Three Undiscovered Gems In Australia With Promising Potential

Reviewed by Simply Wall St

The Australian market has shown impressive performance, climbing 1.2% in the last 7 days with an overall gain of 9.8% over the past year, and earnings are projected to grow by 13% annually in the coming years. In this thriving environment, identifying stocks with strong fundamentals and growth potential can lead to significant investment opportunities; here are three such undiscovered gems in Australia that stand out.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 9.94% | 6.00% | ★★★★★★ |

| Lycopodium | NA | 15.62% | 29.55% | ★★★★★★ |

| Sugar Terminals | NA | 2.34% | 2.64% | ★★★★★★ |

| Hearts and Minds Investments | NA | 18.39% | -3.93% | ★★★★★★ |

| SKS Technologies Group | NA | 31.29% | 43.27% | ★★★★★★ |

| BSP Financial Group | 4.92% | 6.74% | 5.29% | ★★★★★☆ |

| AMCIL | NA | 5.16% | 5.31% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Paragon Care | 340.88% | 28.05% | 68.37% | ★★★★☆☆ |

| Boart Longyear Group | 71.20% | 9.71% | 39.19% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

MFF Capital Investments (ASX:MFF)

Simply Wall St Value Rating: ★★★★★☆

Overview: MFF Capital Investments Limited is an investment firm manager with a market cap of A$2.29 billion.

Operations: MFF Capital Investments Limited generates revenue primarily from its equity investments, amounting to A$659.96 million. The company has a market cap of A$2.29 billion.

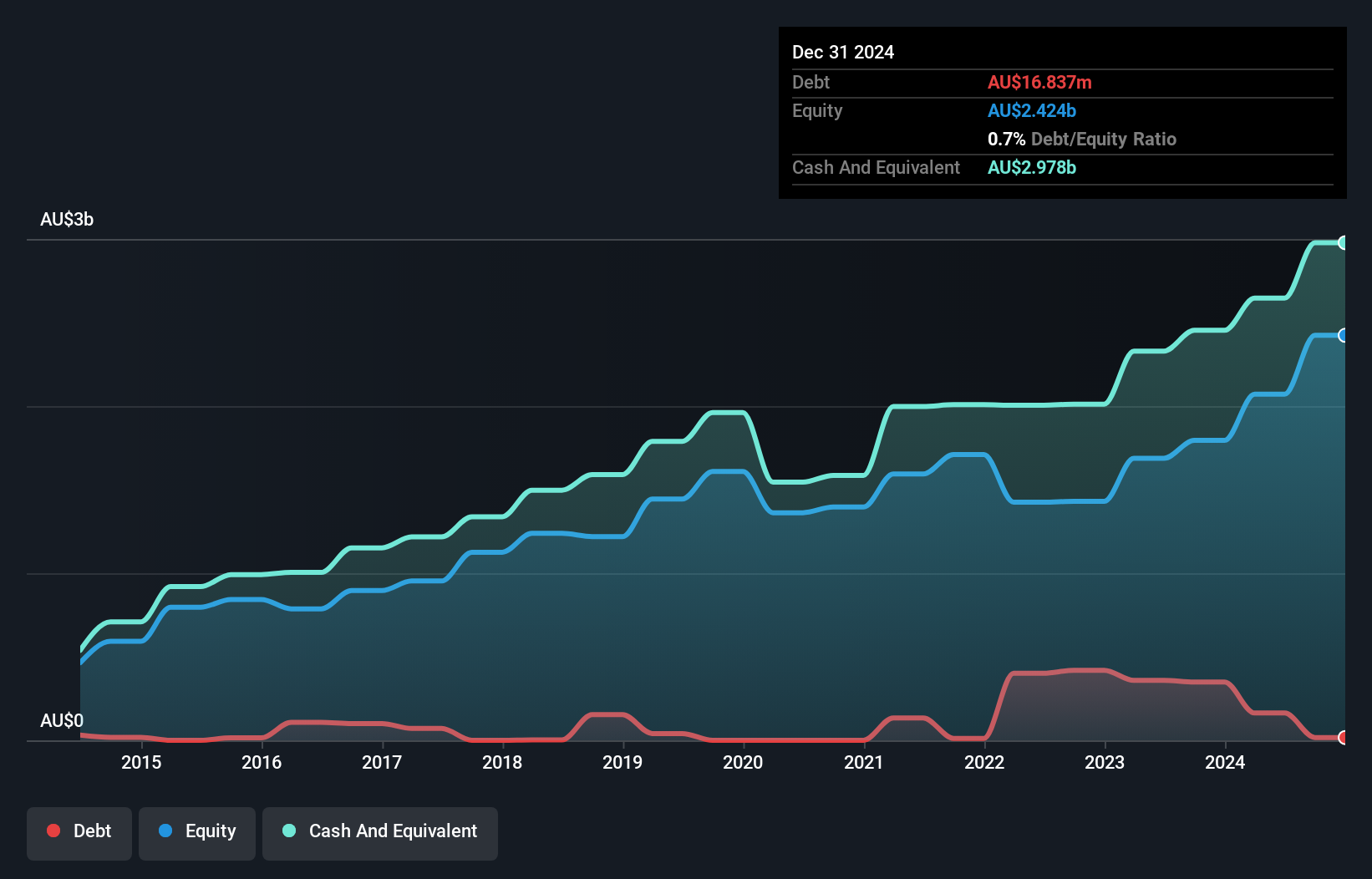

MFF Capital Investments has shown impressive earnings growth of 38.3% over the past year, far outpacing the Capital Markets industry average of -0.2%. The company trades at 43.2% below its estimated fair value, presenting a potential undervaluation opportunity. Despite an increase in its debt to equity ratio from 2.8% to 7.9% over five years, MFF's interest payments are well covered by EBIT at a robust 28.2x coverage ratio, indicating strong financial health and high-quality earnings.

- Click here to discover the nuances of MFF Capital Investments with our detailed analytical health report.

Explore historical data to track MFF Capital Investments' performance over time in our Past section.

Ricegrowers (ASX:SGLLV)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ricegrowers Limited, with a market cap of A$571.64 million, operates as a rice food company across Australia, New Zealand, the Pacific Islands, the Middle East, the United States, and internationally.

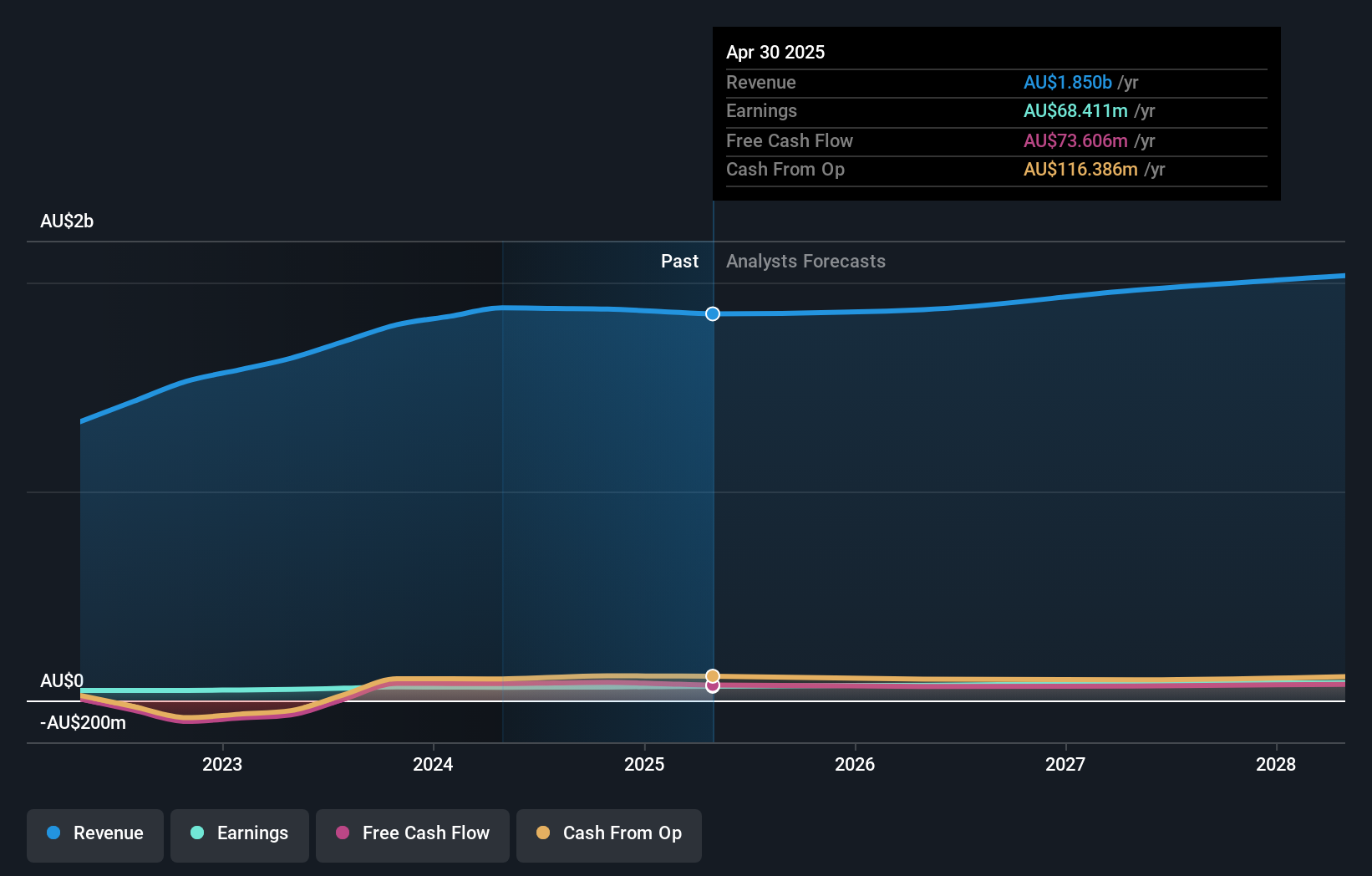

Operations: Ricegrowers Limited generates revenue primarily from its International Rice segment (A$894.03 million), followed by the Rice Pool (A$498.11 million) and Cop Rice (A$252.75 million). The Riviana and Rice Food segments contribute A$222.01 million and A$121.03 million, respectively, while the Corporate Segment adds A$45.79 million in revenue.

Ricegrowers, known for its SunRice brand, has demonstrated solid financial performance with net income rising to A$63.14 million from A$52.55 million last year. The company’s debt to equity ratio has increased from 28.5% to 39.4% over the past five years, indicating a higher leverage but still within satisfactory limits (34%). Additionally, Ricegrowers reported basic earnings per share of A$0.975 and diluted earnings per share of A$0.955 for the fiscal year ending April 2024, reflecting steady growth in profitability and strategic positioning for future acquisitions both domestically and internationally.

- Dive into the specifics of Ricegrowers here with our thorough health report.

Examine Ricegrowers' past performance report to understand how it has performed in the past.

Supply Network (ASX:SNL)

Simply Wall St Value Rating: ★★★★★★

Overview: Supply Network Limited supplies aftermarket parts for the commercial vehicle industry in Australia and New Zealand, with a market cap of A$1.04 billion.

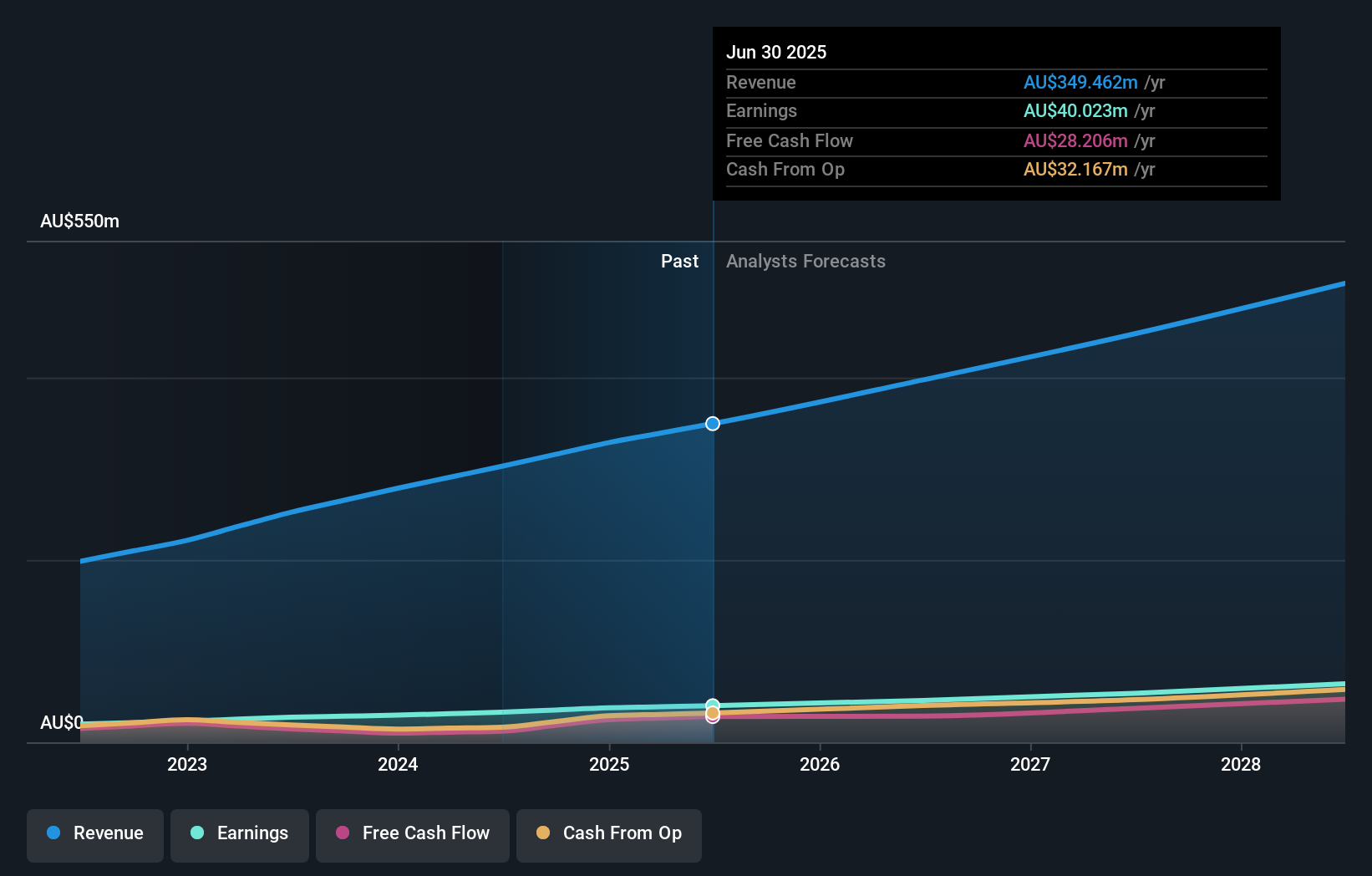

Operations: Supply Network Limited generated A$278.41 million from its aftermarket parts segment for the commercial vehicle market. The company has a market cap of approximately A$1.04 billion.

Supply Network has shown solid performance, with earnings growing 27.9% over the past year, outpacing the Retail Distributors industry’s 2.9%. The company forecasts consolidated sales revenue of A$302.6 million for FY2024 and expects a profit after income tax of A$33.1 million. Their net debt to equity ratio stands at a satisfactory 6%, down from 18.1% five years ago, indicating prudent financial management. Additionally, they declared a final fully franked dividend of A$0.33 per share, up by A$0.05 from last year’s final dividend.

- Take a closer look at Supply Network's potential here in our health report.

Assess Supply Network's past performance with our detailed historical performance reports.

Next Steps

- Dive into all 54 of the ASX Undiscovered Gems With Strong Fundamentals we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SGLLV

Ricegrowers

Operates as a rice food company in Australia, New Zealand, the Pacific Islands, the Middle East, the United States, and internationally.

Undervalued with excellent balance sheet and pays a dividend.