- Australia

- /

- Hospitality

- /

- ASX:PBH

Kogan.com And 2 ASX Penny Stocks To Keep An Eye On

Reviewed by Simply Wall St

As the Australian market braces for key inflation data from the ABS, with the ASX 200 futures slightly down, investors are keenly observing economic indicators and company performances. In such a climate, understanding what makes a stock appealing is crucial—particularly when it comes to penny stocks. Despite their old-fashioned moniker, these smaller or newer companies can offer significant value when they possess strong financials and growth potential.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.62 | A$72.68M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.795 | A$145.87M | ★★★★☆☆ |

| MaxiPARTS (ASX:MXI) | A$1.85 | A$102.34M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.77 | A$285.11M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.535 | A$331.78M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.73 | A$847.84M | ★★★★★☆ |

| Perenti (ASX:PRN) | A$1.17 | A$1.08B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.14 | A$61M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$3.40 | A$151.04M | ★★★★★★ |

| Joyce (ASX:JYC) | A$4.21 | A$124.18M | ★★★★★★ |

Click here to see the full list of 1,034 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Kogan.com (ASX:KGN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kogan.com Ltd is an online retailer operating in Australia with a market cap of A$481.32 million.

Operations: The company's revenue is derived from its Australian operations, with A$277.82 million from Kogan Parent and A$11.20 million from Mighty Ape, as well as its New Zealand operations, contributing A$35.35 million from Kogan Parent and A$135.34 million from Mighty Ape.

Market Cap: A$481.32M

Kogan.com Ltd has recently turned profitable, reporting a net income of A$0.083 million for the year ending June 30, 2024, compared to a loss the previous year. Despite declining sales from A$489.49 million to A$459.7 million, the company remains debt-free with strong short-term asset coverage over liabilities and stable weekly volatility at 6%. The board and management are experienced with average tenures of 8.4 and 13.9 years respectively. Kogan.com completed a significant share buyback program in August, enhancing shareholder value by repurchasing nearly 10% of its shares since April 2023 for A$51.8 million.

- Take a closer look at Kogan.com's potential here in our financial health report.

- Assess Kogan.com's future earnings estimates with our detailed growth reports.

OFX Group (ASX:OFX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: OFX Group Limited offers international payments and foreign exchange services across the Asia Pacific, North America, Europe, the Middle East, and Africa with a market cap of A$353.94 million.

Operations: The company generates revenue from various regions, including A$91.10 million from APAC, A$36.67 million from Europe, and A$87.66 million from North America.

Market Cap: A$353.94M

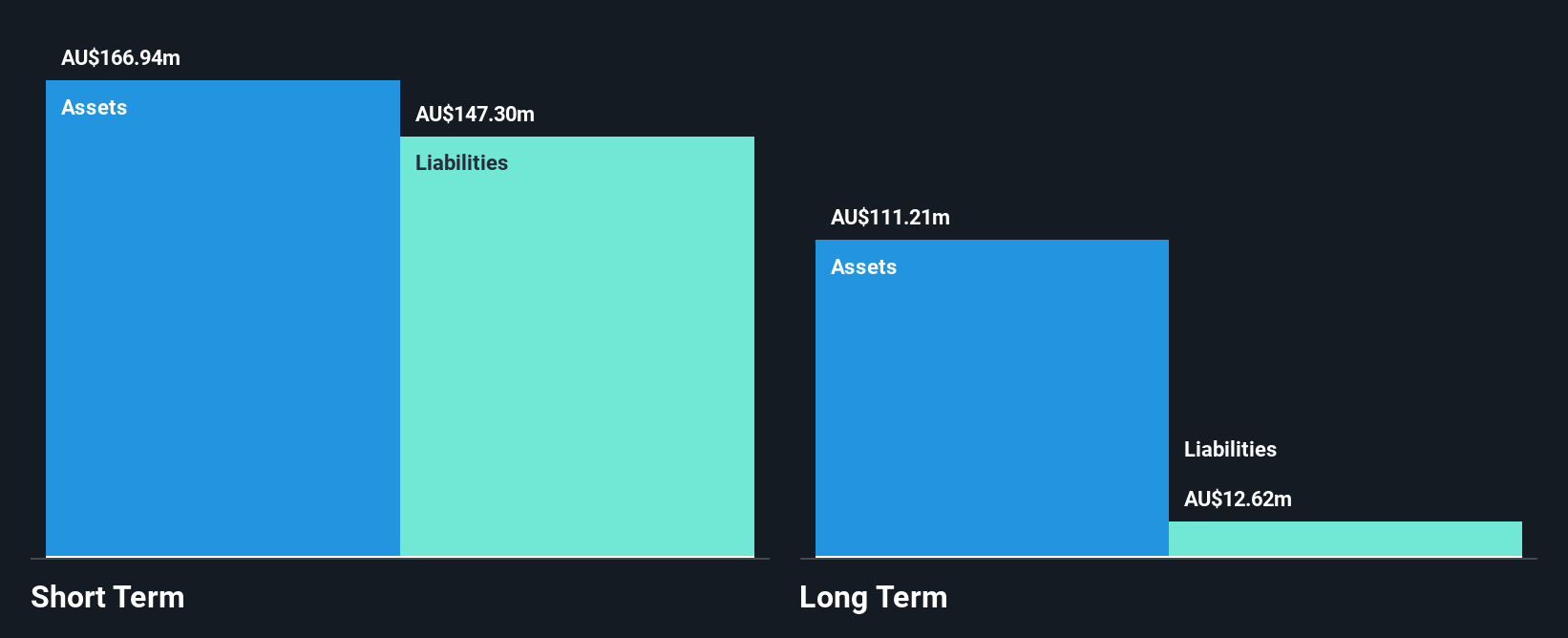

OFX Group Limited, with a market cap of A$353.94 million, operates across multiple regions, generating significant revenue from APAC and North America. Despite a decrease in net profit margins from 13.7% to 12.9%, the company maintains high-quality earnings and has not diluted shareholders recently. OFX's short-term assets exceed both its long-term and short-term liabilities, indicating strong financial stability. The company is trading below estimated fair value and analysts expect a potential price increase of 51.6%. Recent guidance suggests positive NOI growth for fiscal year 2025 despite being lower than initially forecasted due to first-half conditions.

- Dive into the specifics of OFX Group here with our thorough balance sheet health report.

- Gain insights into OFX Group's future direction by reviewing our growth report.

PointsBet Holdings (ASX:PBH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: PointsBet Holdings Limited operates a cloud-based platform offering sports, racing, and iGaming betting products and services in Australia with a market cap of A$240.22 million.

Operations: The company generates revenue from its Australian Trading segment (A$211.54 million), Canada Trading segment (A$33.95 million), and Technology segment (A$21.37 million).

Market Cap: A$240.22M

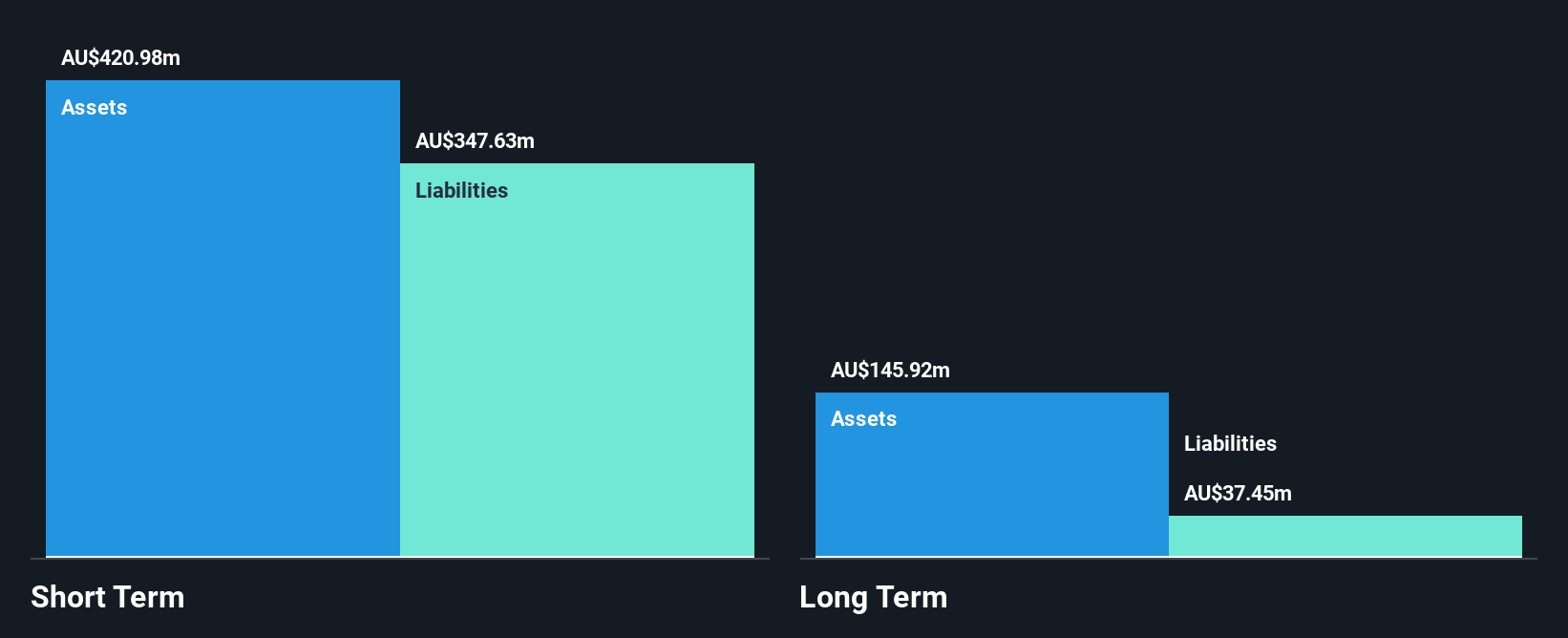

PointsBet Holdings Limited, with a market cap of A$240.22 million, is navigating its unprofitable status by focusing on revenue growth, reporting A$245.49 million in sales for the year ending June 30, 2024. This marks an increase from A$210.3 million the previous year while significantly reducing its net loss from A$276.3 million to A$42.32 million over the same period. Despite negative return on equity and shareholder dilution, PointsBet maintains a stable cash runway exceeding three years and operates debt-free with experienced management and board members guiding strategic decisions amidst industry volatility.

- Jump into the full analysis health report here for a deeper understanding of PointsBet Holdings.

- Explore PointsBet Holdings' analyst forecasts in our growth report.

Key Takeaways

- Unlock our comprehensive list of 1,034 ASX Penny Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PBH

PointsBet Holdings

Provides sports, racing, and iGaming betting products and services through its cloud-based technology platform in Australia.

Undervalued with high growth potential.