- Australia

- /

- Life Sciences

- /

- ASX:TRJ

Fewer Investors Than Expected Jumping On Trajan Group Holdings Limited (ASX:TRJ)

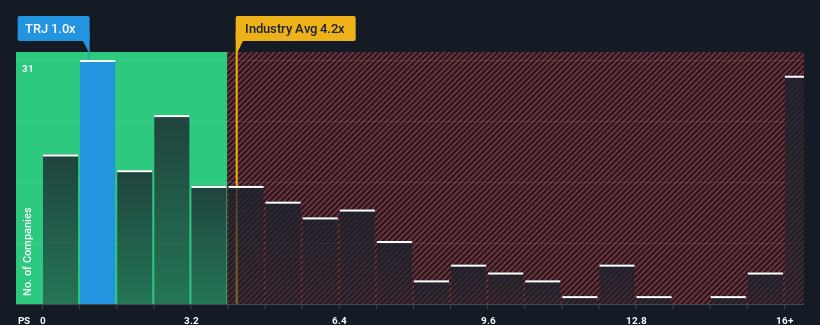

You may think that with a price-to-sales (or "P/S") ratio of 1x Trajan Group Holdings Limited (ASX:TRJ) is definitely a stock worth checking out, seeing as almost half of all the Life Sciences companies in Australia have P/S ratios greater than 4.5x and even P/S above 14x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Trajan Group Holdings

How Trajan Group Holdings Has Been Performing

Recent times have been advantageous for Trajan Group Holdings as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Trajan Group Holdings will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Trajan Group Holdings' to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 10% last year. This was backed up an excellent period prior to see revenue up by 117% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 6.2% as estimated by the dual analysts watching the company. That's shaping up to be similar to the 5.2% growth forecast for the broader industry.

With this information, we find it odd that Trajan Group Holdings is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

What Does Trajan Group Holdings' P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It looks to us like the P/S figures for Trajan Group Holdings remain low despite growth that is expected to be in line with other companies in the industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Trajan Group Holdings with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Trajan Group Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Trajan Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:TRJ

Trajan Group Holdings

Develops, manufactures, and sells analytical and life science products and devices in Malaysia, Japan, Australia, New Zealand, the United States, Europe, the Middle East, Africa, and India.

Very undervalued with flawless balance sheet.

Market Insights

Community Narratives