Over the last 7 days, the Australian market has remained flat, although the Information Technology sector saw an impressive 11% gain. With the market up 12% over the past year and earnings forecasted to grow by 14% annually, identifying undervalued stocks could present significant opportunities for investors.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Mader Group (ASX:MAD) | A$5.30 | A$10.53 | 49.7% |

| GTN (ASX:GTN) | A$0.46 | A$0.9 | 48.7% |

| Shine Justice (ASX:SHJ) | A$0.695 | A$1.34 | 48.3% |

| Ansell (ASX:ANN) | A$29.69 | A$56.94 | 47.9% |

| HMC Capital (ASX:HMC) | A$8.20 | A$15.48 | 47% |

| MLG Oz (ASX:MLG) | A$0.64 | A$1.19 | 46.3% |

| Charter Hall Group (ASX:CHC) | A$14.95 | A$29.82 | 49.9% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| Electro Optic Systems Holdings (ASX:EOS) | A$1.79 | A$3.44 | 48% |

| Superloop (ASX:SLC) | A$1.76 | A$3.31 | 46.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

Charter Hall Group (ASX:CHC)

Overview: Charter Hall Group (ASX:CHC) is one of Australia’s leading fully integrated property investment and funds management groups, with a market cap of A$7.07 billion.

Operations: Charter Hall's revenue segments include A$448.60 million from Funds Management, A$322.80 million from Property Investments, and A$73.30 million from Development Investments.

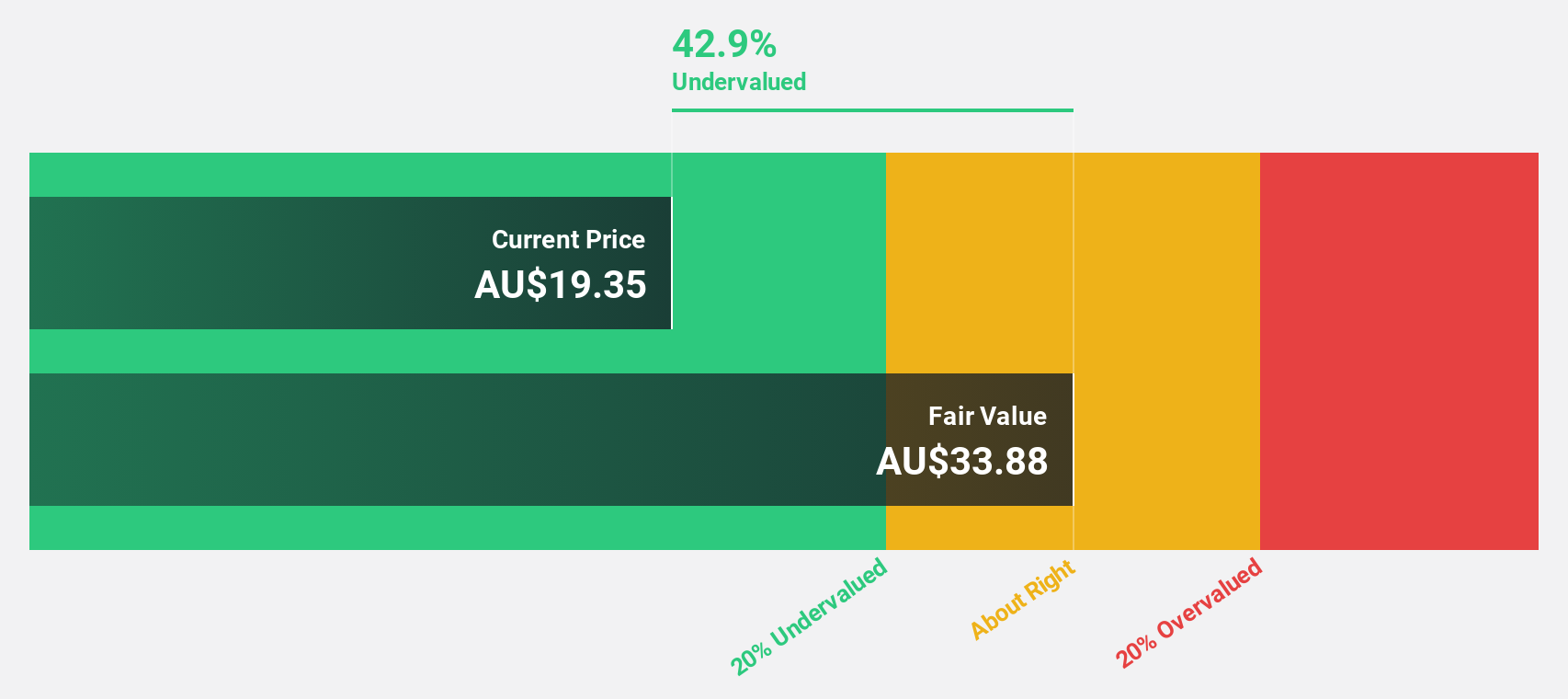

Estimated Discount To Fair Value: 49.9%

Charter Hall Group is trading at A$14.95, significantly below its estimated fair value of A$29.82, indicating it may be undervalued based on cash flows. Despite a net loss of A$222.1 million for FY24 and reduced revenue from the previous year, the company forecasts 8.3% annual revenue growth and expects to become profitable within three years, outperforming market averages. Additionally, Charter Hall offers a reliable dividend yield of 3.08%.

- The analysis detailed in our Charter Hall Group growth report hints at robust future financial performance.

- Take a closer look at Charter Hall Group's balance sheet health here in our report.

MAAS Group Holdings (ASX:MGH)

Overview: MAAS Group Holdings Limited (ASX:MGH) provides construction materials, equipment, and services for the civil, infrastructure, and mining sectors in Australia, Vietnam, Indonesia, and internationally with a market cap of A$1.49 billion.

Operations: The company's revenue segments include Manufacturing (A$25.30 million), Commercial Real Estate (A$131.65 million), Construction Materials (A$385.93 million), Residential Real Estate (A$84.73 million), and Civil, Construction and Hire (A$340.68 million).

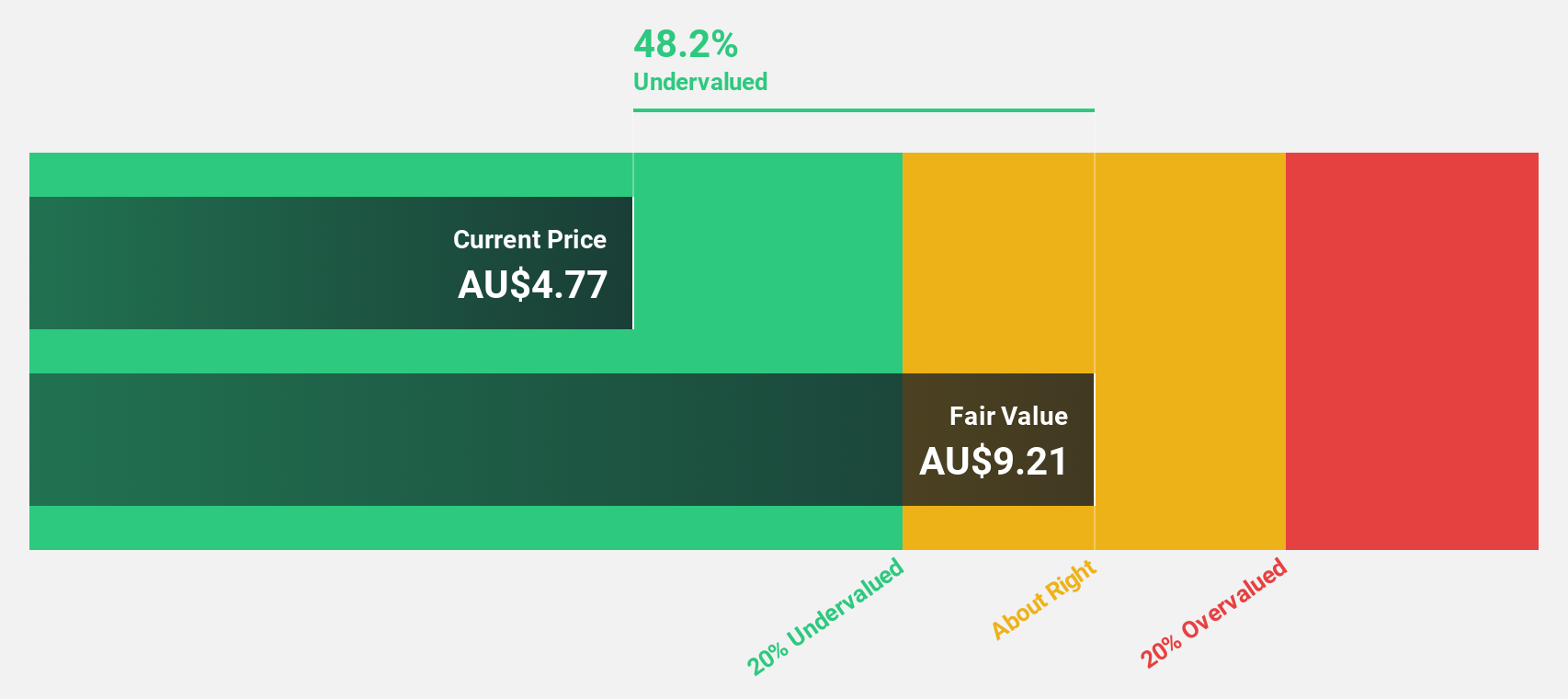

Estimated Discount To Fair Value: 46.1%

MAAS Group Holdings is trading at A$4.55, significantly below its estimated fair value of A$8.45, suggesting it is undervalued based on cash flows. The company reported full-year sales of A$908.52 million and net income of A$72.96 million, both up from the previous year. Despite debt concerns, earnings have grown 31.3% annually over the past five years and are forecast to grow 21.43% per year, outpacing market averages.

- In light of our recent growth report, it seems possible that MAAS Group Holdings' financial performance will exceed current levels.

- Get an in-depth perspective on MAAS Group Holdings' balance sheet by reading our health report here.

Nickel Industries (ASX:NIC)

Overview: Nickel Industries Limited is involved in nickel ore mining and the production of nickel pig iron and nickel matte, with a market cap of A$3.56 billion.

Operations: The company's revenue segments include $36.81 million from Nickel Ore Mining in Indonesia, $32.58 million from HPAL Projects in Indonesia and Hong Kong, and $1.81 billion from RKEF Projects in Indonesia and Singapore.

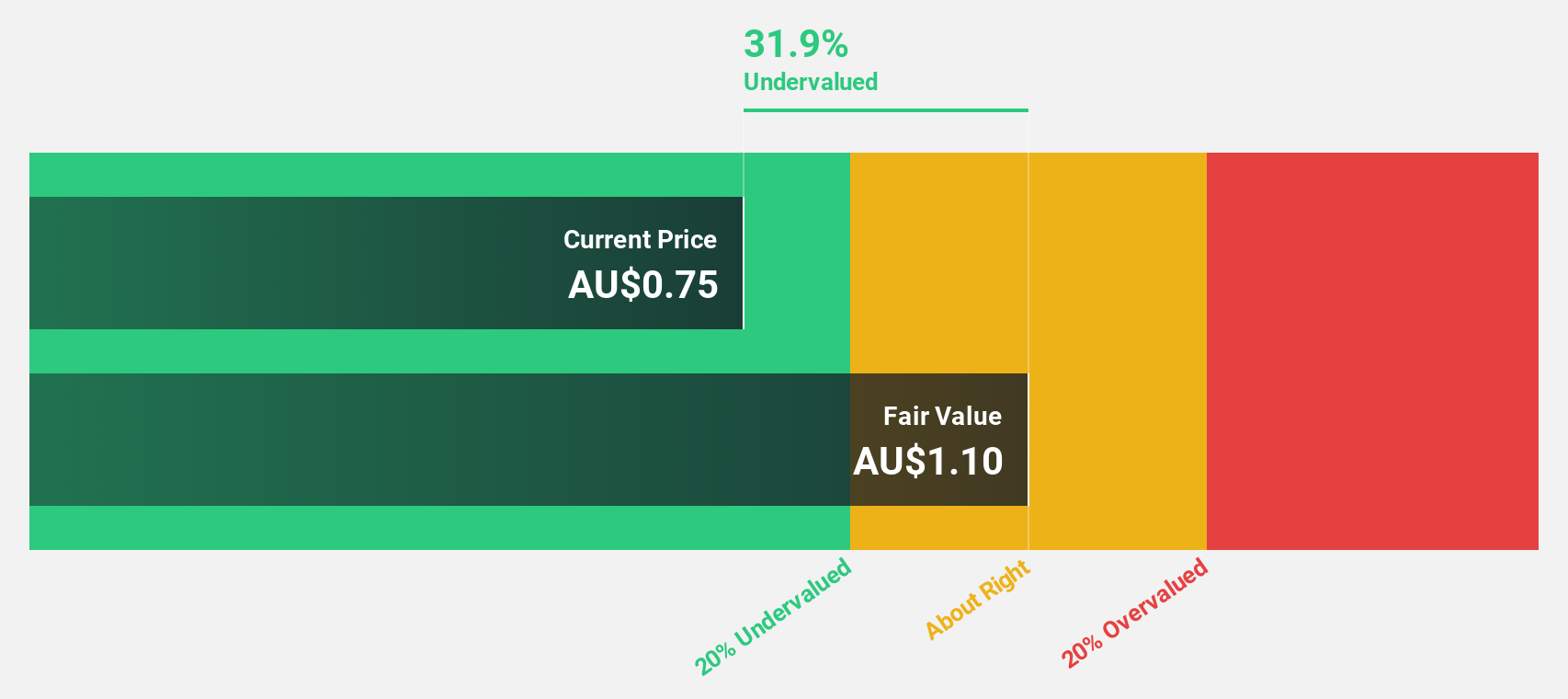

Estimated Discount To Fair Value: 21.8%

Nickel Industries Limited is trading at A$0.84, which is 21.8% below its estimated fair value of A$1.07, indicating it is undervalued based on cash flows. Despite a dividend yield of 5.66% not being well covered by free cash flows, the company’s earnings are forecast to grow significantly at 41.5% per year, outpacing the Australian market's growth rate of 13.6%. However, profit margins have decreased from last year's 13.1% to 6.5%.

- Our expertly prepared growth report on Nickel Industries implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Nickel Industries stock in this financial health report.

Where To Now?

- Discover the full array of 48 Undervalued ASX Stocks Based On Cash Flows right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CHC

Charter Hall Group

Charter Hall is one of Australia’s leading fully integrated property investment and funds management groups.

Excellent balance sheet established dividend payer.