Stock Analysis

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like JB Hi-Fi (ASX:JBH). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for JB Hi-Fi

JB Hi-Fi's Earnings Per Share Are Growing.

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That means EPS growth is considered a real positive by most successful long-term investors. Impressively, JB Hi-Fi has grown EPS by 29% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

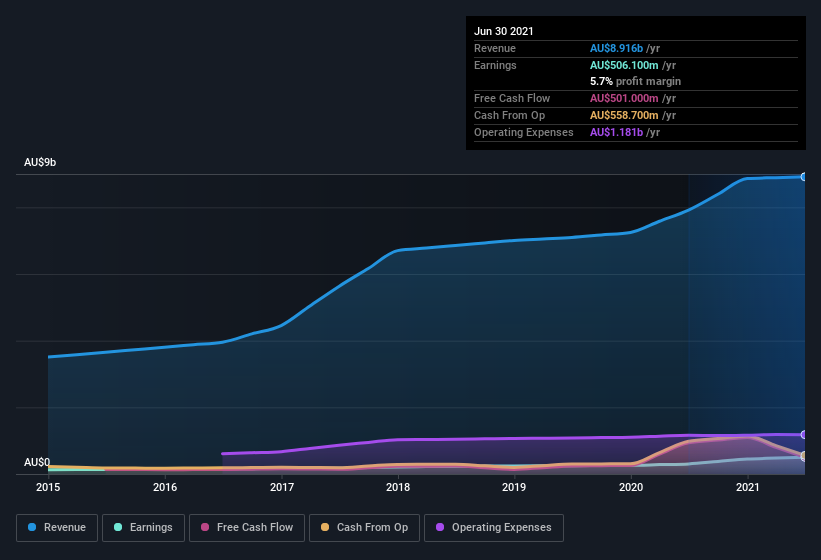

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. JB Hi-Fi shareholders can take confidence from the fact that EBIT margins are up from 6.1% to 8.4%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for JB Hi-Fi's future profits.

Are JB Hi-Fi Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Not only did JB Hi-Fi insiders refrain from selling stock during the year, but they also spent AU$213k buying it. That's nice to see, because it suggests insiders are optimistic. It is also worth noting that it was Independent Non-Executive Director Geoffrey Roberts who made the biggest single purchase, worth AU$141k, paying AU$47.04 per share.

Along with the insider buying, another encouraging sign for JB Hi-Fi is that insiders, as a group, have a considerable shareholding. Indeed, they hold AU$43m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 0.8% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. The cherry on top is that the CEO, Terry Smart is paid comparatively modestly to CEOs at similar sized companies. I discovered that the median total compensation for the CEOs of companies like JB Hi-Fi with market caps between AU$2.8b and AU$8.8b is about AU$2.6m.

JB Hi-Fi offered total compensation worth AU$2.3m to its CEO in the year to . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. I'd also argue reasonable pay levels attest to good decision making more generally.

Should You Add JB Hi-Fi To Your Watchlist?

For growth investors like me, JB Hi-Fi's raw rate of earnings growth is a beacon in the night. Not only that, but we can see that insiders both own a lot of, and are buying more, shares in the company. So I do think this is one stock worth watching. We should say that we've discovered 2 warning signs for JB Hi-Fi (1 is concerning!) that you should be aware of before investing here.

The good news is that JB Hi-Fi is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're helping make it simple.

Find out whether JB Hi-Fi is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:JBH

JB Hi-Fi

JB Hi-Fi Limited, together with its subsidiaries, retails home consumer products.

Flawless balance sheet average dividend payer.