- Australia

- /

- Construction

- /

- ASX:TEA

Discovering Undiscovered Gems in Australia This August 2024

Reviewed by Simply Wall St

In the last week, the Australian market has stayed flat, although the Information Technology sector saw an impressive 11% gain. With the market up 12% over the past year and earnings forecast to grow by 14% annually, identifying promising stocks becomes crucial for capitalizing on these trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 9.94% | 6.48% | ★★★★★★ |

| Lycopodium | NA | 17.22% | 33.85% | ★★★★★★ |

| Schaffer | 24.98% | 2.97% | -6.23% | ★★★★★★ |

| Sugar Terminals | NA | 2.34% | 2.64% | ★★★★★★ |

| Plato Income Maximiser | NA | 11.43% | 14.26% | ★★★★★★ |

| SKS Technologies Group | NA | 34.65% | 47.39% | ★★★★★★ |

| Hearts and Minds Investments | NA | 18.39% | -3.93% | ★★★★★★ |

| AMCIL | NA | 5.16% | 5.31% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Boart Longyear Group | 71.20% | 9.71% | 39.19% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

AMCIL (ASX:AMH)

Simply Wall St Value Rating: ★★★★★☆

Overview: Amcil Limited is a publicly owned investment manager with a market cap of A$368.99 million.

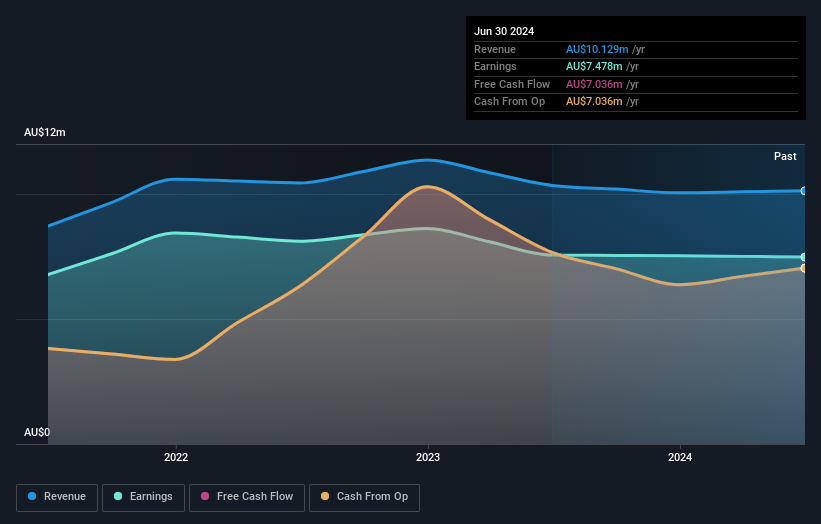

Operations: Amcil Limited generates its revenue primarily from investments, amounting to A$10.13 million.

AMCIL Limited, a small cap investment company in Australia, recently announced a share repurchase program to buy back up to 31.13 million shares, representing 9.9% of its issued capital. The company reported earnings for the year ended June 30, 2024, with net income at A$7.48 million and basic earnings per share at A$0.0238. AMCIL is debt-free and has consistently generated positive free cash flow over the past five years, showcasing strong financial health despite a slight -1% earnings growth last year compared to the industry average of 4.7%.

- Delve into the full analysis health report here for a deeper understanding of AMCIL.

Explore historical data to track AMCIL's performance over time in our Past section.

DroneShield (ASX:DRO)

Simply Wall St Value Rating: ★★★★★★

Overview: DroneShield Limited develops, commercializes, and sells hardware and software technology for drone detection and security in Australia and the United States, with a market cap of A$1.11 billion.

Operations: DroneShield generates revenue primarily from its Aerospace & Defense segment, amounting to A$55.08 million. The company's financial performance is reflected in its market cap of A$1.11 billion.

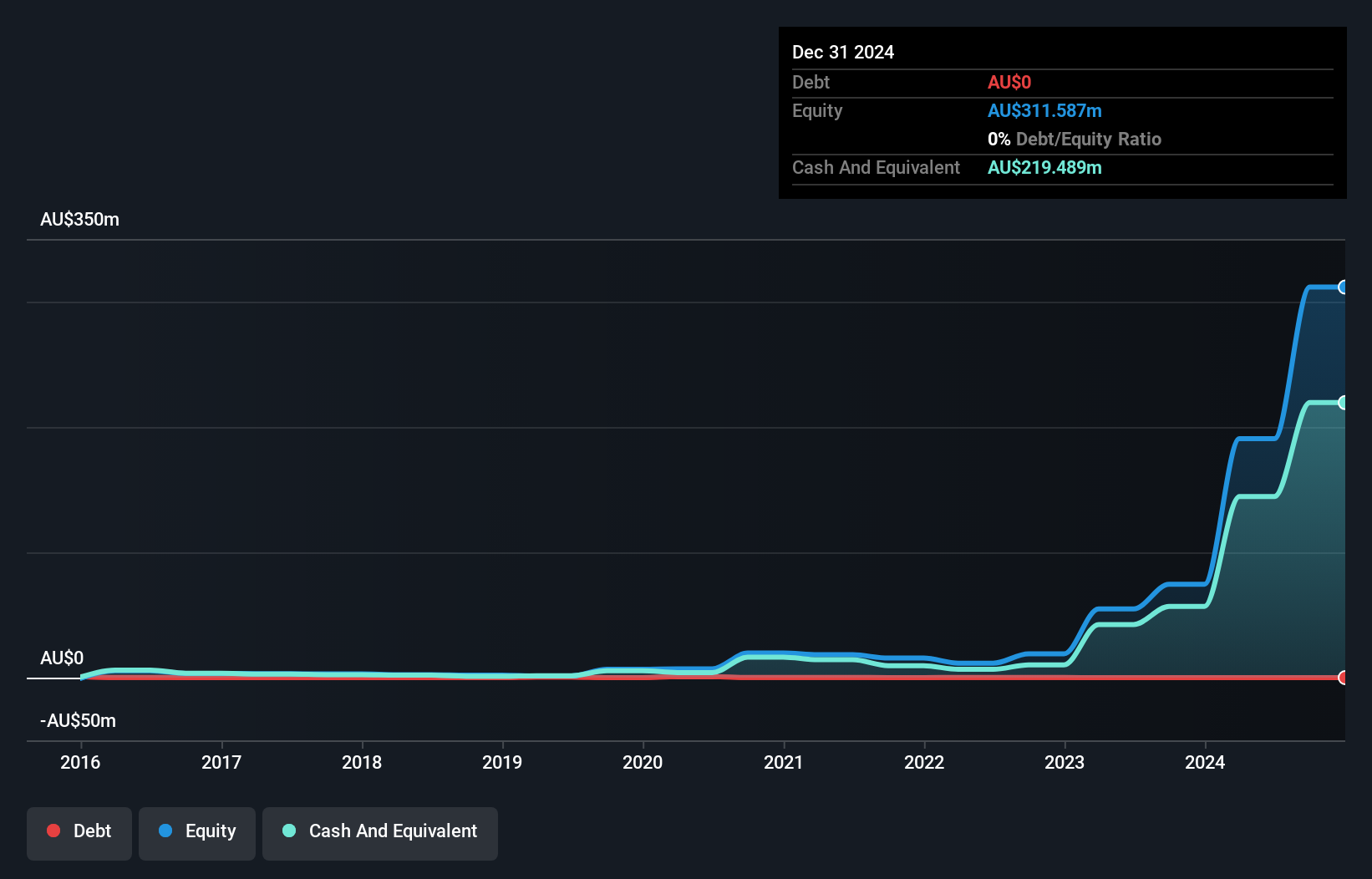

DroneShield, a promising player in the Aerospace & Defense sector, recently turned profitable and forecasts earnings growth of 40.21% annually. Despite high volatility over the past three months, DRO remains debt-free and has been so for five years. The company completed an equity offering worth A$120 million in August 2024, issuing 104 million shares at A$1.15 each. Notably, shareholders experienced dilution last year but DRO's high-quality earnings and free cash flow positivity highlight its potential for future growth.

- Click here and access our complete health analysis report to understand the dynamics of DroneShield.

Gain insights into DroneShield's historical performance by reviewing our past performance report.

Tasmea (ASX:TEA)

Simply Wall St Value Rating: ★★★★★★

Overview: Tasmea Limited, with a market cap of A$376.23 million, offers shutdown, maintenance, emergency breakdown, and capital upgrade services across Australia.

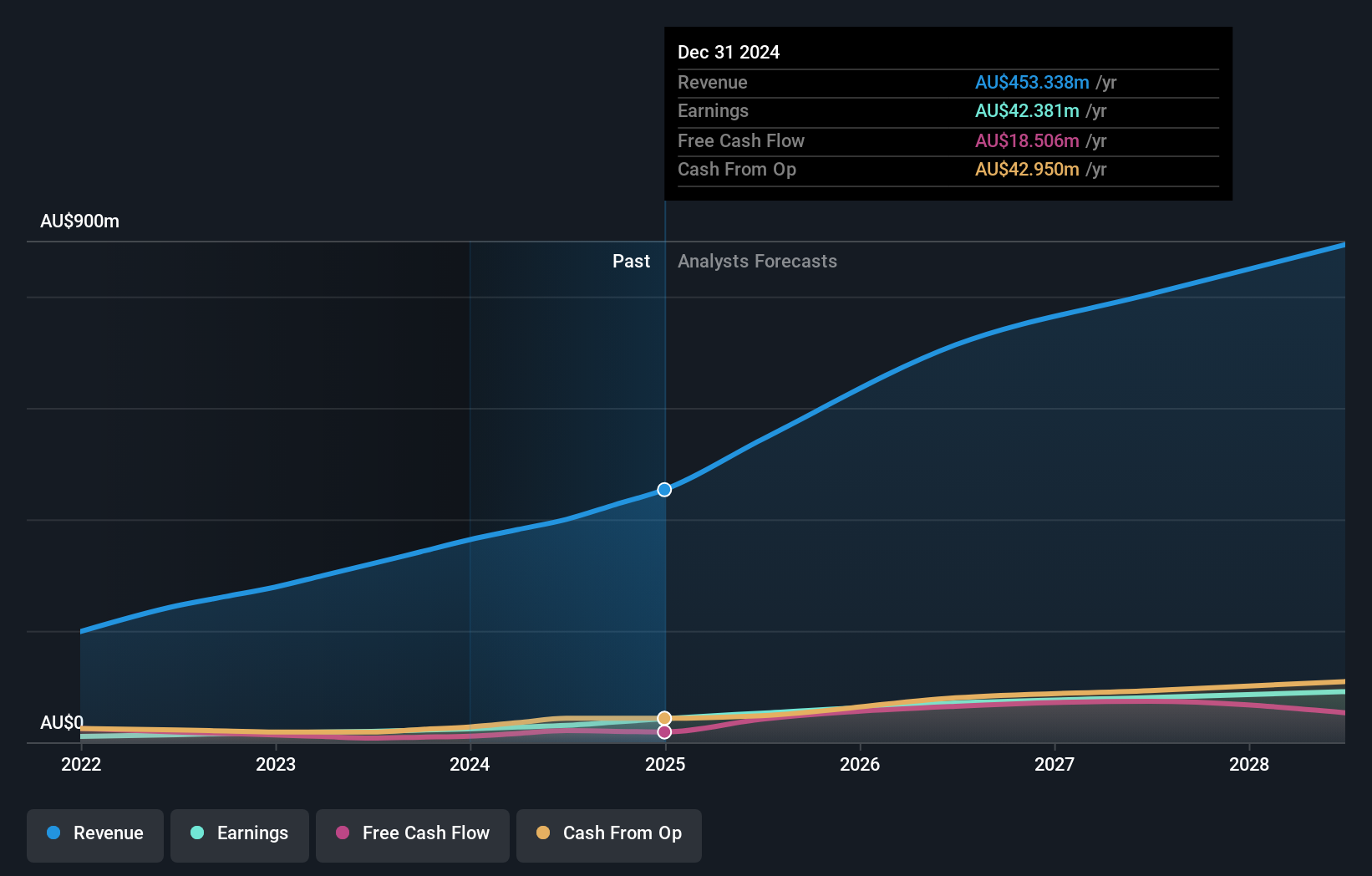

Operations: Tasmea Limited generates revenue from five primary segments: Water & Fluid (A$67.50 million), Civil Services (A$42.50 million), Electrical Services (A$120.29 million), and Mechanical Services (A$89.96 million).

Tasmea Limited reported strong financial results for the year ending June 30, 2024, with sales reaching A$400.01 million, up from A$319.98 million the previous year. Net income also saw a significant rise to A$30.35 million compared to A$19.32 million last year, reflecting high-quality earnings and robust growth of 41.7%. The company's net debt to equity ratio stands at a satisfactory 27.5%, while its interest payments are well covered by EBIT at an impressive 8.1x coverage ratio.

- Navigate through the intricacies of Tasmea with our comprehensive health report here.

Review our historical performance report to gain insights into Tasmea's's past performance.

Make It Happen

- Take a closer look at our ASX Undiscovered Gems With Strong Fundamentals list of 53 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tasmea might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TEA

Tasmea

Provides shutdown, maintenance, emergency breakdown, and capital upgrade services in Australia.

Exceptional growth potential with flawless balance sheet.