- Australia

- /

- Retail REITs

- /

- ASX:VCX

Assessing Vicinity Centres (ASX:VCX) Valuation Following Strong Earnings Growth and New Dividend

Reviewed by Simply Wall St

If you have been eyeing Vicinity Centres (ASX:VCX), the latest earnings should definitely be on your radar. The company just posted its full-year results, showing a substantial increase in net income and earnings per share compared to last year, even as revenue growth remained fairly flat. Paired with a fresh dividend announcement, these numbers are prompting some investors to reassess what comes next for the stock and whether now is the right time to take a closer look.

The market has responded with some momentum as well. Over the past year, Vicinity Centres shares have gained 25%, and the uptrend has picked up pace in the last month and quarter. In the background, the company faces leadership changes as Michael Hawker AM prepares to retire from the board in August, but the earnings and dividend news have taken the spotlight for those weighing near-term risk and return.

With results like these, it is worth asking if the market has already priced in Vicinity Centres’ future growth, or if there could be some value left to unlock for investors looking at current levels.

Most Popular Narrative: 3.6% Overvalued

According to community narrative, Vicinity Centres is currently viewed as slightly overvalued, with the current share price sitting just above the fair value estimate derived from forward earnings and risk factors.

"The transformation of Vicinity's portfolio toward premium, experience-led, and strategically located assets, along with a highly publicized pipeline of major redevelopments and mixed-use projects, has likely caused investors to price in sustained elevated earnings and margin expansion. This could potentially overlook the risk of cyclical consumer pullback or delayed project ramp-up, which would pressure net margins."

Big expectations and bolder projections. Will this focus on experience-led assets and retail transformation really justify today’s price? Want clarity on the assumptions shaping this valuation and the hidden levers that could swing it? The full narrative has details you will not want to miss.

Result: Fair Value of $2.52 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, a tightening supply of retail space and high occupancy rates could support continued rental growth. This may offer a potential upside to these cautious forecasts.

Find out about the key risks to this Vicinity Centres narrative.Another View: Our DCF Model Suggests a Different Story

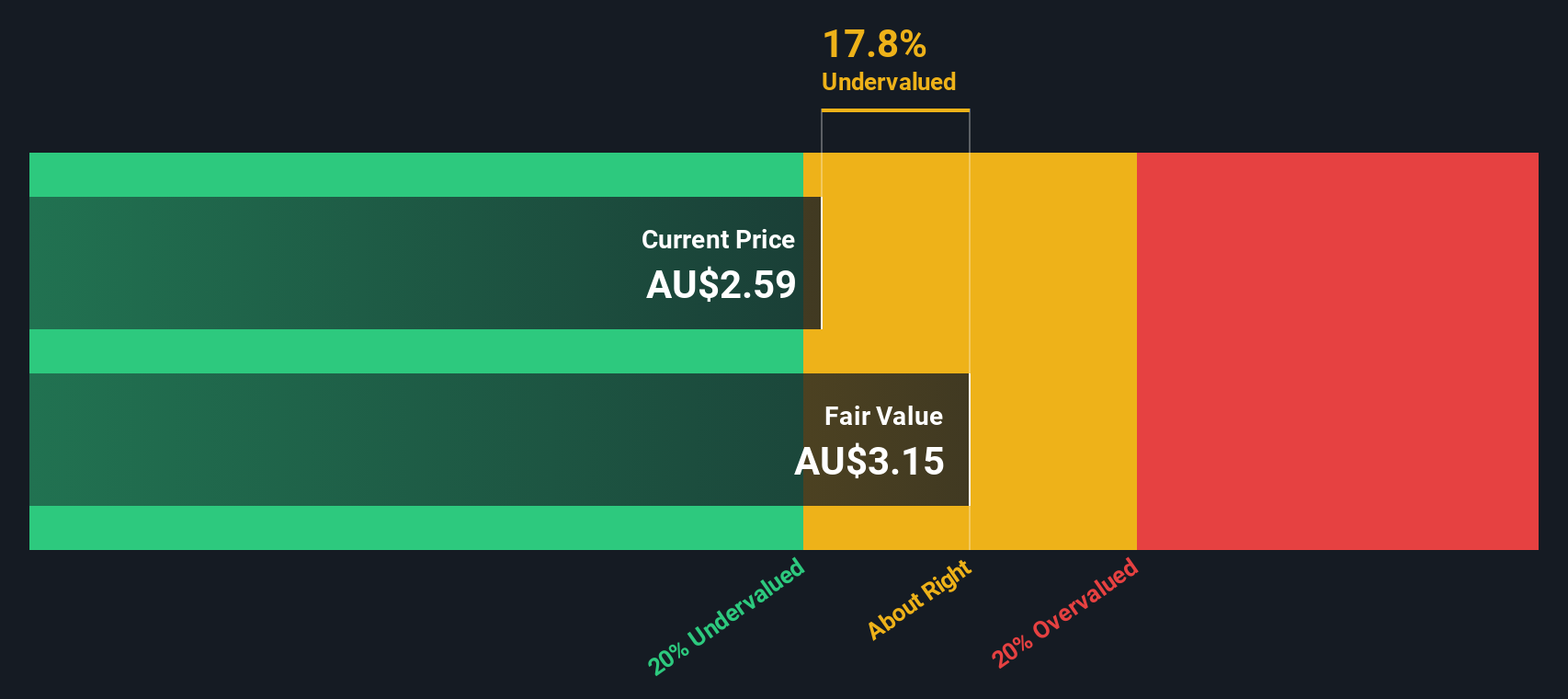

While many investors focus on current market multiples, our SWS DCF model takes a different approach by estimating the present value of future cash flows. Interestingly, this method points to a more optimistic valuation and indicates Vicinity Centres may be undervalued. Which perspective better captures the company's true long-term outlook?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Vicinity Centres for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Vicinity Centres Narrative

If you want to see the figures for yourself and take a different approach, it only takes a few minutes to build your own view. do it your way.

A great starting point for your Vicinity Centres research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t let great opportunities pass you by. The smartest investors use powerful tools to uncover stocks with standout growth, value, or sector potential. Give yourself an edge by diversifying your portfolio and checking out these curated ideas that could help you get ahead of the next market move:

- Catch income potential by scanning for dividend stocks with yields > 3% that consistently yield over 3% and provide a steady stream of returns.

- Tap into cutting-edge breakthroughs by spotting quantum computing stocks at the forefront of revolutionary tech and computing power.

- Secure your stake in tomorrow’s health revolution with healthcare AI stocks, featuring companies reshaping the future of medicine with artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:VCX

Vicinity Centres

Vicinity Centres (Vicinity or the Group) is one of Australia's leading retail property groups with a fully integrated asset management platform, and $24 billion in retail assets under management across 52 shopping centres, making it the second largest listed manager of Australian retail property.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives