Joshua Zhou became the CEO of AuMake Limited (ASX:AUK) in 2017, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Check out our latest analysis for AuMake

Comparing AuMake Limited's CEO Compensation With the industry

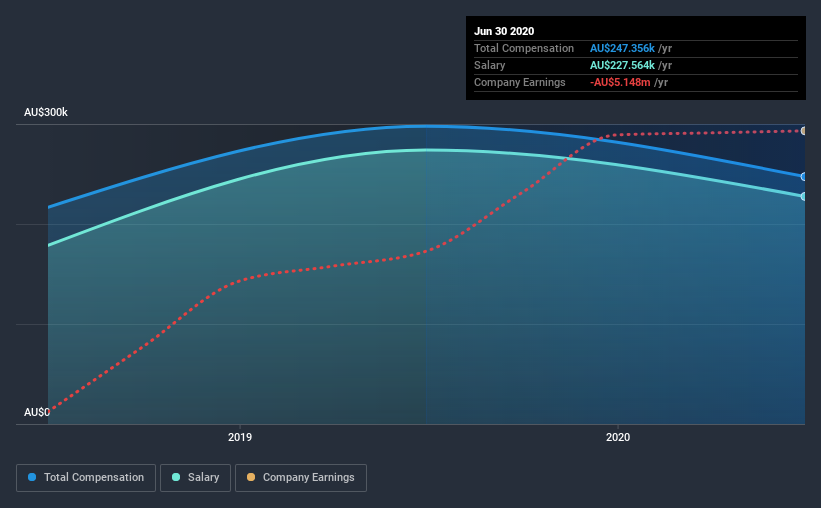

According to our data, AuMake Limited has a market capitalization of AU$29m, and paid its CEO total annual compensation worth AU$247k over the year to June 2020. Notably, that's a decrease of 17% over the year before. In particular, the salary of AU$227.6k, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar-sized companies in the industry with market capitalizations below AU$263m, we found that the median total CEO compensation was AU$811k. That is to say, Joshua Zhou is paid under the industry median. Furthermore, Joshua Zhou directly owns AU$4.3m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$228k | AU$274k | 92% |

| Other | AU$20k | AU$24k | 8% |

| Total Compensation | AU$247k | AU$298k | 100% |

On an industry level, roughly 61% of total compensation represents salary and 39% is other remuneration. According to our research, AuMake has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

AuMake Limited's Growth

AuMake Limited's earnings per share (EPS) grew 26% per year over the last three years. Its revenue is up 38% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. Most shareholders would be pleased to see strong revenue growth combined with EPS growth. This combo suggests a fast growing business. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has AuMake Limited Been A Good Investment?

Given the total shareholder loss of 89% over three years, many shareholders in AuMake Limited are probably rather dissatisfied, to say the least. So shareholders would probably want the company to be lessto generous with CEO compensation.

In Summary...

As we touched on above, AuMake Limited is currently paying its CEO below the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. Importantly though, the company has impressed with its EPS growth over three years. Considering EPS are on the up, we would say Joshua is compensated fairly. But shareholders will likely want to hold off on any raise for Joshua until investor returns are positive.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We did our research and spotted 3 warning signs for AuMake that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading AuMake or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:AUK

AuMake

Engages in the sale of various products through its online e-commerce store in Australia, Hong Kong, Mainland China, and New Zealand.

Mediocre balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026