Market Cool On Adacel Technologies Limited's (ASX:ADA) Revenues

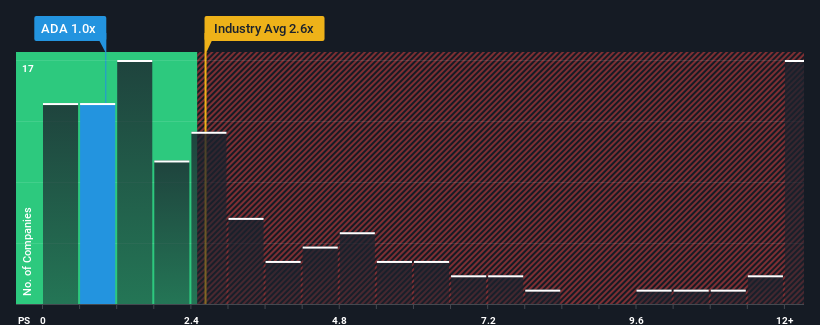

With a price-to-sales (or "P/S") ratio of 1x Adacel Technologies Limited (ASX:ADA) may be sending bullish signals at the moment, given that almost half of all the Software companies in Australia have P/S ratios greater than 2.6x and even P/S higher than 7x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Adacel Technologies

How Has Adacel Technologies Performed Recently?

While the industry has experienced revenue growth lately, Adacel Technologies' revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Adacel Technologies.How Is Adacel Technologies' Revenue Growth Trending?

Adacel Technologies' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 9.3% decrease to the company's top line. As a result, revenue from three years ago have also fallen 13% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 32% as estimated by the one analyst watching the company. That's shaping up to be materially higher than the 22% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Adacel Technologies' P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Adacel Technologies' P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

A look at Adacel Technologies' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Adacel Technologies that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ADA

Adacel Technologies

Provides air traffic management, air traffic control simulation, and training systems and services in the United States, Canada, Australia, and Estonia.

Slight and slightly overvalued.

Similar Companies

Market Insights

Community Narratives