Data#3 Limited's (ASX:DTL) CEO Looks Like They Deserve Their Pay Packet

We have been pretty impressed with the performance at Data#3 Limited (ASX:DTL) recently and CEO Laurence Baynham deserves a mention for their role in it. The pleasing results would be something shareholders would keep in mind at the upcoming AGM on 28 October 2021. It is likely that the focus will be on company strategy going forward as shareholders hear from the board and cast their votes on resolutions such as executive remuneration and other matters. In light of the great performance, we discuss the case why we think CEO compensation is not excessive.

See our latest analysis for Data#3

How Does Total Compensation For Laurence Baynham Compare With Other Companies In The Industry?

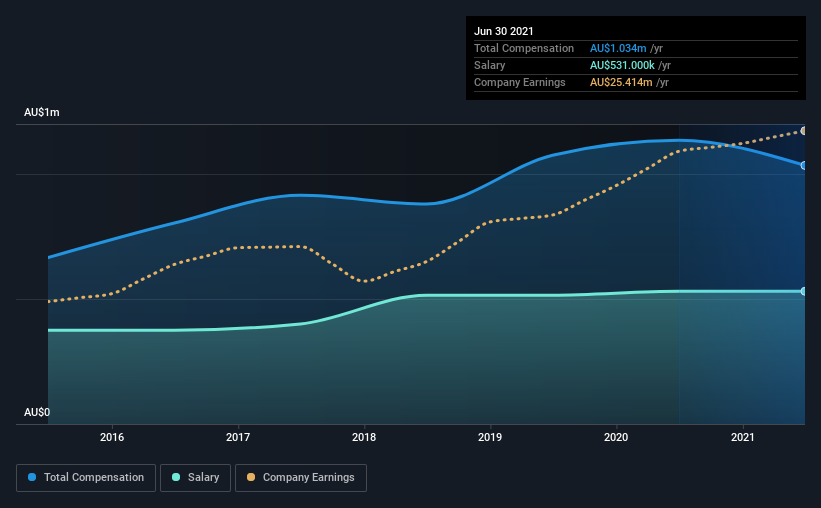

At the time of writing, our data shows that Data#3 Limited has a market capitalization of AU$852m, and reported total annual CEO compensation of AU$1.0m for the year to June 2021. We note that's a decrease of 8.9% compared to last year. We note that the salary of AU$531.0k makes up a sizeable portion of the total compensation received by the CEO.

On comparing similar companies from the same industry with market caps ranging from AU$534m to AU$2.1b, we found that the median CEO total compensation was AU$1.4m. From this we gather that Laurence Baynham is paid around the median for CEOs in the industry. Furthermore, Laurence Baynham directly owns AU$1.3m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | AU$531k | AU$531k | 51% |

| Other | AU$503k | AU$604k | 49% |

| Total Compensation | AU$1.0m | AU$1.1m | 100% |

Talking in terms of the industry, salary represented approximately 44% of total compensation out of all the companies we analyzed, while other remuneration made up 56% of the pie. According to our research, Data#3 has allocated a higher percentage of pay to salary in comparison to the wider industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Data#3 Limited's Growth

Data#3 Limited's earnings per share (EPS) grew 22% per year over the last three years. In the last year, its revenue is up 20%.

Shareholders would be glad to know that the company has improved itself over the last few years. It's a real positive to see this sort of revenue growth in a single year. That suggests a healthy and growing business. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Data#3 Limited Been A Good Investment?

Boasting a total shareholder return of 318% over three years, Data#3 Limited has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

The company's solid performance might have made most shareholders happy, possibly making CEO remuneration the least of the matters to be discussed in the AGM. However, investors will get the chance to engage on key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 1 warning sign for Data#3 that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:DTL

Data#3

Provides information technology (IT) solutions and services in Australia.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives