing user experience, positioning it favorably within the high-growth tech landscape in Australia.

- Get an in-depth perspective on Life360's performance by reading our health report here.

Review our historical performance report to gain insights into Life360's's past performance.

Iress (ASX:IRE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Iress Limited designs and develops software and services for the financial services industry across the Asia Pacific, United Kingdom, Europe, Africa, and North America with a market cap of A$1.82 billion.

Operations: Iress Limited generates revenue primarily from its segments in Superannuation (A$52.32 million), APAC Wealth Management (A$132.02 million), Managed Portfolio - UK (A$173.43 million), Managed Portfolio - Other (A$83.89 million), and APAC Trading & Global Market Data (A$179.20 million). The company operates across multiple regions including the Asia Pacific, United Kingdom, Europe, Africa, and North America.

Iress, navigating through a transformative phase, has shown resilience with a 2.1% annual revenue growth and an impressive forecast of 29.8% in earnings growth per year, outpacing the Australian market's average. This financial uplift is supported by strategic R&D investments aimed at enhancing software capabilities and service offerings, which are crucial as tech firms increasingly transition to SaaS models for stable revenue streams. The company recently announced plans to reinstate dividends by March 2025, reflecting confidence in its financial health and future prospects amidst rumors of potential acquisition interests from private equity entities like Blackstone Inc., indicating a vibrant interest in its evolving business model within the tech sector.

- Dive into the specifics of Iress here with our thorough health report.

Evaluate Iress' historical performance by accessing our past performance report.

Megaport (ASX:MP1)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Megaport Limited offers on-demand interconnection and internet exchange services to enterprises and service providers across Australia, New Zealand, Hong Kong, Singapore, Japan, North America, and Europe with a market cap of A$1.18 billion.

Operations: Megaport Limited generates revenue primarily from its on-demand interconnection and internet exchange services, with significant contributions from North America (A$110.81 million), Asia-Pacific (A$52.58 million), and Europe (A$31.88 million). The company operates across multiple regions including Australia, New Zealand, Hong Kong, Singapore, Japan, North America, and Europe.

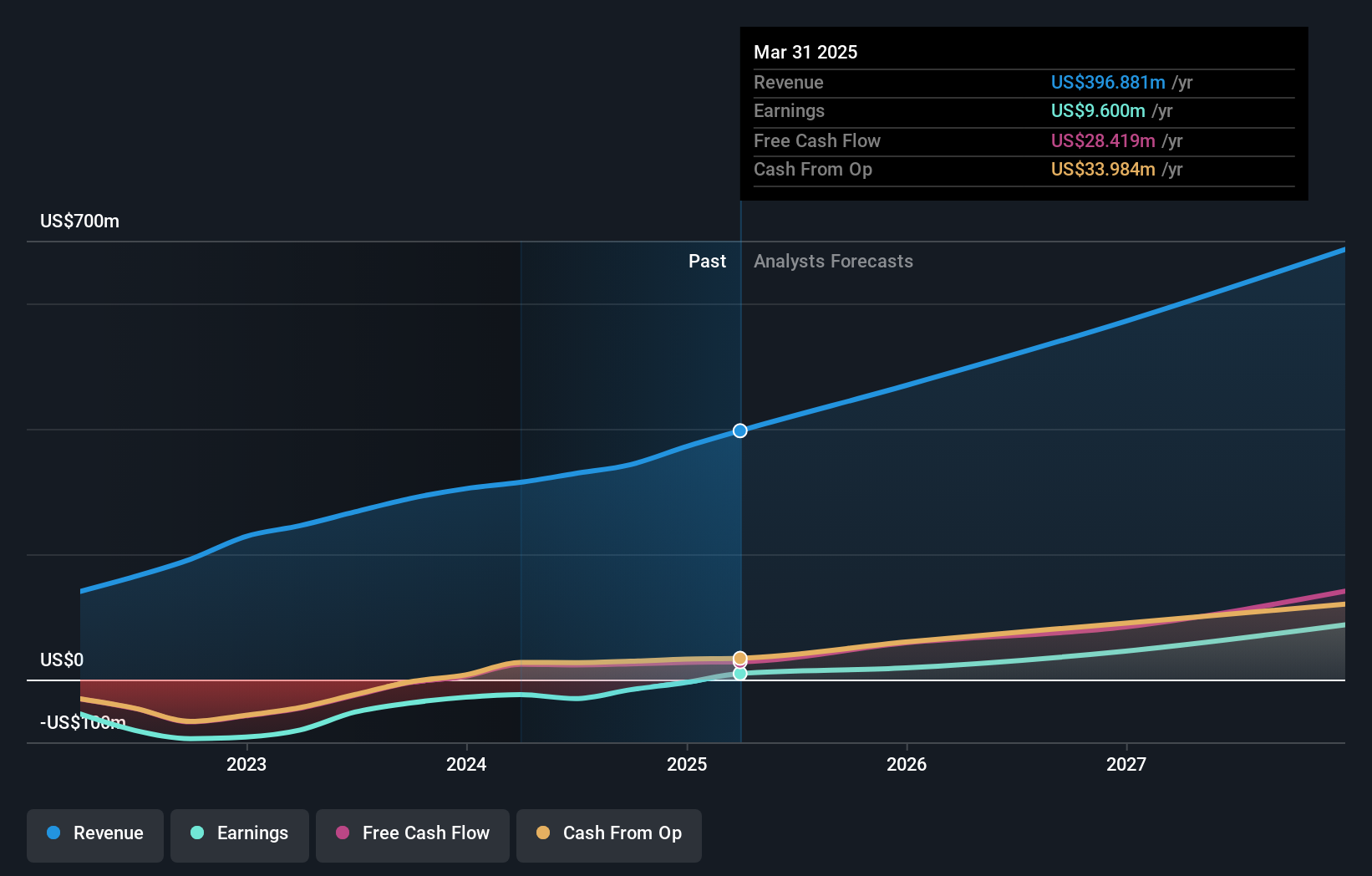

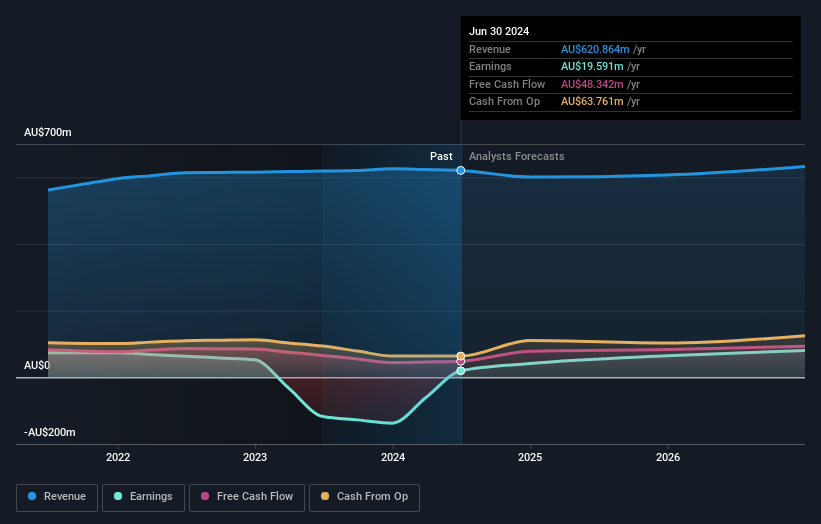

Amidst a transformative landscape, Megaport has pivoted from a net loss to posting an AUD 9.61 million profit this year, underpinned by a robust 13.4% annual revenue growth. This turnaround is significantly bolstered by strategic R&D investments, which have surged to capture emerging opportunities in hybrid and multicloud connectivity—a sector poised for expansion as enterprises demand more integrated and secure network solutions. Notably, the company's earnings are expected to ascend by 32.5% annually, outstripping broader market projections and underscoring its potential in a competitive tech arena. Recent alliances with entities like Aviatrix highlight Megaport’s commitment to enhancing its service offerings, further cementing its role in reshaping cloud connectivity landscapes globally.

Key Takeaways

- Gain an insight into the universe of 63 ASX High Growth Tech and AI Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MP1

Megaport

Provides on-demand interconnection and internet exchange services to the enterprises and service providers in Australia, New Zealand, Hong Kong, Singapore, Japan, North America, Italy, and rest of Europe.