This article will reflect on the compensation paid to Rod Sherwood who has served as CEO of CV Check Ltd (ASX:CV1) since 2016. This analysis will also assess whether CV Check pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

See our latest analysis for CV Check

Comparing CV Check Ltd's CEO Compensation With the industry

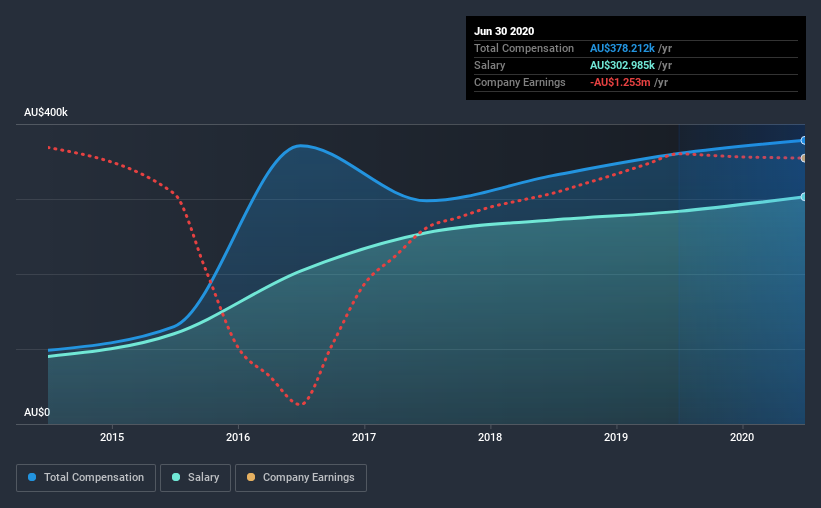

According to our data, CV Check Ltd has a market capitalization of AU$54m, and paid its CEO total annual compensation worth AU$378k over the year to June 2020. That's just a smallish increase of 4.9% on last year. Notably, the salary which is AU$303.0k, represents most of the total compensation being paid.

On comparing similar-sized companies in the industry with market capitalizations below AU$259m, we found that the median total CEO compensation was AU$397k. This suggests that CV Check remunerates its CEO largely in line with the industry average. Moreover, Rod Sherwood also holds AU$2.7m worth of CV Check stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$303k | AU$284k | 80% |

| Other | AU$75k | AU$77k | 20% |

| Total Compensation | AU$378k | AU$361k | 100% |

Talking in terms of the industry, salary represented approximately 66% of total compensation out of all the companies we analyzed, while other remuneration made up 34% of the pie. CV Check is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at CV Check Ltd's Growth Numbers

Over the past three years, CV Check Ltd has seen its earnings per share (EPS) grow by 49% per year. In the last year, its revenue changed by just 0.005%.

Shareholders would be glad to know that the company has improved itself over the last few years. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has CV Check Ltd Been A Good Investment?

Most shareholders would probably be pleased with CV Check Ltd for providing a total return of 123% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

As we noted earlier, CV Check pays its CEO in line with similar-sized companies belonging to the same industry. The company is growing EPS and total shareholder returns have been pleasing. Indeed, many might consider that Rod is compensated rather modestly, given the solid company performance! Also, such solid returns might lead to shareholders warming to the idea of a bump in pay.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We've identified 2 warning signs for CV Check that investors should be aware of in a dynamic business environment.

Important note: CV Check is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you decide to trade CV Check, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kinatico might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:KYP

Kinatico

Provides screening, verification, and SaaS-based workforce management and compliance technology systems in Australia and New Zealand.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives