Will Wesfarmers' (ASX:WES) Special Dividend and Capital Return Reshape Its Capital Allocation Strategy?

Reviewed by Sasha Jovanovic

- In early November 2025, Wesfarmers Limited announced a special dividend of A$0.40 per share and a capital return of A$1.10 per security, both payable to shareholders on December 4, 2025, following approval at the recent Annual General Meeting.

- These shareholder distributions provide a direct cash benefit and reflect Wesfarmers' ability to return surplus capital, highlighting management's ongoing focus on capital efficiency and shareholder value.

- We’ll discuss how the return of A$1.10 per security could shape Wesfarmers’ future investment case and capital allocation outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Wesfarmers Investment Narrative Recap

For me, being a Wesfarmers shareholder is largely about believing in the company’s ability to manage its portfolio of diverse, market-leading businesses through Australia’s economic cycles while investing in new growth areas. The recent special dividend and capital return are a tangible reflection of Wesfarmers’ strong balance sheet and ongoing focus on disciplined capital allocation. However, these announcements do not shift the short-term catalyst of improving demand in core retail and industrial divisions, nor do they materially reduce the heightened risk of sustained cost inflation impacting margins in the near term.

Of the recent announcements, the approval of the A$1.10 per security capital return at the Annual General Meeting is most relevant here, emphasizing Wesfarmers’ ongoing approach to generating shareholder returns from surplus capital rather than operational outperformance alone. This aligns with the overall thesis, but investors will still be watching for evidence that future earnings growth is driven by productivity improvements or new revenue sources, especially as the Bunnings and Kmart businesses face ongoing margin pressures.

By contrast, margin risk from persistent cost pressures, something every Wesfarmers investor should be watching for, could quickly become more material if ...

Read the full narrative on Wesfarmers (it's free!)

Wesfarmers' outlook anticipates A$51.6 billion in revenue and A$3.5 billion in earnings by 2028. This implies a 4.1% annual revenue growth rate and an increase in earnings of A$0.6 billion from the current A$2.9 billion.

Uncover how Wesfarmers' forecasts yield a A$81.64 fair value, in line with its current price.

Exploring Other Perspectives

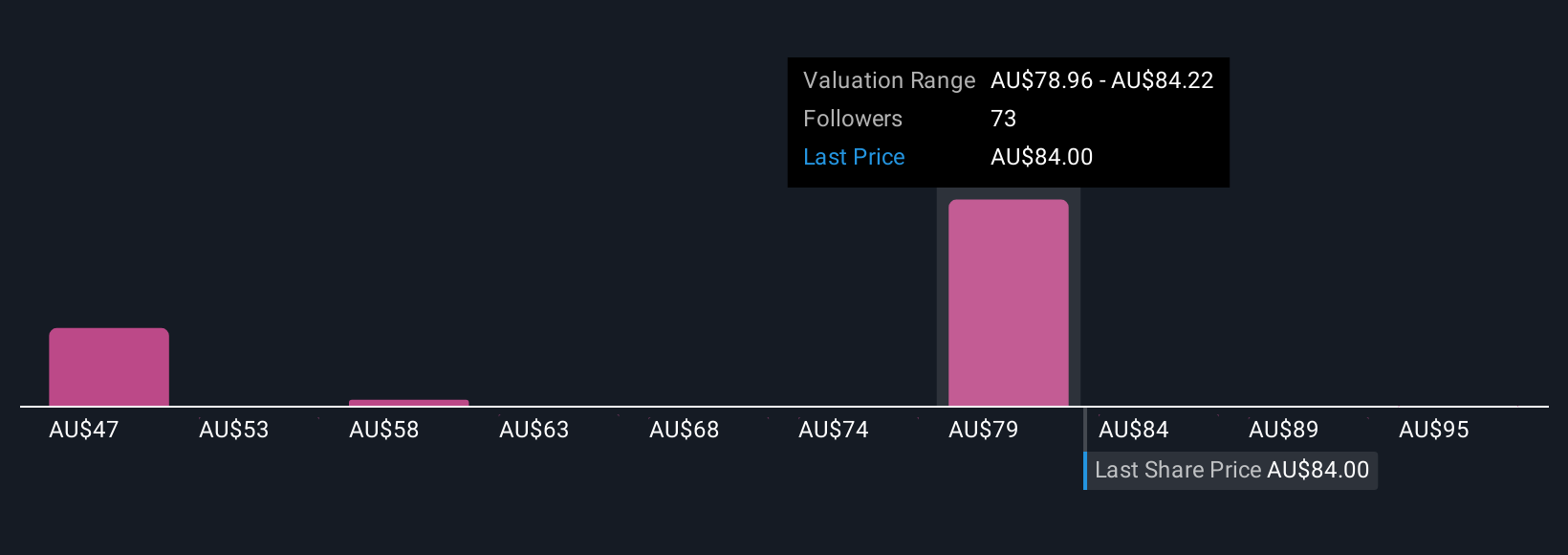

Community-sourced fair value opinions from the Simply Wall St Community span A$46.84 to A$100, with 9 individual analyses represented. Many contributors are weighing ongoing cost pressures in Bunnings and Kmart as a key influence on future returns, inviting you to compare how your own view stacks up against such a broad set of forecasts.

Explore 9 other fair value estimates on Wesfarmers - why the stock might be worth 42% less than the current price!

Build Your Own Wesfarmers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wesfarmers research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Wesfarmers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wesfarmers' overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wesfarmers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WES

Wesfarmers

Engages in the retail business in Australia, New Zealand, and internationally.

Outstanding track record average dividend payer.

Similar Companies

Market Insights

Community Narratives