- Australia

- /

- Specialty Stores

- /

- ASX:APE

3 Undervalued Small Caps In Australia With Insider Buying

Reviewed by Simply Wall St

The Australian market has remained flat over the past week but has seen a 10% rise over the last 12 months, with earnings expected to grow by 12% annually. In this context, identifying small-cap stocks that are undervalued and have insider buying can be a promising strategy for investors looking to capitalize on potential growth opportunities.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Beach Energy | NA | 1.5x | 33.21% | ★★★★★☆ |

| Elders | 23.1x | 0.5x | 48.76% | ★★★★☆☆ |

| Corporate Travel Management | 20.7x | 2.5x | 3.51% | ★★★★☆☆ |

| Lycopodium | 9.4x | 1.4x | 25.09% | ★★★★☆☆ |

| Bapcor | NA | 0.8x | 48.23% | ★★★★☆☆ |

| Eagers Automotive | 10.7x | 0.3x | 38.39% | ★★★★☆☆ |

| Codan | 33.7x | 5.0x | 15.47% | ★★★☆☆☆ |

| Megaport | 135.3x | 6.7x | 40.05% | ★★★☆☆☆ |

| Coventry Group | 251.7x | 0.4x | -21.00% | ★★★☆☆☆ |

| Abacus Group | NA | 5.8x | 27.25% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

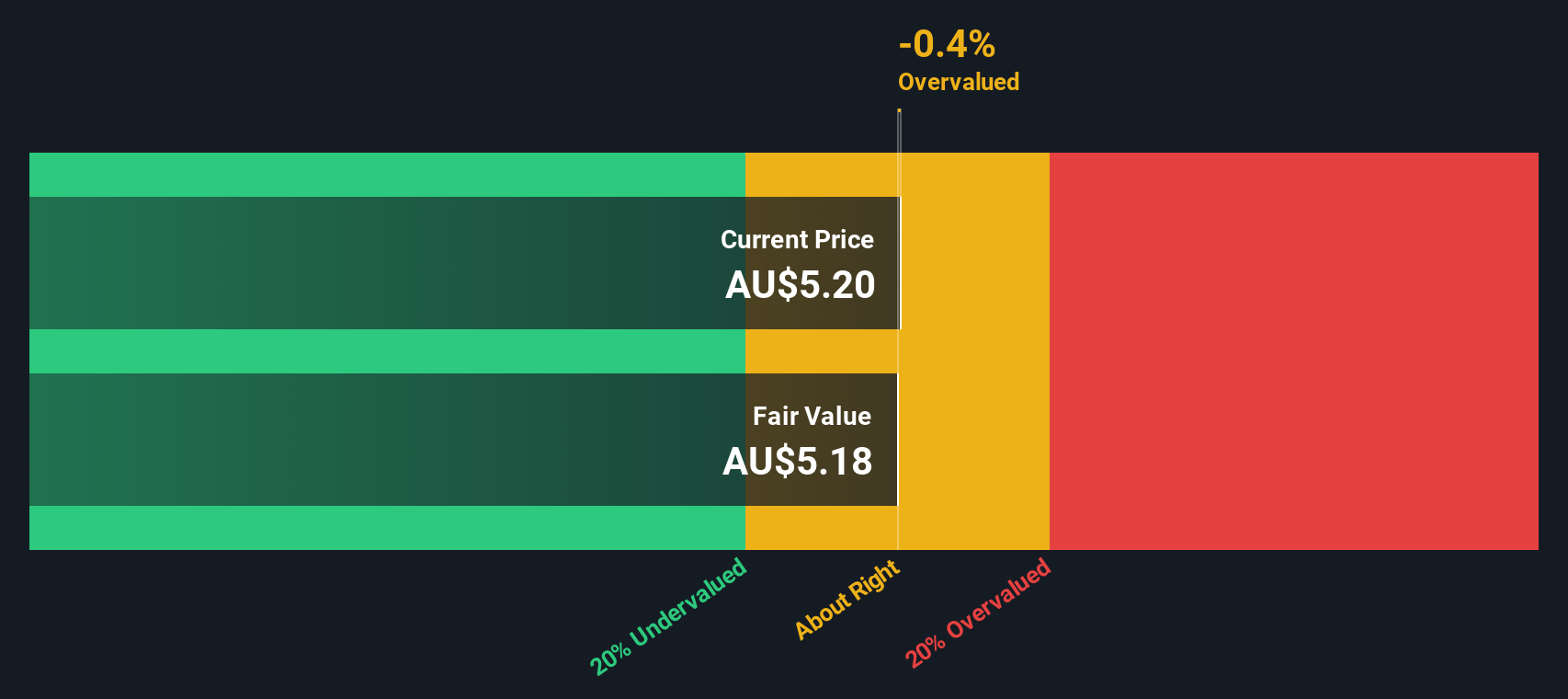

Abacus Group (ASX:ABG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Abacus Group is a diversified property investment and management company with operations primarily in commercial real estate, boasting a market cap of approximately A$2.50 billion.

Operations: Abacus Group's revenue streams primarily derive from commercial operations, with notable gross profit margins reaching up to 84.50%. Key costs include COGS and operating expenses, with recent data showing a net income margin of -125.81% for the latest period ending 2024-09-03.

PE: -4.6x

Abacus Group, a smaller Australian stock, recently reported a net loss of A$241.04 million for the fiscal year ending June 30, 2024, compared to a net income of A$25.5 million the previous year. Despite this downturn and reduced dividend payouts (A$0.0425 per share), insider confidence remains evident with notable share purchases in recent months. The company relies entirely on external borrowing for funding, which carries higher risk but is forecasted to grow earnings by 47% annually.

- Unlock comprehensive insights into our analysis of Abacus Group stock in this valuation report.

Explore historical data to track Abacus Group's performance over time in our Past section.

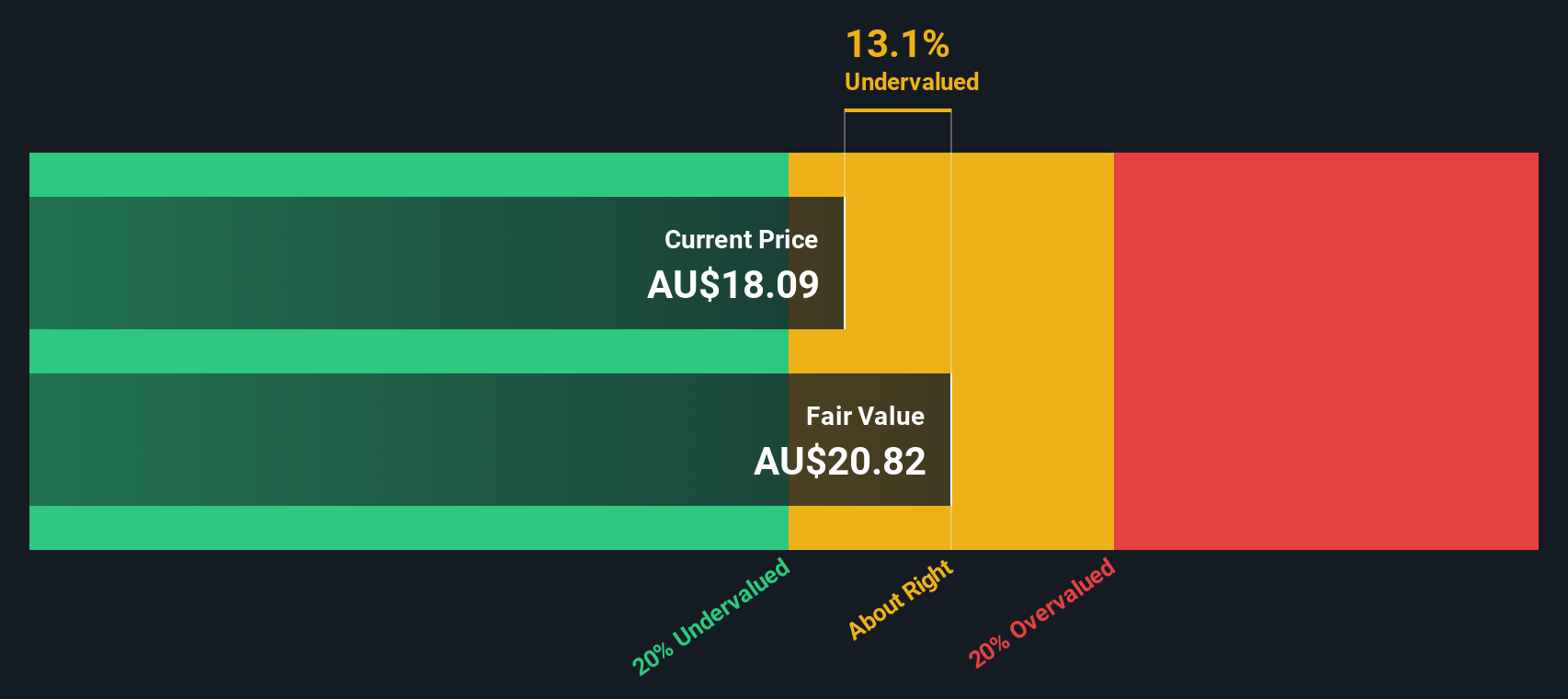

Eagers Automotive (ASX:APE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Eagers Automotive is a leading Australian car retailing company with operations in property and car sales, boasting a market cap of A$3.92 billion.

Operations: Car Retailing generates the bulk of revenue at A$10.50 billion, with a gross profit margin fluctuating between 17.59% and 19.14% over recent periods. Operating expenses have been significant, with General & Administrative Expenses consistently being a major cost factor, reaching up to A$753.51 million recently.

PE: 10.7x

Eagers Automotive, a small Australian company, reported A$5.46 billion in sales for the first half of 2024, up from A$4.82 billion last year. Despite a slight dip in net income to A$116 million from A$138 million, the company announced a dividend of A$0.24 per share for the period ending June 30, 2024. Notably, they initiated a buyback program to repurchase up to 25.8 million shares by June 2025, reflecting strong insider confidence in their future prospects despite higher risk funding sources and lower earnings per share compared to last year.

- Take a closer look at Eagers Automotive's potential here in our valuation report.

Understand Eagers Automotive's track record by examining our Past report.

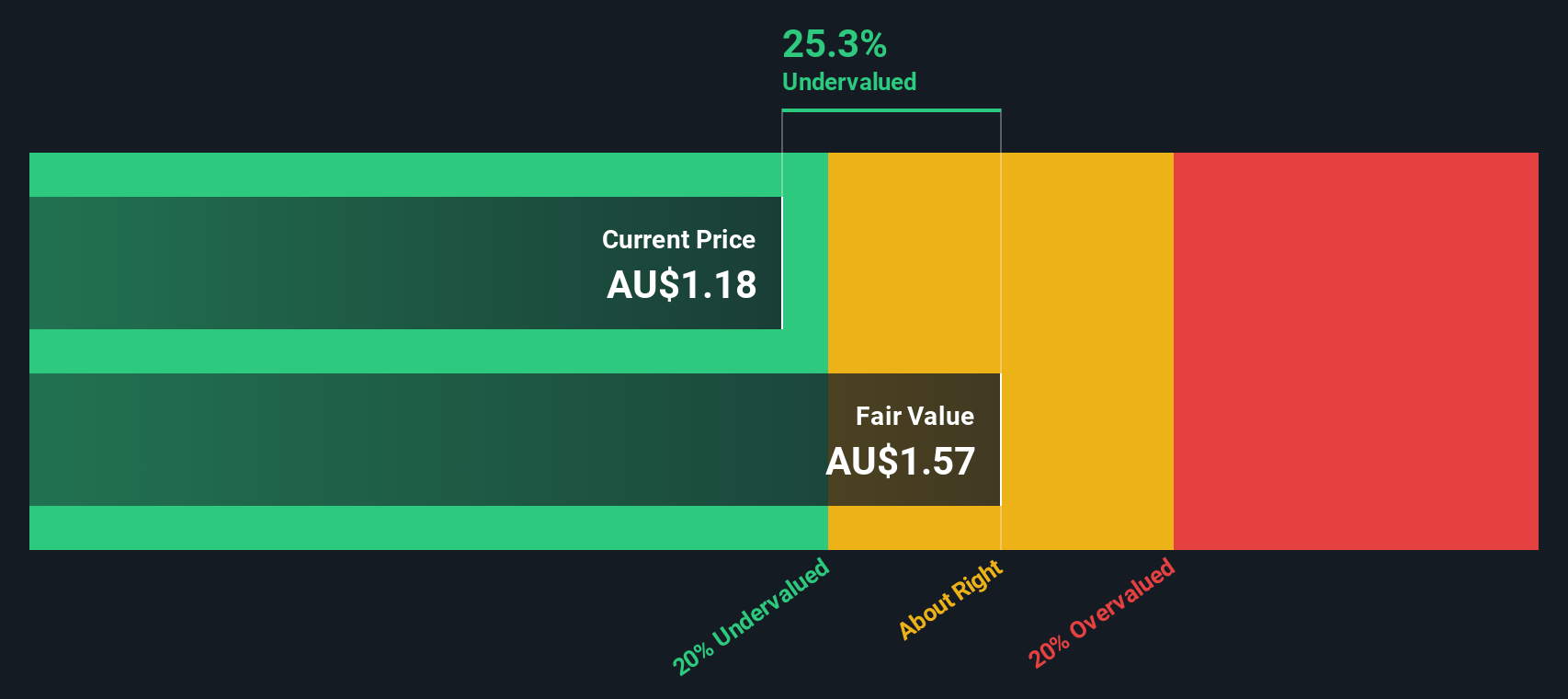

Ingenia Communities Group (ASX:INA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ingenia Communities Group is a company focused on the development, operation, and ownership of lifestyle and holiday communities across Australia with a market cap of A$1.86 billion.

Operations: Ingenia Communities Group generates revenue from segments including Tourism, Residential Lifestyle Development, Residential Lifestyle Rental, and Fuel, Food & Beverage. For the period ending 2024-06-30, the company reported a gross profit of A$287.05 million with a gross profit margin of 61.56%. Operating expenses were A$165.03 million and non-operating expenses amounted to A$108 million.

PE: 153.2x

Ingenia Communities Group, a small cap in Australia, has shown insider confidence with recent share purchases by executives. Despite a drop in net income to A$14.02 million for the year ending June 30, 2024 from A$64.37 million the previous year, revenue climbed to A$472.29 million from A$394.47 million. The company recently increased its dividend to A$0.061 per share and is undergoing significant board renewal with new appointments aimed at enhancing governance and strategic direction.

Summing It All Up

- Click through to start exploring the rest of the 21 Undervalued ASX Small Caps With Insider Buying now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eagers Automotive might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:APE

Eagers Automotive

An automotive retail company, owns and operates motor vehicle dealerships in Australia and New Zealand.

Established dividend payer and good value.