How Investors Are Reacting To BrainChip Holdings (ASX:BRN) Raising A$35 Million Through Equity Offering

Reviewed by Sasha Jovanovic

- BrainChip Holdings Ltd recently completed a follow-on equity offering, raising A$35 million through the sale of 200,000,000 ordinary shares at A$0.175 each, accompanied by underwriter changes that included Morgans Corporate Limited and Unified Capital Partners Pty Ltd as co-lead underwriters.

- This substantial capital raising stands out as it directly adjusts the company’s financial flexibility and alters its share base, drawing considerable investor focus.

- We’ll explore how BrainChip Holdings’ enhanced capital position, following this significant equity raise, shapes its current investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is BrainChip Holdings' Investment Narrative?

Being a shareholder in BrainChip Holdings means buying into the vision of a company at the frontier of neuromorphic AI chips, with technology that aims to reshape intelligent computing at the edge. The recent A$35 million follow-on equity raise directly bolsters their cash position, potentially extending their operational runway as the business moves toward volume production of the AKD1500 and pushes further product development. While this substantial capital raise provides extra flexibility and could support BrainChip through the next phase of growth, especially with the AKD1500’s market introduction planned for 2026, it does come at the cost of share dilution, which may affect current shareholders. Investors are still watching for early revenue traction given BrainChip’s unprofitable status, and the near-term risks of continued losses, high valuation multiples, and a relatively inexperienced executive team remain relevant even after this capital injection. The increased financial buffer may shift shorter-term focus away from capital constraints toward execution on commercial milestones and partnerships, but the path to sustained profitability remains uncertain and highly dependent on successful product adoption in a competitive industry.

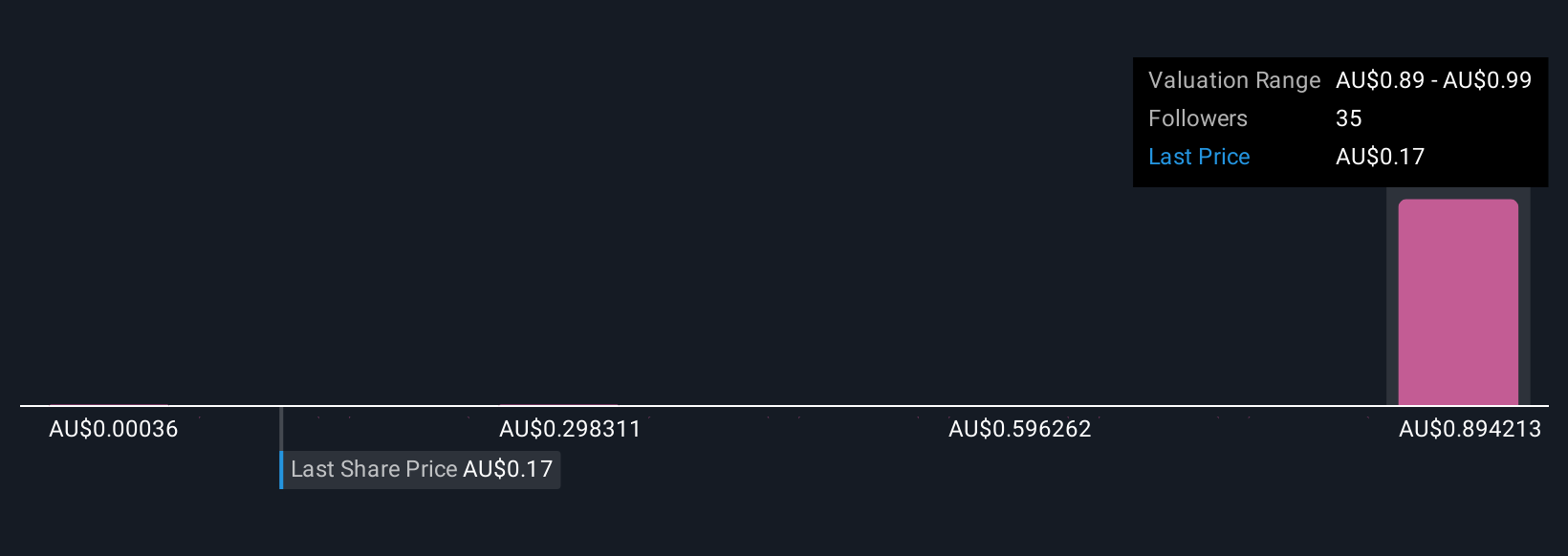

Contrastingly, shareholder dilution is an important factor that investors should be aware of. Insights from our recent valuation report point to the potential overvaluation of BrainChip Holdings shares in the market.Exploring Other Perspectives

Explore 7 other fair value estimates on BrainChip Holdings - why the stock might be worth over 10x more than the current price!

Build Your Own BrainChip Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BrainChip Holdings research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free BrainChip Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BrainChip Holdings' overall financial health at a glance.

No Opportunity In BrainChip Holdings?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BrainChip Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BRN

BrainChip Holdings

Develops software and hardware accelerated solutions for artificial intelligence and machine learning applications in North America, Oceania, Europe, the Middle East, and Asia.

Flawless balance sheet with low risk.

Market Insights

Community Narratives