Investors Will Want DUG Technology's (ASX:DUG) Growth In ROCE To Persist

To find a multi-bagger stock, what are the underlying trends we should look for in a business? In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. So on that note, DUG Technology (ASX:DUG) looks quite promising in regards to its trends of return on capital.

Understanding Return On Capital Employed (ROCE)

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. Analysts use this formula to calculate it for DUG Technology:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

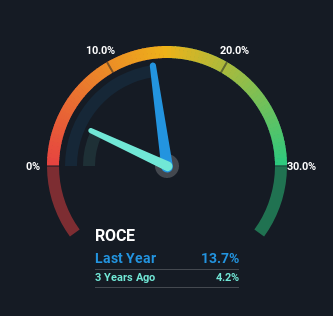

0.14 = US$4.0m ÷ (US$46m - US$16m) (Based on the trailing twelve months to December 2022).

So, DUG Technology has an ROCE of 14%. In absolute terms, that's a pretty normal return, and it's somewhat close to the Software industry average of 12%.

View our latest analysis for DUG Technology

In the above chart we have measured DUG Technology's prior ROCE against its prior performance, but the future is arguably more important. If you're interested, you can view the analysts predictions in our free report on analyst forecasts for the company.

SWOT Analysis for DUG Technology

- Debt is well covered by cash flow.

- Interest payments on debt are not well covered.

- Expected to breakeven next year.

- Has sufficient cash runway for more than 3 years based on current free cash flows.

- Trading below our estimate of fair value by more than 20%.

- No apparent threats visible for DUG.

What Does the ROCE Trend For DUG Technology Tell Us?

DUG Technology has not disappointed with their ROCE growth. More specifically, while the company has kept capital employed relatively flat over the last four years, the ROCE has climbed 382% in that same time. So our take on this is that the business has increased efficiencies to generate these higher returns, all the while not needing to make any additional investments. The company is doing well in that sense, and it's worth investigating what the management team has planned for long term growth prospects.

On a side note, we noticed that the improvement in ROCE appears to be partly fueled by an increase in current liabilities. Effectively this means that suppliers or short-term creditors are now funding 35% of the business, which is more than it was four years ago. Keep an eye out for future increases because when the ratio of current liabilities to total assets gets particularly high, this can introduce some new risks for the business.

The Bottom Line

To sum it up, DUG Technology is collecting higher returns from the same amount of capital, and that's impressive. Since the stock has returned a solid 76% to shareholders over the last year, it's fair to say investors are beginning to recognize these changes. In light of that, we think it's worth looking further into this stock because if DUG Technology can keep these trends up, it could have a bright future ahead.

On a separate note, we've found 1 warning sign for DUG Technology you'll probably want to know about.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:DUG

DUG Technology

A technology company, provides hardware and software solutions for the technology and resource sectors in Australia, the United States, the United Kingdom, Malaysia, and the United Arab Emirates.

Very undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives