Stock Analysis

- Australia

- /

- Specialty Stores

- /

- ASX:NCK

Collins Foods And Two More ASX Dividend Stocks To Consider

Reviewed by Simply Wall St

The Australian market has shown robust performance, with an 11% increase over the past year and earnings projected to grow by 14% annually. In this promising environment, dividend stocks like Collins Foods can offer investors both stability and potential income growth.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Collins Foods (ASX:CKF) | 3.07% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 7.14% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 5.13% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 3.97% | ★★★★★☆ |

| Centuria Capital Group (ASX:CNI) | 6.65% | ★★★★★☆ |

| Charter Hall Group (ASX:CHC) | 3.62% | ★★★★★☆ |

| Eagers Automotive (ASX:APE) | 7.13% | ★★★★★☆ |

| Fortescue (ASX:FMG) | 9.25% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.28% | ★★★★★☆ |

| Diversified United Investment (ASX:DUI) | 3.02% | ★★★★★☆ |

Click here to see the full list of 28 stocks from our Top ASX Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Collins Foods (ASX:CKF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Collins Foods Limited operates and manages a chain of restaurants across Australia and Europe, with a market capitalization of approximately A$1.18 billion.

Operations: Collins Foods Limited generates revenue through its KFC restaurants in Australia (A$1.12 billion), KFC restaurants in Europe (A$313.47 million), and Taco Bell restaurants (A$54.38 million).

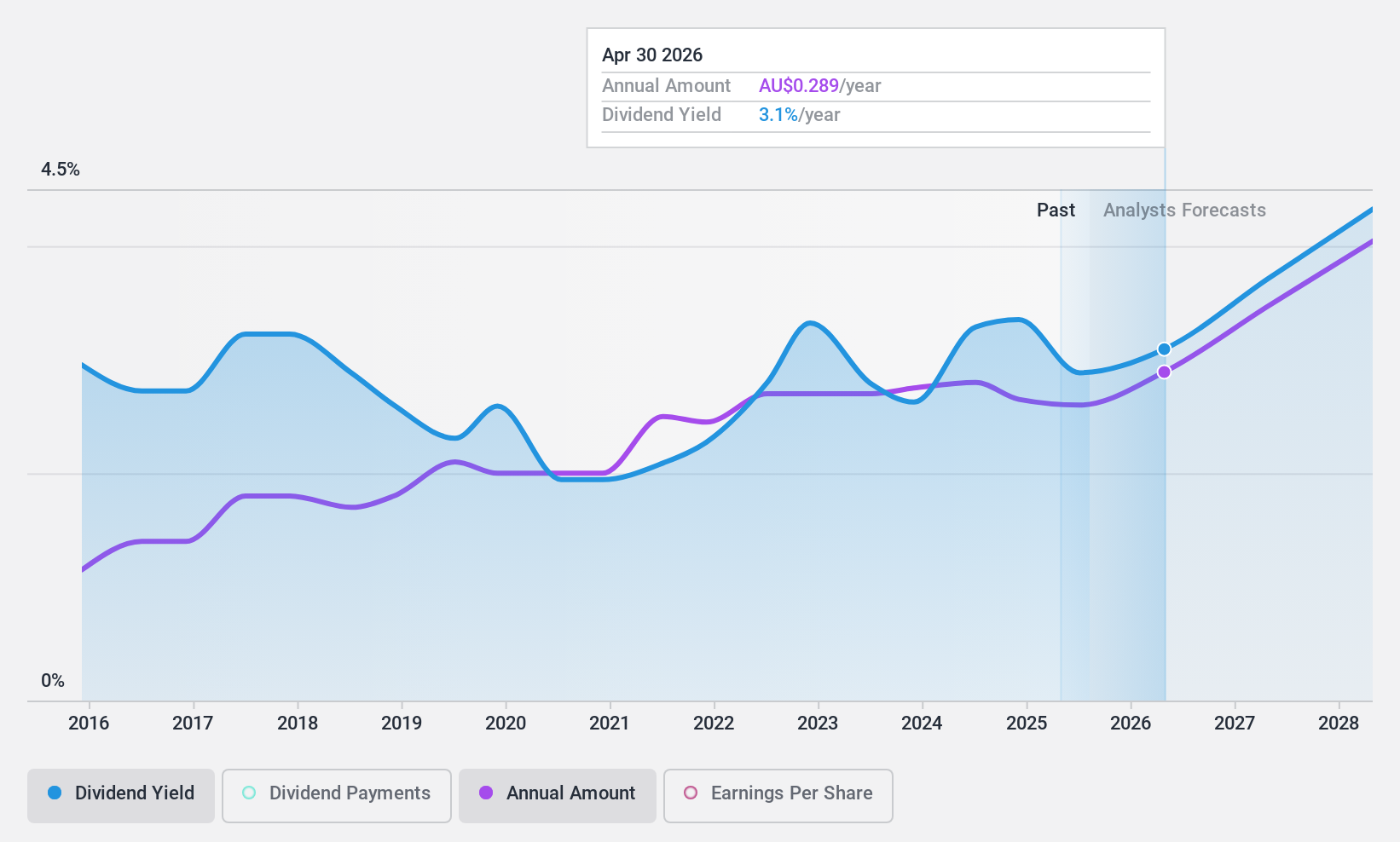

Dividend Yield: 3.1%

Collins Foods Limited showcased significant growth in its latest earnings, with sales rising to A$1.49 billion and net income increasing to A$76.72 million, reflecting a substantial improvement from the previous year. Despite recent leadership changes, with Kevin Perkins serving as interim CEO amid a global search for a permanent successor, the company maintains a stable dividend yield of 3.07%. However, this yield is relatively low compared to the top Australian dividend payers. Collins Foods' dividends are well-supported by both earnings and cash flows, indicating sustainability despite its modest yield in comparison to peers.

- Get an in-depth perspective on Collins Foods' performance by reading our dividend report here.

- Our valuation report here indicates Collins Foods may be undervalued.

Nick Scali (ASX:NCK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nick Scali Limited operates in the sourcing and retailing of household furniture and related accessories across Australia and New Zealand, with a market capitalization of approximately A$1.19 billion.

Operations: Nick Scali Limited generates its revenue primarily through the furniture retailing segment, which accounted for A$450.45 million.

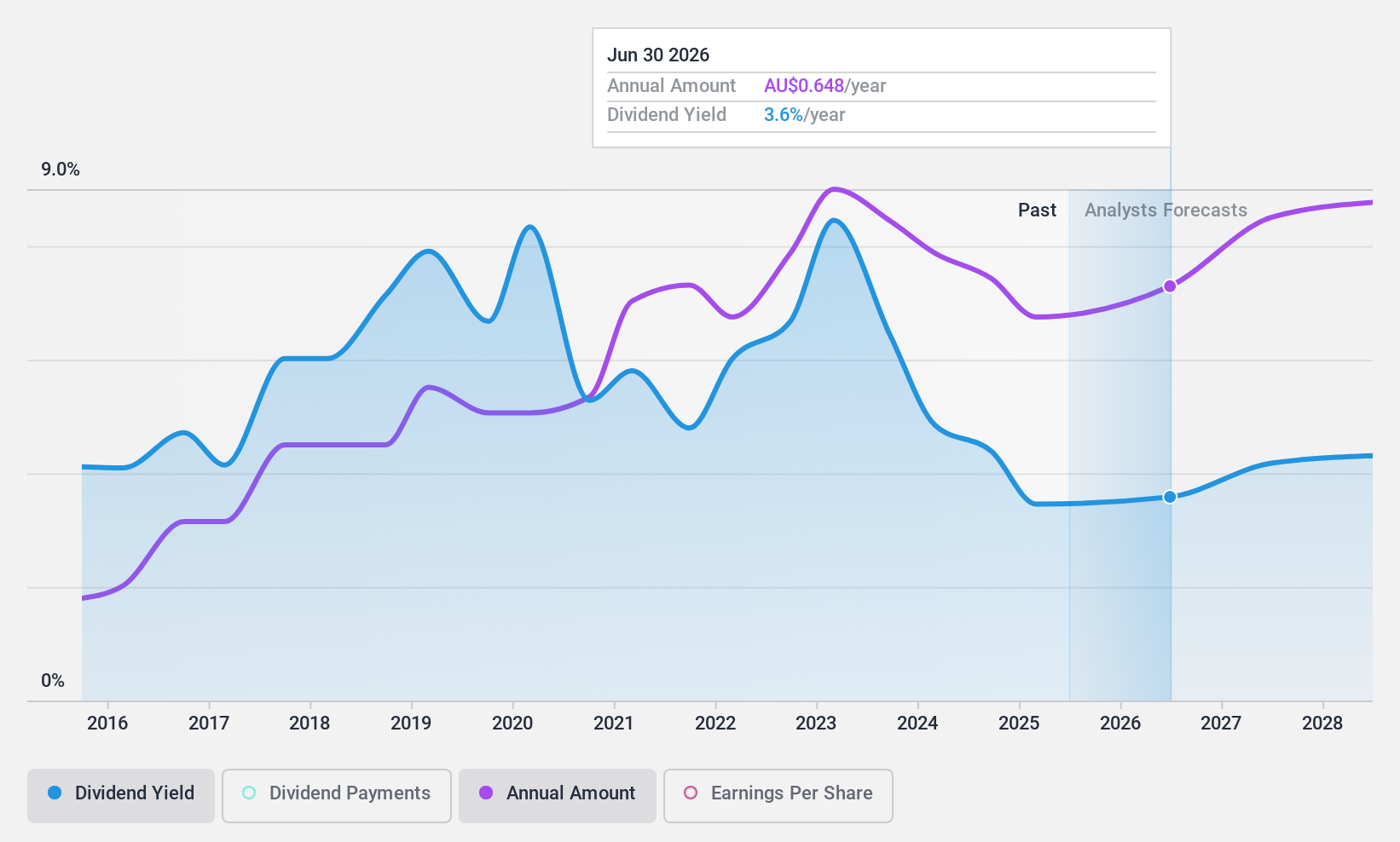

Dividend Yield: 5.1%

Nick Scali Limited has demonstrated a mixed performance as a dividend stock. While the company's dividend yield of 5.13% falls below the top quartile of Australian dividend payers, its dividends are well-supported by both earnings and cash flows, with payout ratios of 67.9% and 45.6%, respectively. Recent equity offerings totaling A$120 million may raise concerns about shareholder dilution, despite stable dividends over the past decade and an anticipated earnings growth of 8.3% per year.

- Take a closer look at Nick Scali's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Nick Scali is priced lower than what may be justified by its financials.

Sonic Healthcare (ASX:SHL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sonic Healthcare Limited provides medical diagnostic services to a range of healthcare providers including medical practitioners and hospitals, with a market capitalization of approximately A$12.85 billion.

Operations: Sonic Healthcare Limited generates A$7.12 billion from its Laboratory segment and A$0.84 billion from Radiology.

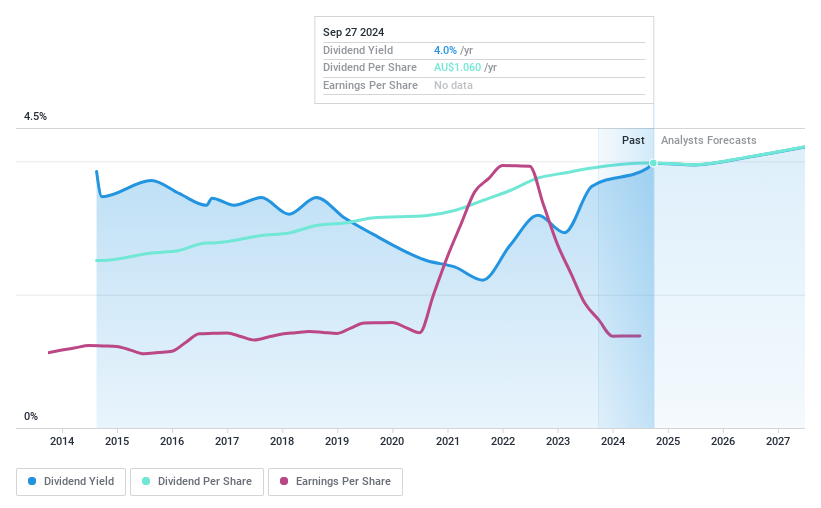

Dividend Yield: 4%

Sonic Healthcare's dividend yield of 3.96% is modest relative to Australia's top dividend payers. Despite a stable 10-year history of dividend payments, the sustainability is questionable with dividends not fully covered by earnings and a high payout ratio of 98%. However, cash flows do cover the current dividend payments. Recent moves to acquire Healius Limited’s diagnostic imaging business for up to A$800 million indicate strategic growth efforts, although it underscores potential financial commitments that could impact future dividends.

- Unlock comprehensive insights into our analysis of Sonic Healthcare stock in this dividend report.

- Upon reviewing our latest valuation report, Sonic Healthcare's share price might be too pessimistic.

Taking Advantage

- Embark on your investment journey to our 28 Top ASX Dividend Stocks selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Nick Scali is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NCK

Nick Scali

Engages in sourcing and retailing of household furniture and related accessories in Australia and New Zealand.

Undervalued established dividend payer.