Bravura Solutions Limited's (ASX:BVS) 33% Share Price Surge Not Quite Adding Up

Bravura Solutions Limited (ASX:BVS) shares have continued their recent momentum with a 33% gain in the last month alone. The last month tops off a massive increase of 160% in the last year.

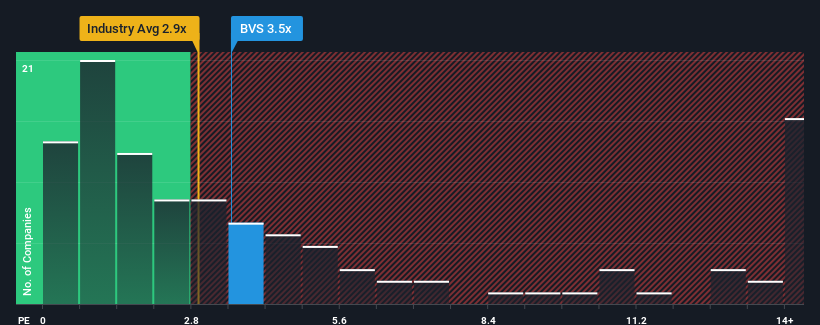

In spite of the firm bounce in price, there still wouldn't be many who think Bravura Solutions' price-to-sales (or "P/S") ratio of 3.5x is worth a mention when the median P/S in Australia's Software industry is similar at about 3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Bravura Solutions

How Bravura Solutions Has Been Performing

Recent times haven't been great for Bravura Solutions as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Bravura Solutions will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Bravura Solutions' to be considered reasonable.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. That's essentially a continuation of what we've seen over the last three years, as its revenue growth has been virtually non-existent for that entire period. Therefore, it's fair to say that revenue growth has definitely eluded the company recently.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 0.6% per year over the next three years. With the industry predicted to deliver 20% growth per annum, the company is positioned for a weaker revenue result.

With this information, we find it interesting that Bravura Solutions is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Bravura Solutions' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Given that Bravura Solutions' revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Bravura Solutions with six simple checks will allow you to discover any risks that could be an issue.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Bravura Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:BVS

Bravura Solutions

Provides software solutions for the wealth management and transfer agency industries in Australia, the United Kingdom, New Zealand, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives