Stock Analysis

The Australian market has recently experienced a downturn, with the ASX200 closing down 0.87% amid investor concerns over the Chinese economy's strength, affecting all sectors negatively. In this climate of uncertainty, identifying high-growth tech stocks becomes crucial as these companies often offer potential resilience and innovation-driven growth opportunities despite broader market challenges.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 22.32% | 27.42% | ★★★★★★ |

| Pureprofile | 14.94% | 80.73% | ★★★★★☆ |

| Adherium | 86.80% | 73.66% | ★★★★★★ |

| ImExHS | 20.47% | 111.20% | ★★★★★★ |

| Telix Pharmaceuticals | 21.53% | 38.41% | ★★★★★★ |

| AVA Risk Group | 32.56% | 118.83% | ★★★★★★ |

| Careteq | 37.17% | 126.21% | ★★★★★☆ |

| Pointerra | 56.62% | 126.45% | ★★★★★★ |

| Wrkr | 36.31% | 100.29% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

Click here to see the full list of 64 stocks from our ASX High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Iress (ASX:IRE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Iress Limited designs and develops software and services for the financial services industry across Asia Pacific, the United Kingdom, Europe, Africa, and North America, with a market capitalization of A$1.75 billion.

Operations: Iress generates revenue through its diverse software and services offerings, primarily from APAC Trading & Global Market Data (A$179.20 million), Managed Portfolio - UK (A$173.43 million), and APAC Wealth Management (A$132.02 million). The company caters to the financial services industry across multiple regions, including Asia Pacific, Europe, and North America.

Iress, amidst a transformative phase under new leadership, has shown notable resilience and strategic focus. With a recent earnings report highlighting a shift from a net loss to a profit of AUD 17.28 million and revenue stabilizing at AUD 309 million, the company's financial health appears on the mend. The forecasted annual earnings growth of 29.6% signals robust potential, albeit against a backdrop of modest revenue growth projections at 1.9% per year. This juxtaposition underscores Iress's strategic push towards operational efficiency and market adaptability rather than aggressive expansion. Recent executive reshuffles further align with this strategy, aiming to fortify its core software offerings while navigating competitive pressures within Australia's tech landscape.

- Dive into the specifics of Iress here with our thorough health report.

Gain insights into Iress' past trends and performance with our Past report.

Megaport (ASX:MP1)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Megaport Limited offers on-demand interconnection and internet exchange services to enterprises and service providers across various regions including Australia, New Zealand, Hong Kong, Singapore, Japan, North America, Italy, and the rest of Europe with a market cap of A$1.15 billion.

Operations: Megaport Limited generates revenue through its on-demand interconnection and internet exchange services, with significant contributions from North America (A$110.81 million), Asia-Pacific (A$52.58 million), and Europe (A$31.88 million). The company operates across multiple regions, serving a diverse range of enterprises and service providers.

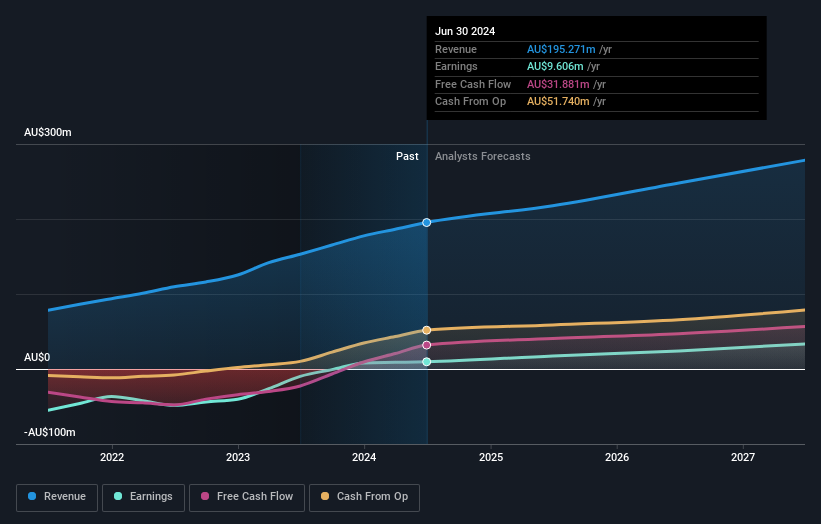

Megaport's recent expansion into Italy and across Europe underscores its strategic push to capitalize on high-growth opportunities, leveraging new Points of Presence to enhance its network connectivity solutions. This move aligns with a 13.3% annual revenue growth forecast, outpacing the Australian market's 5.5%. The company turned profitable this year, reflecting a significant turnaround with net income reaching AUD 9.61 million from a previous loss, supported by robust R&D investment which is crucial for sustaining innovation and competitive edge in the tech industry. These developments suggest Megaport is effectively scaling operations while maintaining focus on high-quality earnings and strategic partnerships to boost its service offerings globally.

- Delve into the full analysis health report here for a deeper understanding of Megaport.

Understand Megaport's track record by examining our Past report.

Qoria (ASX:QOR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Qoria Limited is engaged in the marketing, distribution, and sale of cyber safety products and services across Australia, New Zealand, the United Kingdom, the United States, Europe, and other international markets with a market capitalization of A$573.10 million.

Operations: The company generates revenue primarily through the provision of cyber safety services, reporting A$101.88 million in this segment. It operates across several key international markets, focusing on technology-driven solutions to enhance online safety.

Qoria, navigating through a transformative phase, recently bolstered its governance structure with the appointment of Jack Rosagro as Company Secretary, signaling a strengthened focus on compliance and market confidence. This strategic move complements their aggressive R&D investment strategy; despite a net loss reduction to AUD 54.77 million from AUD 86.72 million year-on-year, they channelled substantial funds into innovation—14.9% of their revenue towards R&D to hone competitive edges in tech development. With revenue growth outpacing the Australian market's average at 14.9% annually, Qoria is setting the stage for future profitability and sector leadership by leveraging these investments to potentially reverse its current unprofitable status and achieve forecasted earnings growth of 66.7%.

Next Steps

- Gain an insight into the universe of 64 ASX High Growth Tech and AI Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qoria might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:QOR

Qoria

Qoria Limited markets, distributes, and sells cyber safety products and services in Australia, New Zealand, the United Kingdom, the United States, Europe, and internationally.