Wesfarmers (ASX:WES): Assessing Valuation After Announced Special Dividend and Capital Return

Reviewed by Simply Wall St

Wesfarmers (ASX:WES) just announced a special dividend of A$0.40 per share along with a significant capital return of A$1.10 per security. Both are scheduled for early November. These payouts are drawing increased investor interest.

See our latest analysis for Wesfarmers.

Wesfarmers has served up more than just special payouts lately. After reaching year-to-date price gains of 13.09%, the share price has slipped in recent weeks, down 9.29% over the last month, highlighting shifting sentiment after its capital return and board changes. Yet, when you look at the bigger picture, Wesfarmers has delivered an impressive 23.22% total shareholder return over the past year and has more than doubled investors’ money over five years, showing that long-term momentum remains strong despite short-term volatility.

If you’re in the mood to broaden your investment sights after recent retail news, now’s the perfect time to discover fast growing stocks with high insider ownership.

With recent returns moderating and the share price now close to analyst targets, the next question is whether Wesfarmers is trading at a bargain or if the market has already factored in future growth potential.

Most Popular Narrative: Fairly Valued

With Wesfarmers closing at A$80.77, the most followed narrative puts its fair value at A$81.64, nearly matching the current price and suggesting consensus sees the stock as neither a bargain nor overhyped right now. This alignment calls for a closer look at what drives the analysts’ calculations.

Stronger investments and execution in omnichannel retail and digital capabilities across Bunnings, Kmart, and Officeworks (including expanded next-day delivery, app usage, and fulfillment centers) are increasing both online and in-store engagement. This is expected to drive higher transaction volumes and support steady revenue and margin growth.

Curious what’s fueling that fair value? The narrative hinges on substantial future growth for major retail brands, sharper margins, and ambitious digital expansion. Want to see which underlying forecasts push the valuation so high? Uncover the numbers steering this narrative and decide if you agree with the analyst logic behind the target price.

Result: Fair Value of $81.64 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost inflation and reliance on local markets could challenge Wesfarmers’ growth assumptions and may test the current fair value narrative.

Find out about the key risks to this Wesfarmers narrative.

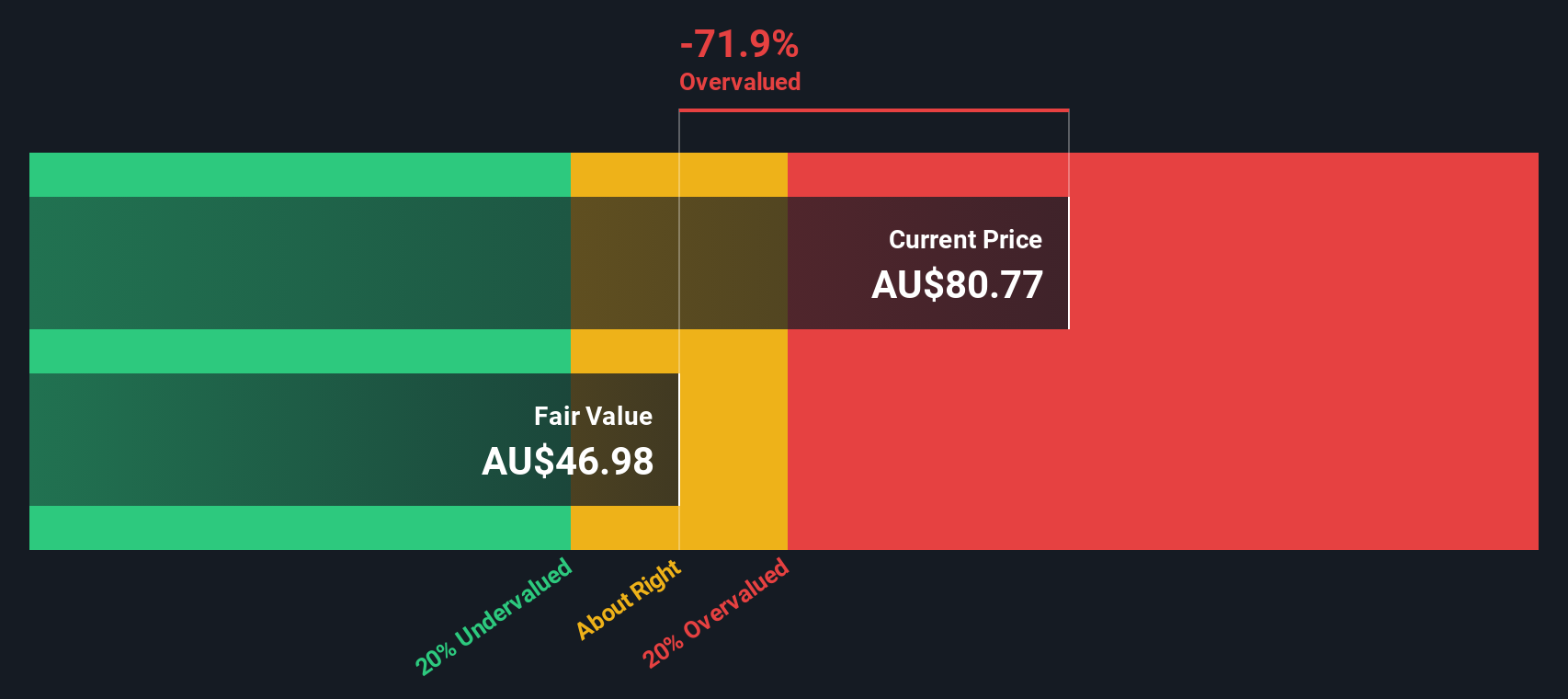

Another View: The DCF Angle

While analysts see Wesfarmers as fairly valued based on near-term forecasts, our SWS DCF model presents a much more cautious picture. According to this discounted cash flow approach, Wesfarmers' shares are trading well above what the underlying cash flows suggest is fair value. Does the market know something the models do not, or is caution warranted here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Wesfarmers for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Wesfarmers Narrative

If you want to weigh up the data for yourself or think there’s another story to tell, you can shape your own view in just a few minutes. Start with Do it your way.

A great starting point for your Wesfarmers research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let tomorrow’s winners slip past you. Act now to uncover new opportunities and strengthen your portfolio with fresh, data-driven stock ideas from Simply Wall Street.

- Turbocharge your returns by checking out these 876 undervalued stocks based on cash flows to spot companies overlooked by the market that may offer the next big value surprise.

- Unlock steady income streams when you browse these 16 dividend stocks with yields > 3% to find strong dividend payers with yields above 3 percent.

- Get ahead of the next wave of medical breakthroughs when you scan these 32 healthcare AI stocks to pinpoint healthcare innovators harnessing AI to transform patient outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wesfarmers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WES

Wesfarmers

Engages in the retail business in Australia, New Zealand, and internationally.

Outstanding track record average dividend payer.

Similar Companies

Market Insights

Community Narratives