The Australian stock market has been navigating through a period of uncertainty, with indices fluctuating due to geopolitical events and rising inflation, leaving investors cautious yet hopeful as they seek stability. In such volatile conditions, identifying stocks that may be trading below their estimated value can offer potential opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Symal Group (ASX:SYL) | A$2.39 | A$4.55 | 47.5% |

| Superloop (ASX:SLC) | A$2.98 | A$5.62 | 47% |

| Smart Parking (ASX:SPZ) | A$1.24 | A$2.25 | 44.9% |

| Regal Partners (ASX:RPL) | A$2.73 | A$4.84 | 43.6% |

| NRW Holdings (ASX:NWH) | A$4.76 | A$8.91 | 46.5% |

| Immutep (ASX:IMM) | A$0.255 | A$0.49 | 47.8% |

| Cynata Therapeutics (ASX:CYP) | A$0.235 | A$0.44 | 46% |

| CleanSpace Holdings (ASX:CSX) | A$0.70 | A$1.34 | 48% |

| Airtasker (ASX:ART) | A$0.365 | A$0.68 | 46.2% |

| Advanced Braking Technology (ASX:ABV) | A$0.12 | A$0.24 | 49.1% |

Here we highlight a subset of our preferred stocks from the screener.

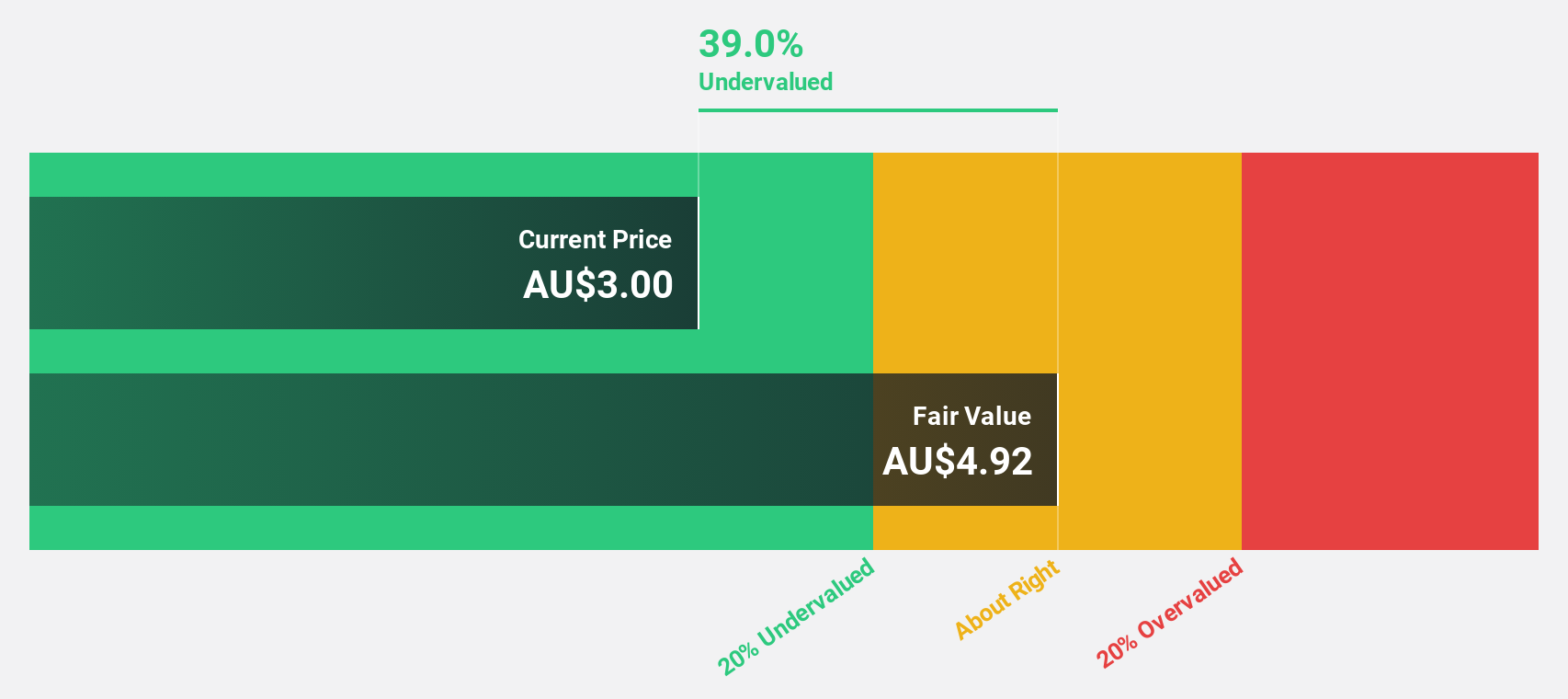

Superloop (ASX:SLC)

Overview: Superloop Limited operates as a telecommunications and internet service provider in Australia, with a market cap of A$1.53 billion.

Operations: The company's revenue segments are comprised of Business at A$104.85 million, Consumer at A$363.69 million, and Wholesale at A$77.92 million.

Estimated Discount To Fair Value: 47%

Superloop's recent inclusion in the S&P/ASX 200 Index reflects its growing market presence. The company reported a significant turnaround with A$1.21 million net income, reversing a previous loss, and revenue growth to A$550.27 million. Trading at A$2.98, it's considered highly undervalued based on discounted cash flow analysis compared to an estimated fair value of A$5.62. Despite insider selling, its projected earnings growth of 35.9% annually surpasses the market average significantly.

- The analysis detailed in our Superloop growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Superloop's balance sheet health report.

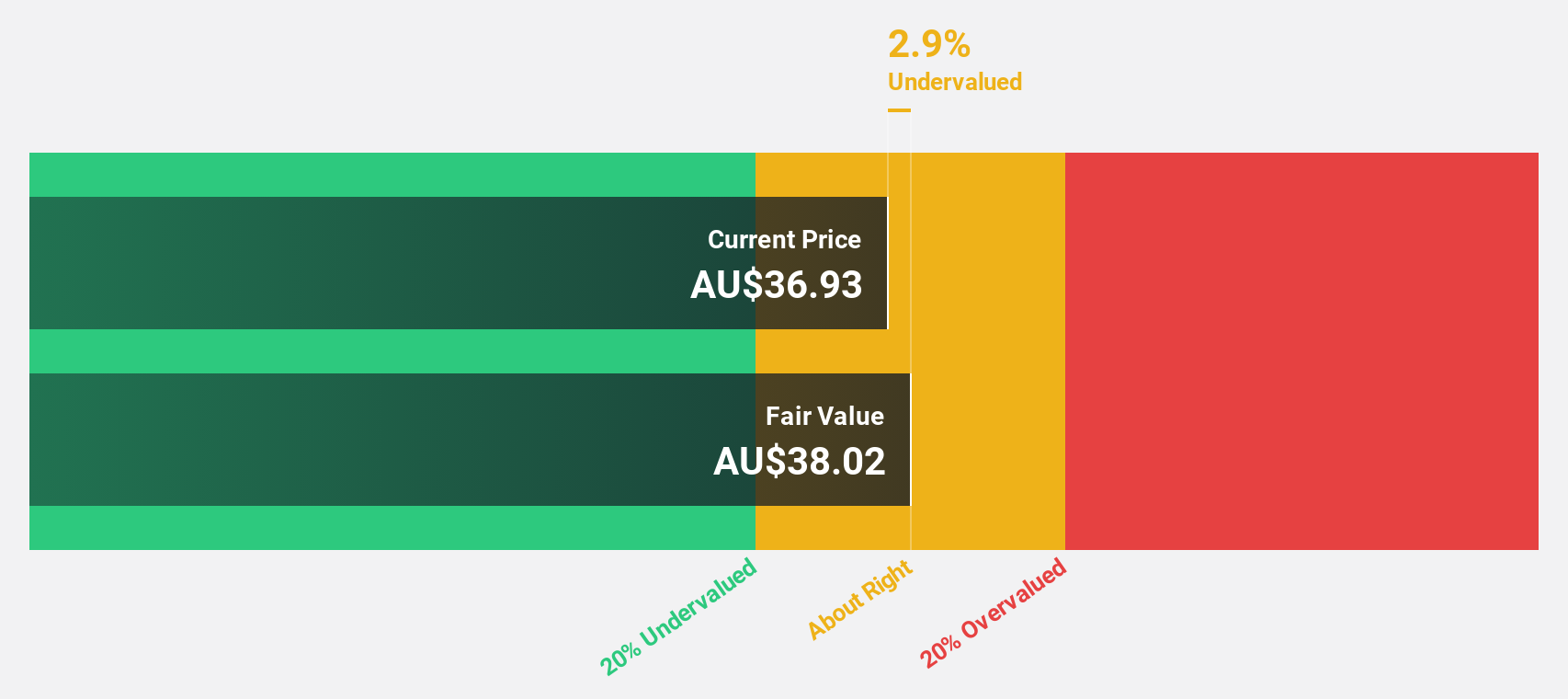

Supply Network (ASX:SNL)

Overview: Supply Network Limited supplies aftermarket parts for commercial vehicles in Australia and New Zealand, with a market cap of A$1.47 billion.

Operations: The company generates revenue of A$349.46 million from providing aftermarket parts for the commercial vehicle sector in Australia and New Zealand.

Estimated Discount To Fair Value: 10.3%

Supply Network Limited, trading at A$33.53, is undervalued based on cash flow analysis with a fair value estimate of A$37.39. The company reported sales of A$348.83 million and net income of A$40.02 million for the year ending June 2025, reflecting solid financial performance. Earnings are expected to grow at 14.4% annually, outpacing the Australian market's average growth rate. Recent board changes include appointing Karen Phin as an independent director, enhancing governance expertise and oversight capabilities.

- Our earnings growth report unveils the potential for significant increases in Supply Network's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Supply Network.

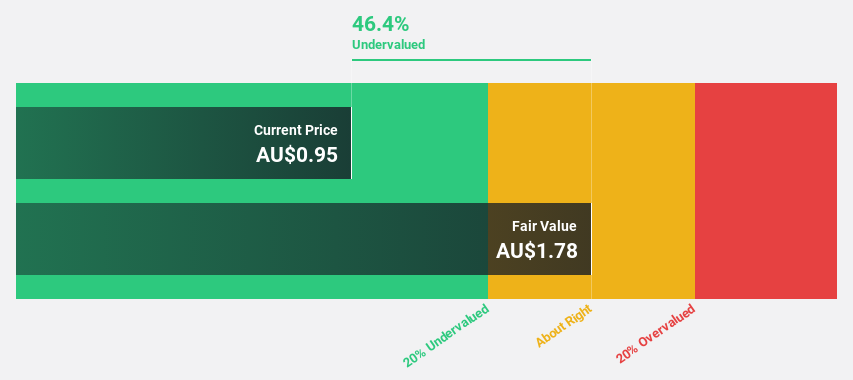

Smart Parking (ASX:SPZ)

Overview: Smart Parking Limited designs, develops, and manages parking management solutions across New Zealand, Australia, Denmark, Germany, and the United Kingdom with a market cap of A$506.34 million.

Operations: The company's revenue segments include A$5.27 million from the Technology Division and parking management revenues of A$1.30 million in Denmark, A$4.00 million in Germany, A$0.08 million in Australia, A$7.40 million in New Zealand, A$10.22 million in the United States, and A$52.52 million in the United Kingdom.

Estimated Discount To Fair Value: 44.9%

Smart Parking Limited, trading at A$1.24, is significantly undervalued based on cash flow analysis with a fair value estimate of A$2.25. Recent earnings show robust growth, with net income rising to A$5.42 million from A$3.69 million the previous year, and revenue forecasted to grow faster than the Australian market at 16.7% annually. The company's capital-light model supports positive cash flows and high returns on investments while pursuing strategic acquisitions for further expansion in nascent markets.

- The growth report we've compiled suggests that Smart Parking's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Smart Parking.

Seize The Opportunity

- Click here to access our complete index of 30 Undervalued ASX Stocks Based On Cash Flows.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SLC

Superloop

Operates as a telecommunications and internet service provider in Australia.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives