- Australia

- /

- Specialized REITs

- /

- ASX:NSR

National Storage REIT (ASX:NSR): Evaluating Valuation After Recent Market Sentiment Shift

Reviewed by Simply Wall St

National Storage REIT (ASX:NSR) shares have been fairly steady lately, with investors looking for clues about where the stock could head next. Over the past month, the stock dipped about 4% as market sentiment cooled.

See our latest analysis for National Storage REIT.

National Storage REIT has seen its share price drift lower in recent months, reflecting a cautious shift in market sentiment. However, this comes after years of steady progress. While the 1-year total shareholder return sits at -3.7%, long-term holders have enjoyed a 51.8% gain over five years. This suggests that the bigger picture still points to solid value creation for patient investors.

If you’re searching for more ways to spot resilient performers beyond the REIT sector, now is a great time to broaden your horizons and discover fast growing stocks with high insider ownership

With shares trading below analyst price targets and recent growth in both revenue and net income, the key question is whether National Storage REIT is undervalued or if the market is already factoring in the company’s future prospects.

Price-to-Earnings of 115.9x: Is it justified?

National Storage REIT's shares currently trade at a price-to-earnings (P/E) ratio of 115.9x, which is significantly higher than both its industry peers and the broader market. At a last close price of A$2.27, this historic premium raises questions about whether investors are overvaluing the future earnings power of the company.

The price-to-earnings multiple is a key metric that shows how much investors are willing to pay today for each dollar of earnings. For REITs and other income-focused stocks, it often reflects expectations for stable cash flows, sector growth, and the perceived reliability of profits over time.

With National Storage REIT valued at more than six times the industry average of 17x and a substantial multiple above the peer group average of 11.5x, this premium looks steep by any standard. Notably, even our estimated fair price-to-earnings ratio for NSR is just 22.4x, suggesting that market optimism is far ahead of typical benchmarks and regression-based valuations for this sector.

Explore the SWS fair ratio for National Storage REIT

Result: Price-to-Earnings of 115.9x (OVERVALUED)

However, risks such as potential earnings disappointments or sector-wide shifts in property demand could quickly challenge the current optimism around National Storage REIT.

Find out about the key risks to this National Storage REIT narrative.

Another View: What Does the DCF Model Say?

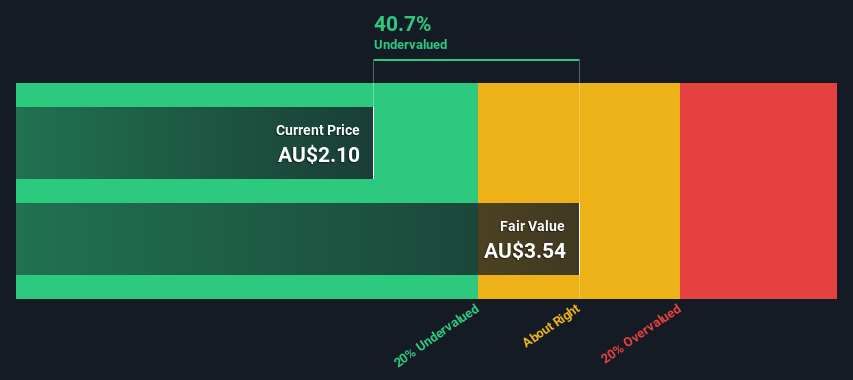

While the stand-out price-to-earnings ratio suggests National Storage REIT is expensive, our SWS DCF model points in the opposite direction. Based on future cash flow projections, the DCF model values NSR at A$3.73 per share, which is more than 39% above today’s price. Does this signal a hidden opportunity?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out National Storage REIT for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 883 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own National Storage REIT Narrative

If you want to take a different angle or prefer a hands-on approach, you can independently build your own assessment in just a few minutes with Do it your way

A great starting point for your National Storage REIT research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investing means never settling for one opportunity when there are countless others waiting to be found. Give yourself the edge and tap into hand-picked ideas that could shape your next move.

- Unlock high yields with companies offering impressive payouts when you browse these 16 dividend stocks with yields > 3% which features yields over 3% for steady, defensive income potential.

- Target future growth by exploring these 25 AI penny stocks featuring AI innovators advancing automation, robotics, and intelligent systems.

- Capitalize on emerging tech trends and position yourself for tomorrow’s breakthroughs by reviewing these 28 quantum computing stocks leading in quantum computing innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Storage REIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NSR

National Storage REIT

National Storage is the largest self-storage provider in Australia and New Zealand, with over 275 locations providing tailored storage solutions to more than 94,500 residential and commercial customers.

Established dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives