Here's Why We Think Adacel Technologies Limited's (ASX:ADA) CEO Compensation Looks Fair for the time being

Key Insights

- Adacel Technologies will host its Annual General Meeting on 21st of November

- CEO Daniel Verret's total compensation includes salary of US$306.4k

- The overall pay is comparable to the industry average

- Adacel Technologies' total shareholder return over the past three years was 11% while its EPS was down 32% over the past three years

Despite positive share price growth of 11% for Adacel Technologies Limited (ASX:ADA) over the last few years, earnings growth has been disappointing, which suggests something is amiss. The upcoming AGM on 21st of November may be an opportunity for shareholders to bring up any concerns they may have for the board’s attention. They will be able to influence managerial decisions through the exercise of their voting power on resolutions, such as CEO remuneration and other matters, which may influence future company prospects. From what we gathered, we think shareholders should be wary of raising CEO compensation until the company shows some marked improvement.

View our latest analysis for Adacel Technologies

Comparing Adacel Technologies Limited's CEO Compensation With The Industry

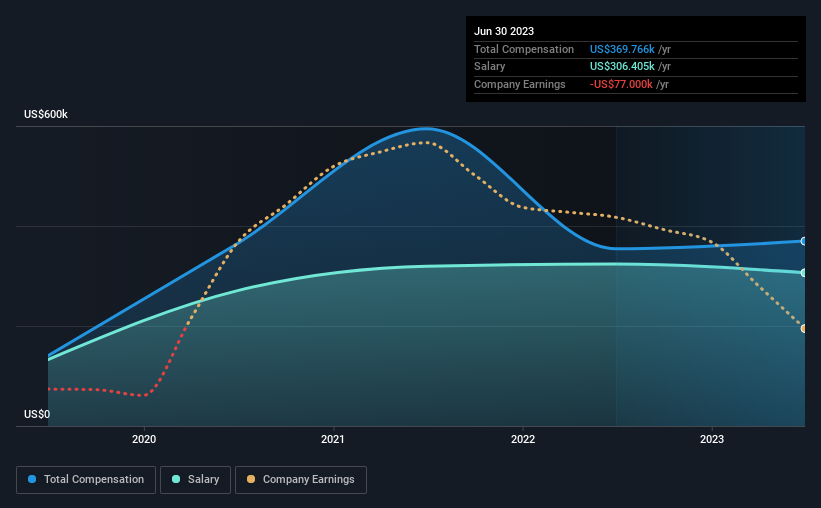

At the time of writing, our data shows that Adacel Technologies Limited has a market capitalization of AU$56m, and reported total annual CEO compensation of US$370k for the year to June 2023. That's just a smallish increase of 4.4% on last year. Notably, the salary which is US$306.4k, represents most of the total compensation being paid.

In comparison with other companies in the Australian Software industry with market capitalizations under AU$314m, the reported median total CEO compensation was US$328k. So it looks like Adacel Technologies compensates Daniel Verret in line with the median for the industry. Furthermore, Daniel Verret directly owns AU$528k worth of shares in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$306k | US$324k | 83% |

| Other | US$63k | US$30k | 17% |

| Total Compensation | US$370k | US$354k | 100% |

Talking in terms of the industry, salary represented approximately 59% of total compensation out of all the companies we analyzed, while other remuneration made up 41% of the pie. According to our research, Adacel Technologies has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Adacel Technologies Limited's Growth

Over the last three years, Adacel Technologies Limited has shrunk its earnings per share by 32% per year. The trailing twelve months of revenue was pretty much the same as the prior period.

The decline in EPS is a bit concerning. And the flat revenue is seriously uninspiring. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Adacel Technologies Limited Been A Good Investment?

Adacel Technologies Limited has generated a total shareholder return of 11% over three years, so most shareholders would be reasonably content. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

To Conclude...

While it's true that shareholders have owned decent returns, it's hard to overlook the lack of earnings growth and this makes us question whether these returns will continue. Shareholders should make the most of the coming opportunity to question the board on key concerns they may have and revisit their investment thesis with regards to the company.

CEO compensation can have a massive impact on performance, but it's just one element. We've identified 2 warning signs for Adacel Technologies that investors should be aware of in a dynamic business environment.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ADA

Adacel Technologies

Provides air traffic management, air traffic control simulation, and training systems and services in the United States, Canada, Australia, and Estonia.

Slight and slightly overvalued.

Similar Companies

Market Insights

Community Narratives