A Look at GPT Group (ASX:GPT)'s Valuation Following Record Holiday Traffic Forecasts and New Engagement Initiatives

Reviewed by Simply Wall St

GPT Group (ASX:GPT) has drawn attention after announcing it expects more than 35 million visitors will pass through its 16 shopping centres during the upcoming Black Friday, Cyber Week and Christmas trading period. This will be the largest on record for the company.

See our latest analysis for GPT Group.

Market momentum has quietly favored GPT Group this year, with a 25.1% year-to-date share price return and a notable 26.2% total shareholder return over the past twelve months. Excitement over record holiday traffic estimates and new initiatives like the Joy Portal appear to be shaping investor sentiment, adding to the company’s strong three- and five-year total returns.

If the retail recovery and foot traffic surge have you interested in what else is trending, this is a perfect moment to discover fast growing stocks with high insider ownership

But with the stock up sharply and record-breaking customer traffic on the horizon, the key question remains: is GPT Group trading below its true value, or is all the upside already reflected in the share price?

Most Popular Narrative: 4.4% Undervalued

With GPT Group's fair value pegged at A$5.79 by the most widely followed narrative, investors face only a slight gap compared to its last close at A$5.53. This sets up a narrow difference worth further scrutiny.

Execution on sustainability and ESG leadership (for example, a top S&P Global Corporate Sustainability Assessment ranking) positions GPT's high-rated, sustainable assets as preferred options for premium tenants and institutional investors. This supports asset values, potential cap rate compression, and resilient earnings as ESG-driven demand increases.

Want to uncover what’s fueling that edge in fair value? There is a high-stakes bet on margin expansion and resilience, driven by bold forecasts for future profits. The narrative hints at standout assumptions powering this upbeat outlook; however, the real numbers are buried in the full story.

Result: Fair Value of $5.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on Australian retail and office markets, in addition to rising maintenance costs, could threaten earnings and challenge the upbeat outlook.

Find out about the key risks to this GPT Group narrative.

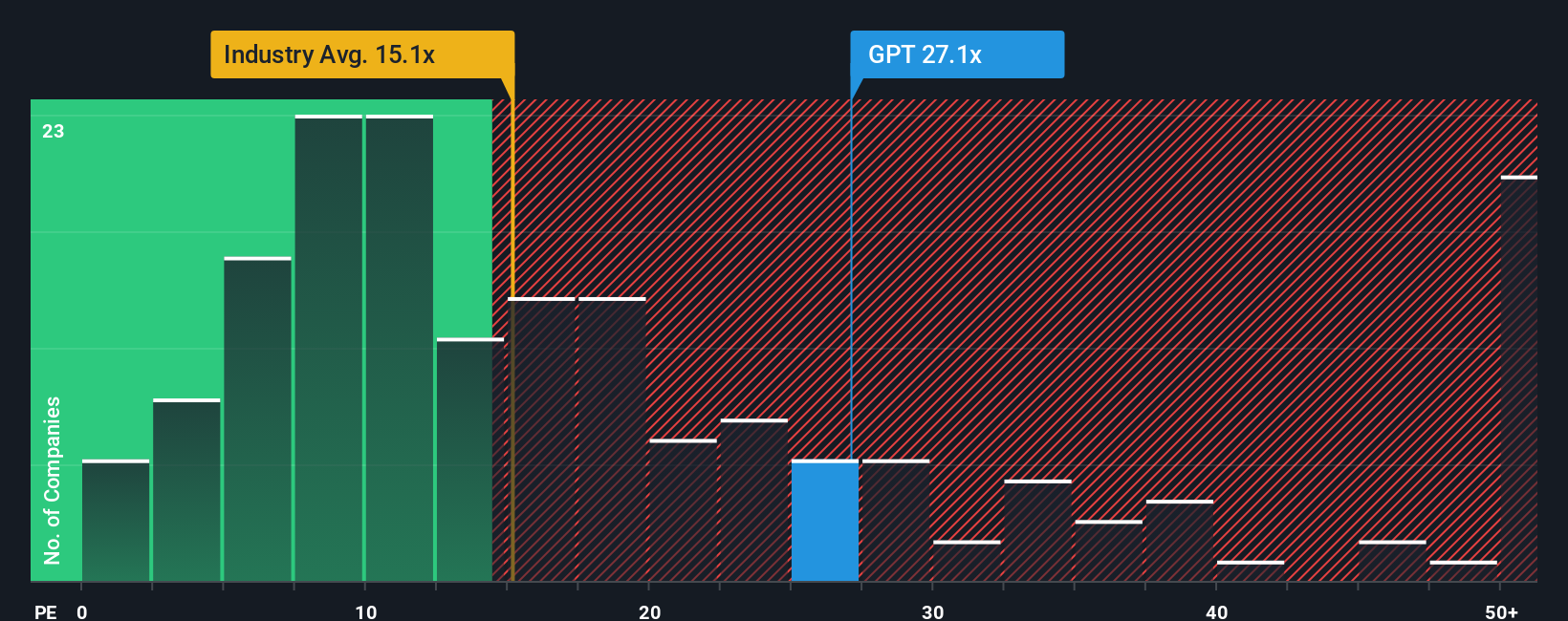

Another View: Multiples Tell a Different Story

Looking at GPT Group through the lens of its price-to-earnings ratio, the stock trades at 28x, well above the global REITs average of 15.9x and pricier than its estimated fair ratio of 19.5x. This premium suggests investors may be pricing in future gains, but it also raises questions about potential downside if the optimism is not matched by performance. Should you trust the multiples or the underlying narrative?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GPT Group Narrative

If you think there’s more to the story or want to test your own perspective, dive into the data and craft your narrative in just minutes. Do it your way

A great starting point for your GPT Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Make your next move count by searching beyond GPT Group. The smartest opportunities rarely wait around, so act now before the next big trend takes off.

- Capture long-term income by reviewing these 18 dividend stocks with yields > 3%, which delivers robust yields and steady growth for portfolio stability.

- Uncover technology leaders by selecting these 27 AI penny stocks, which are at the forefront of artificial intelligence, transforming industries and redefining tomorrow’s economy.

- Tap into hidden bargains with these 905 undervalued stocks based on cash flows, where strong fundamentals meet discounted prices, ideal for strategic value investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GPT

GPT Group

GPT is one of Australia’s leading property groups, with assets under management of $34.1 billion across a portfolio of high quality retail, office and logistics assets.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives