The Australian market recently saw a slight downturn, with the ASX200 closing down 0.4% and all sectors losing ground amid steady interest rates held by the Reserve Bank. In such fluctuating conditions, investors often turn their attention to smaller or newer companies that offer potential for growth at lower price points. Penny stocks, despite being considered a somewhat outdated term, continue to present intriguing opportunities when backed by strong financial health and solid fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.595 | A$71.5M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$143.12M | ★★★★☆☆ |

| Helloworld Travel (ASX:HLO) | A$1.765 | A$289.14M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.52 | A$328.68M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.885 | A$102.34M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.63 | A$818.43M | ★★★★★☆ |

| Perenti (ASX:PRN) | A$1.155 | A$1.07B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.14 | A$61M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$3.19 | A$141.27M | ★★★★★★ |

| Joyce (ASX:JYC) | A$4.33 | A$129.2M | ★★★★★★ |

Click here to see the full list of 1,034 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Advanced Braking Technology (ASX:ABV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Advanced Braking Technology Limited focuses on the research, design, development, manufacture, distribution, and sale of braking solutions globally with a market cap of A$32.25 million.

Operations: The company generates revenue of A$15.29 million from its Failsafe Wet Sealed Braking Systems and Terra Dura Dry Sealed Braking System.

Market Cap: A$32.25M

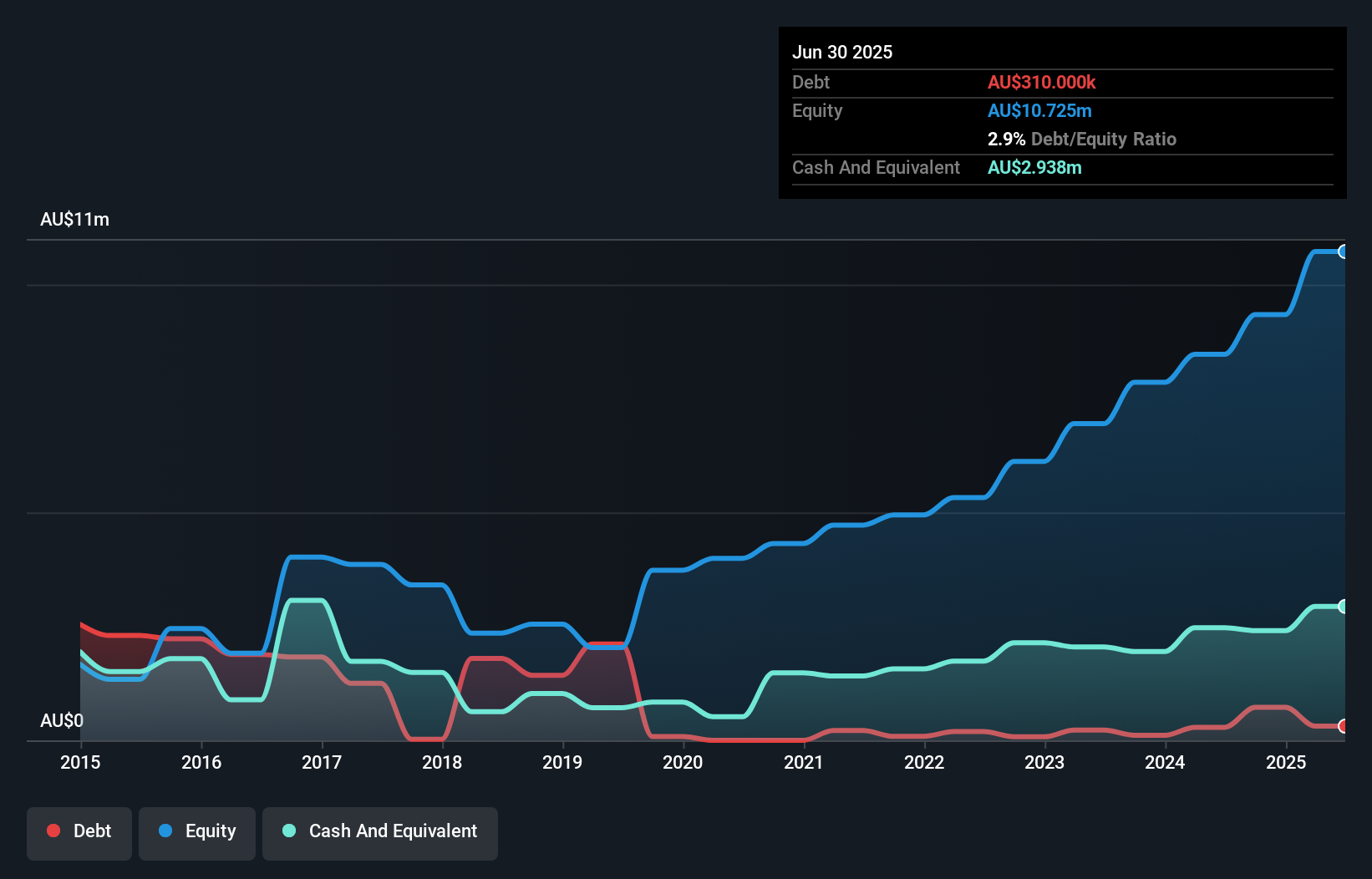

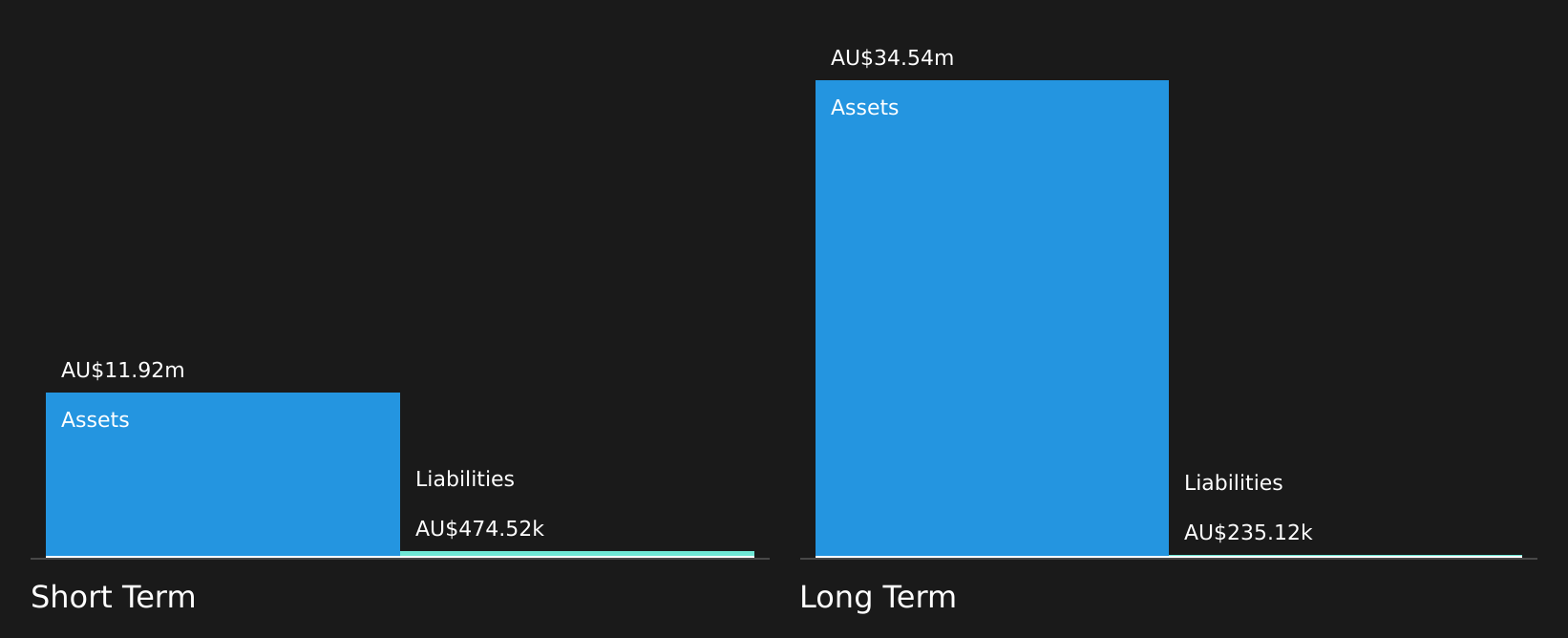

Advanced Braking Technology Limited, with a market cap of A$32.25 million, demonstrates financial stability with short-term assets of A$10.6 million surpassing both short and long-term liabilities. The company reported revenue growth to A$15.29 million and net income of A$1.7 million for the year ended June 2024, highlighting consistent earnings improvement over five years at an average annual rate of 59.2%. Its debt is well-covered by operating cash flow, and interest payments are comfortably managed by EBIT at 15.5x coverage. Despite a low return on equity (19.2%), it maintains good value with a price-to-earnings ratio below the market average.

- Dive into the specifics of Advanced Braking Technology here with our thorough balance sheet health report.

- Understand Advanced Braking Technology's track record by examining our performance history report.

Legend Mining (ASX:LEG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Legend Mining Limited is an Australian company focused on exploring nickel and copper deposits, with a market cap of A$37.82 million.

Operations: Legend Mining Limited has not reported any revenue segments.

Market Cap: A$37.82M

Legend Mining Limited, with a market cap of A$37.82 million, is pre-revenue with less than US$1 million in earnings. The company is debt-free and has sufficient cash runway for over three years due to positive free cash flow. Its short-term assets of A$13.3 million comfortably cover both short and long-term liabilities. However, the company remains unprofitable, with losses increasing by 62.1% annually over five years and a recent net loss of A$4.76 million for the half-year ended June 2024. Despite high volatility in share price recently, shareholder dilution has been minimal over the past year.

- Click here and access our complete financial health analysis report to understand the dynamics of Legend Mining.

- Evaluate Legend Mining's historical performance by accessing our past performance report.

Starpharma Holdings (ASX:SPL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Starpharma Holdings Limited is a biopharmaceutical company focused on the research, development, and commercialization of dendrimer products for pharmaceutical and life science applications globally, with a market cap of A$40.90 million.

Operations: The company generates revenue of A$9.76 million from the discovery, development, and commercialization of dendrimers.

Market Cap: A$40.9M

Starpharma Holdings Limited, with a market cap of A$40.90 million, reported annual sales of A$9.76 million and a net loss reduction to A$8.17 million from the previous year's A$15.64 million loss, reflecting improved financial performance despite being unprofitable. The company has sufficient cash runway for over three years and maintains more cash than its total debt, indicating strong liquidity management. Short-term assets significantly exceed liabilities, providing financial stability in the near term. Recent participation in the Australian Microcap Investment Conference highlights its active engagement with investors amidst ongoing efforts to commercialize dendrimer products globally.

- Jump into the full analysis health report here for a deeper understanding of Starpharma Holdings.

- Examine Starpharma Holdings' past performance report to understand how it has performed in prior years.

Where To Now?

- Explore the 1,034 names from our ASX Penny Stocks screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SPL

Starpharma Holdings

A biopharmaceutical company, engages in the research, development, and commercialization of dendrimer products for pharmaceutical, life science, and other applications worldwide.

Excellent balance sheet and overvalued.