We're Hopeful That Family Zone Cyber Safety (ASX:FZO) Will Use Its Cash Wisely

There's no doubt that money can be made by owning shares of unprofitable businesses. By way of example, Family Zone Cyber Safety (ASX:FZO) has seen its share price rise 487% over the last year, delighting many shareholders. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

Given its strong share price performance, we think it's worthwhile for Family Zone Cyber Safety shareholders to consider whether its cash burn is concerning. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

View our latest analysis for Family Zone Cyber Safety

How Long Is Family Zone Cyber Safety's Cash Runway?

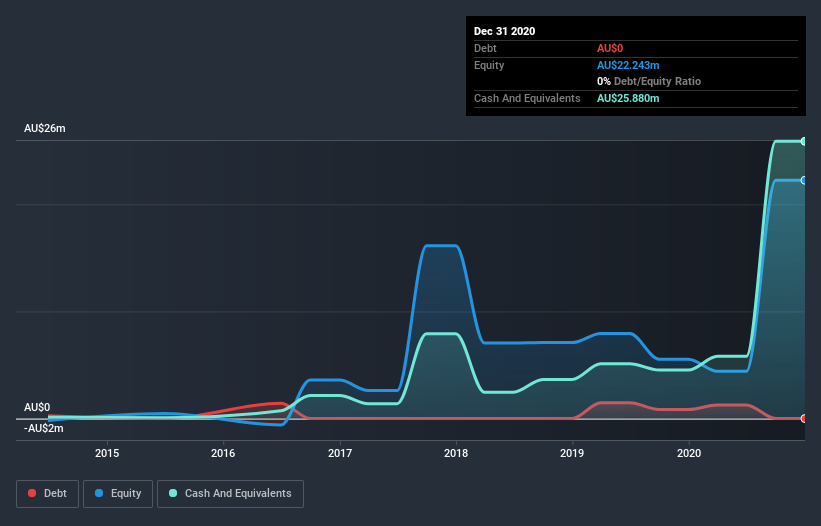

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. In December 2020, Family Zone Cyber Safety had AU$26m in cash, and was debt-free. In the last year, its cash burn was AU$9.4m. That means it had a cash runway of about 2.7 years as of December 2020. That's decent, giving the company a couple years to develop its business. The image below shows how its cash balance has been changing over the last few years.

How Well Is Family Zone Cyber Safety Growing?

Some investors might find it troubling that Family Zone Cyber Safety is actually increasing its cash burn, which is up 3.7% in the last year. But looking on the bright side, its revenue gained by 61%, lending some credence to the growth narrative. Of course, with spend going up shareholders will want to see fast growth continue. It seems to be growing nicely. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Hard Would It Be For Family Zone Cyber Safety To Raise More Cash For Growth?

There's no doubt Family Zone Cyber Safety seems to be in a fairly good position, when it comes to managing its cash burn, but even if it's only hypothetical, it's always worth asking how easily it could raise more money to fund growth. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Many companies end up issuing new shares to fund future growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Family Zone Cyber Safety has a market capitalisation of AU$178m and burnt through AU$9.4m last year, which is 5.3% of the company's market value. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

Is Family Zone Cyber Safety's Cash Burn A Worry?

As you can probably tell by now, we're not too worried about Family Zone Cyber Safety's cash burn. For example, we think its revenue growth suggests that the company is on a good path. While its increasing cash burn wasn't great, the other factors mentioned in this article more than make up for weakness on that measure. After taking into account the various metrics mentioned in this report, we're pretty comfortable with how the company is spending its cash, as it seems on track to meet its needs over the medium term. Taking an in-depth view of risks, we've identified 1 warning sign for Family Zone Cyber Safety that you should be aware of before investing.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

If you decide to trade Family Zone Cyber Safety, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Qoria might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:QOR

Qoria

Qoria Limited markets, distributes, and sells cyber safety products and services in Australia, New Zealand, the United Kingdom, the United States, Europe, and internationally.

Good value with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.