Does the SEC Probe Challenge Telix Pharmaceuticals' (ASX:TLX) Management Credibility and Investor Confidence?

Reviewed by Sasha Jovanovic

- Recently, Telix Pharmaceuticals disclosed that it received a subpoena from the U.S. Securities and Exchange Commission concerning its disclosures about prostate cancer therapeutic candidates, prompting law firms such as Bragar Eagel & Squire and Rosen Law Firm to initiate investigations into potential securities law violations.

- This development has heightened attention to the accuracy of the company’s public statements and their impact on investor trust.

- We’ll consider how the federal investigation into Telix’s disclosures may influence confidence in the company’s investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Telix Pharmaceuticals' Investment Narrative?

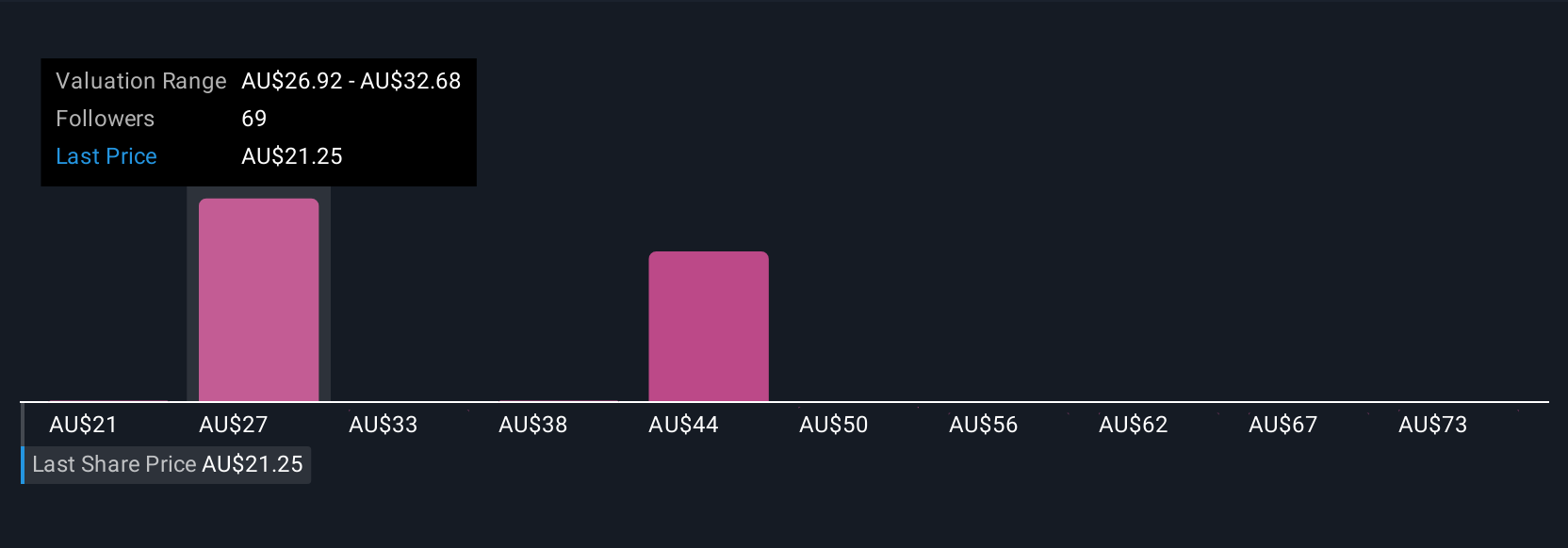

To hold Telix Pharmaceuticals shares, investors have typically focused on rapid advancement in cancer diagnostics and therapeutics, especially in major revenue drivers like prostate cancer imaging and treatment. Prior to the recent SEC subpoena, short-term catalysts centered on successful product launches, regulatory approvals, and the commercial rollout of Gozellix and Illuccix. However, the disclosure of a federal investigation into Telix’s disclosures about its core prostate cancer pipeline adds a new layer of uncertainty, especially in the near term. This event has already spurred a sharp share price drop and drawn class action inquiries from multiple law firms, underscoring heightened scrutiny of management’s transparency. Key risks now include the potential regulatory or legal fallout, which could distract from the company’s ambitious clinical and commercial execution or lead to further volatility. Even if the company executes well operationally, sustained investor confidence now depends on how Telix manages regulatory and reputational challenges. But not all risks are purely operational, some, like regulatory actions, can shift sentiment unexpectedly.

Despite retreating, Telix Pharmaceuticals' shares might still be trading 41% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 38 other fair value estimates on Telix Pharmaceuticals - why the stock might be worth over 4x more than the current price!

Build Your Own Telix Pharmaceuticals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Telix Pharmaceuticals research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Telix Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Telix Pharmaceuticals' overall financial health at a glance.

No Opportunity In Telix Pharmaceuticals?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telix Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TLX

Telix Pharmaceuticals

A commercial-stage biopharmaceutical company, focuses on the development and commercialization of therapeutic and diagnostic radiopharmaceuticals.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives