Catapult Sports (ASX:CAT) Sees 12% Share Price Rise Over The Week

Reviewed by Simply Wall St

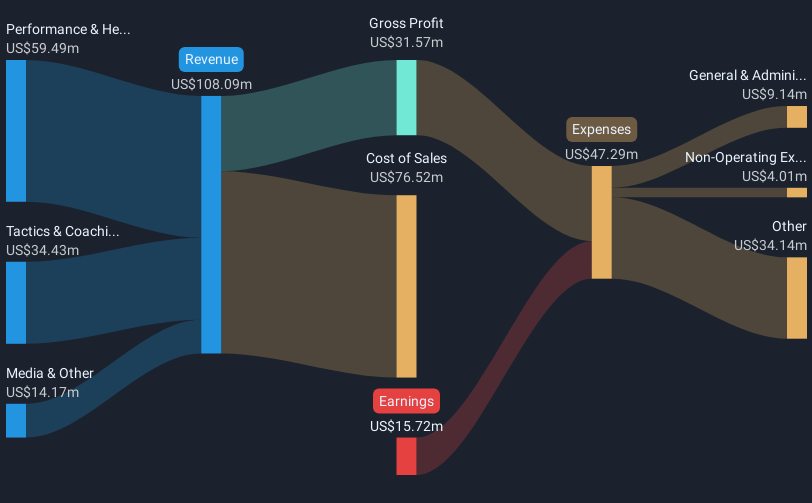

Catapult Sports (ASX:CAT) experienced a 12% increase in share price last week, with several factors potentially influencing this move. While details of recent events specific to the company are not available, the overall market environment saw tech stocks perform robustly amidst record highs for the S&P 500 and Nasdaq, likely adding upward pressure. Broader economic indicators, such as a slight decline in the Producer Prices Index, may have suggested easing inflation, offering a supportive backdrop for tech-related stocks. Catapult's price shift aligns with a generally bullish market trend, signaling investor optimism in tech sectors.

We've discovered 1 weakness for Catapult Sports that you should be aware of before investing here.

The recent share price increase for Catapult Sports could influence the company's financial narrative positively by aligning with a broader tech market upswing, potentially buoying investor sentiment and supporting revenue growth expectations. The company's efforts in introducing innovative products like the Sideline Video analysis could gain more traction amidst heightened market optimism, possibly impacting future revenue forecasts favorably.

Over the past three years, Catapult Sports' total shareholder return, including share price and dividends, has been very large. This substantial long-term growth reflects the company's ability to capitalize on cross-selling opportunities and expansion into new markets. However, despite the impressive three-year performance, it's notable that within the past year, Catapult has outperformed both the Australian market, which returned 10.3%, and the broader Software industry with a 9.6% return.

The recent 12% weekly gain in share price places the current price at A$6.55, in close proximity to the analyst consensus price target of A$6.62. This suggests that the market might be aligning more closely with analyst expectations, although there's still a minimal discount observed. Future revenue and earnings forecasts could remain optimistic if market conditions stay supportive and Catapult manages to mitigate execution risks related to its new product implementations.

Assess Catapult Sports' previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CAT

Catapult Sports

A sports science and analytics company, development and supply of technologies that improve the performance of athletes and sports teams in Australia, Europe, the Middle East, Africa, the Asia Pacific, and the Americas.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives