- Australia

- /

- Specialty Stores

- /

- ASX:AX1

Accent Group (ASX:AX1) Is Down 16.1% After Earnings Downgrade and Shareholder Remuneration Protest – What's Changed

Reviewed by Sasha Jovanovic

- Earlier this week, Accent Group reported FY25 company-owned sales of A$1.46 billion and a net profit after tax of A$57.7 million, while flagging a sharp earnings downgrade for the coming year and the temporary absence of its CEO due to illness.

- Management’s decision to withdraw several shareholder meeting agenda items after significant investor feedback, alongside a first strike on its remuneration report, highlights heightened governance scrutiny amid challenging retail conditions.

- Here, we examine how Accent Group’s reduced earnings outlook and shareholder protest could impact its longer-term investment narrative and store-led growth strategy.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Accent Group Investment Narrative Recap

To be a shareholder in Accent Group today, you need confidence in its ability to navigate ongoing retail headwinds while delivering on new store expansion and leveraging resilient sports and performance brands. Recent news of an earnings downgrade and sharp share price fall directly impacts the near-term outlook, making gross margin pressure from heavy discounting and consumer caution the most significant short-term risk, while any upside will likely hinge on operational execution and sustained demand for performance-driven banners.

Of the latest company announcements, management’s move to withdraw select AGM agenda items after strong shareholder feedback stands out given the recent "first strike" against the remuneration report. This signals heightened investor focus on governance and capital allocation at a time when board and executive decisions have become crucial for managing key risks, including margin compression and costs that could weigh on any planned growth acceleration.

By contrast, a key question investors should be aware of revolves around whether Accent’s aggressive store rollout might...

Read the full narrative on Accent Group (it's free!)

Accent Group's outlook anticipates A$1.8 billion in revenue and A$84.5 million in earnings by 2028. This is based on a 6.5% annual revenue growth rate and represents an increase of A$26.8 million in earnings from the current A$57.7 million.

Uncover how Accent Group's forecasts yield a A$1.69 fair value, a 67% upside to its current price.

Exploring Other Perspectives

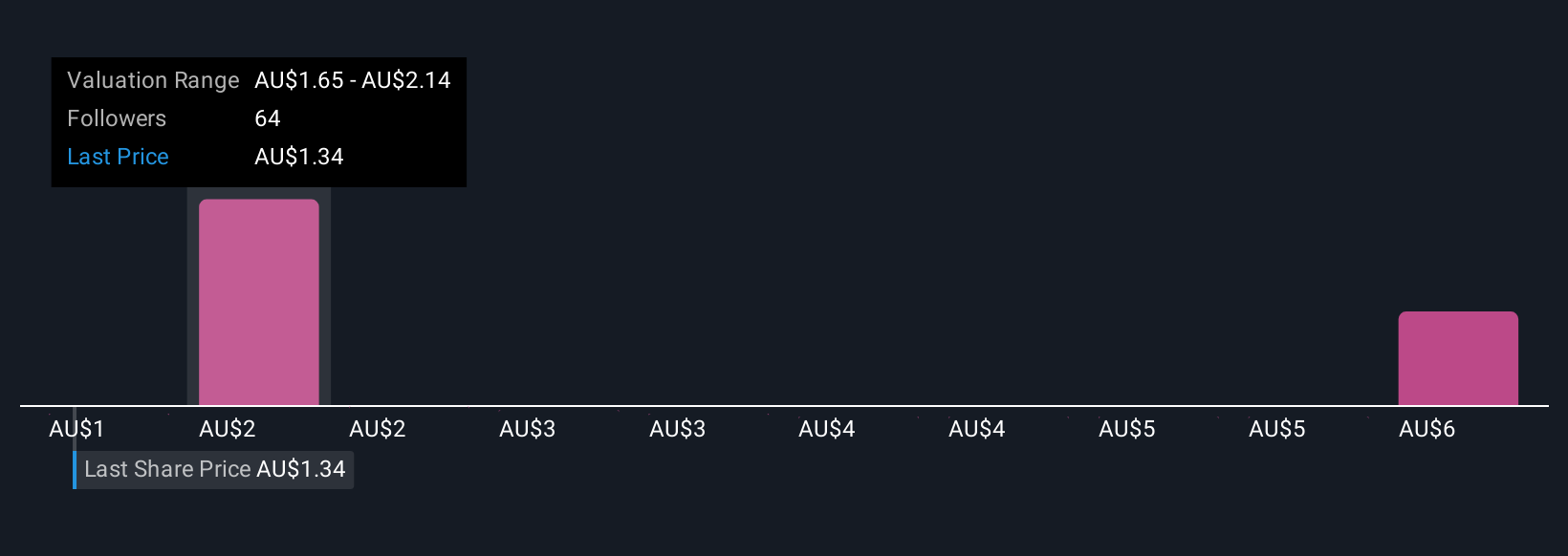

Twelve members of the Simply Wall St Community set Accent Group’s fair value between A$1.16 and A$5.55 per share. Amid these views, pressure on gross margins and promotional costs could play a pivotal role in shaping future returns, so you may want to explore the full spectrum of opinions across the community.

Explore 12 other fair value estimates on Accent Group - why the stock might be worth over 5x more than the current price!

Build Your Own Accent Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Accent Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Accent Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Accent Group's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AX1

Accent Group

Engages in the retail, distribution, and franchise of lifestyle footwear, apparel, and accessories in Australia and New Zealand.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives