As the Australian market navigates a period of mixed sentiment, with the S&P/ASX 200 (XJO) rebounding to 8,600 points despite inflation climbing to 3.8%, investors are closely watching sectors like IT which recently lagged behind materials. In this environment, identifying high-growth tech stocks requires careful consideration of their resilience and potential catalysts for growth amidst broader economic fluctuations and sector-specific challenges.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Pureprofile | 10.51% | 37.56% | ★★★★★☆ |

| Infomedia | 7.00% | 20.05% | ★★★★★☆ |

| Pro Medicus | 19.70% | 21.18% | ★★★★★☆ |

| Kinatico | 13.27% | 42.29% | ★★★★☆☆ |

| Immutep | 104.12% | 46.46% | ★★★★★☆ |

| Clinuvel Pharmaceuticals | 22.04% | 26.15% | ★★★★★☆ |

| BlinkLab | 104.90% | 101.40% | ★★★★★★ |

| Artrya | 50.54% | 61.25% | ★★★★★☆ |

| PYC Therapeutics | 10.34% | 24.39% | ★★★★★☆ |

| FINEOS Corporation Holdings | 9.22% | 57.85% | ★★★★☆☆ |

Click here to see the full list of 22 stocks from our ASX High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Immutep (ASX:IMM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Immutep Limited is a biotechnology company focused on developing innovative Lymphocyte Activation Gene-3 related immunotherapies for cancer and autoimmune diseases in Australia, with a market cap of A$397.42 million.

Operations: Immutep generates revenue primarily from its immunotherapy segment, amounting to A$5.03 million.

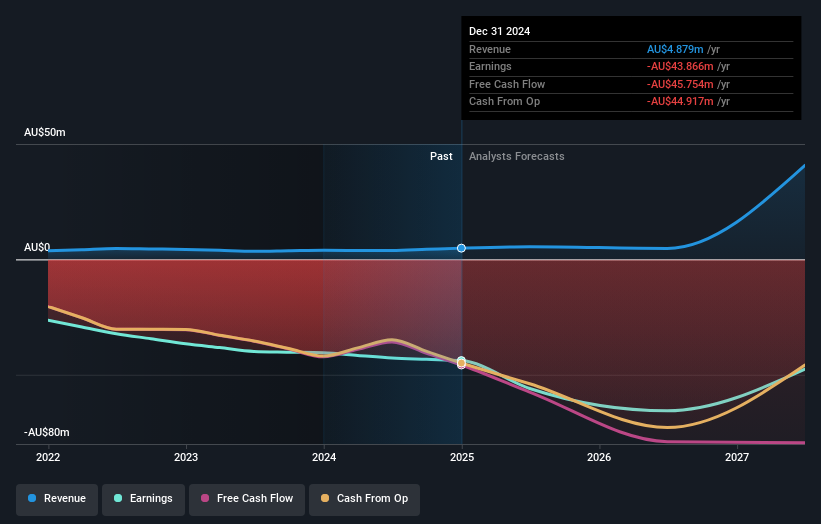

Immutep, an emerging player in the biotech sector, is navigating the high-growth landscape with a focus on innovative cancer treatments. Despite its current unprofitable status and modest annual revenue of A$5M, the company's projected revenue growth is impressive at 104.1% per year, outpacing the Australian market average of 5.9%. Recent breakthroughs in clinical trials, such as the EFTISARC-NEO study showing significant tumor hyalinization rates over triple that of standard care, underscore Immutep's potential in reshaping cancer therapy protocols. With several Phase III trials underway and a Fast Track designation from the FDA for its lead candidate eftilagimod alfa (efti), Immutep's strategic R&D investments may soon yield substantial clinical and commercial successes.

- Unlock comprehensive insights into our analysis of Immutep stock in this health report.

Gain insights into Immutep's historical performance by reviewing our past performance report.

PYC Therapeutics (ASX:PYC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PYC Therapeutics Limited is a drug-development company focused on discovering and developing novel RNA therapeutics for treating genetic diseases in Australia, with a market cap of A$866.14 million.

Operations: PYC Therapeutics focuses on the discovery and development of RNA therapeutics, generating revenue primarily from this segment, which amounts to A$23.49 million.

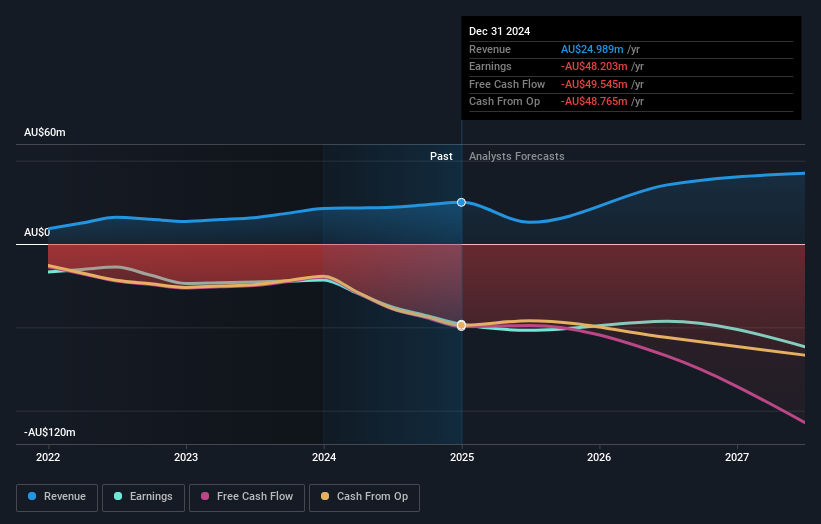

PYC Therapeutics, navigating through the competitive biotech landscape, is poised for significant growth with a forecasted annual revenue increase of 10.3%, outpacing the Australian market average of 5.9%. Despite current unprofitability, the company's strategic focus on innovative therapeutics shows promise with expected profitability within three years. Recent leadership enhancements, including the appointment of Peter Coleman as Non-Executive Chair, align with PYC’s forward-looking strategies aimed at bolstering its pipeline and market position. The firm's commitment to R&D is evident from its substantial investment in this area, crucial for advancing their drug candidates towards commercial success.

Xero (ASX:XRO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Xero Limited is a company that offers online business solutions for small businesses and their advisors across various regions including Australia, New Zealand, the United Kingdom, North America, and internationally, with a market capitalization of approximately A$20.43 billion.

Operations: The company generates revenue primarily through providing online solutions for small businesses and their advisors, with reported revenues of NZ$2.30 billion.

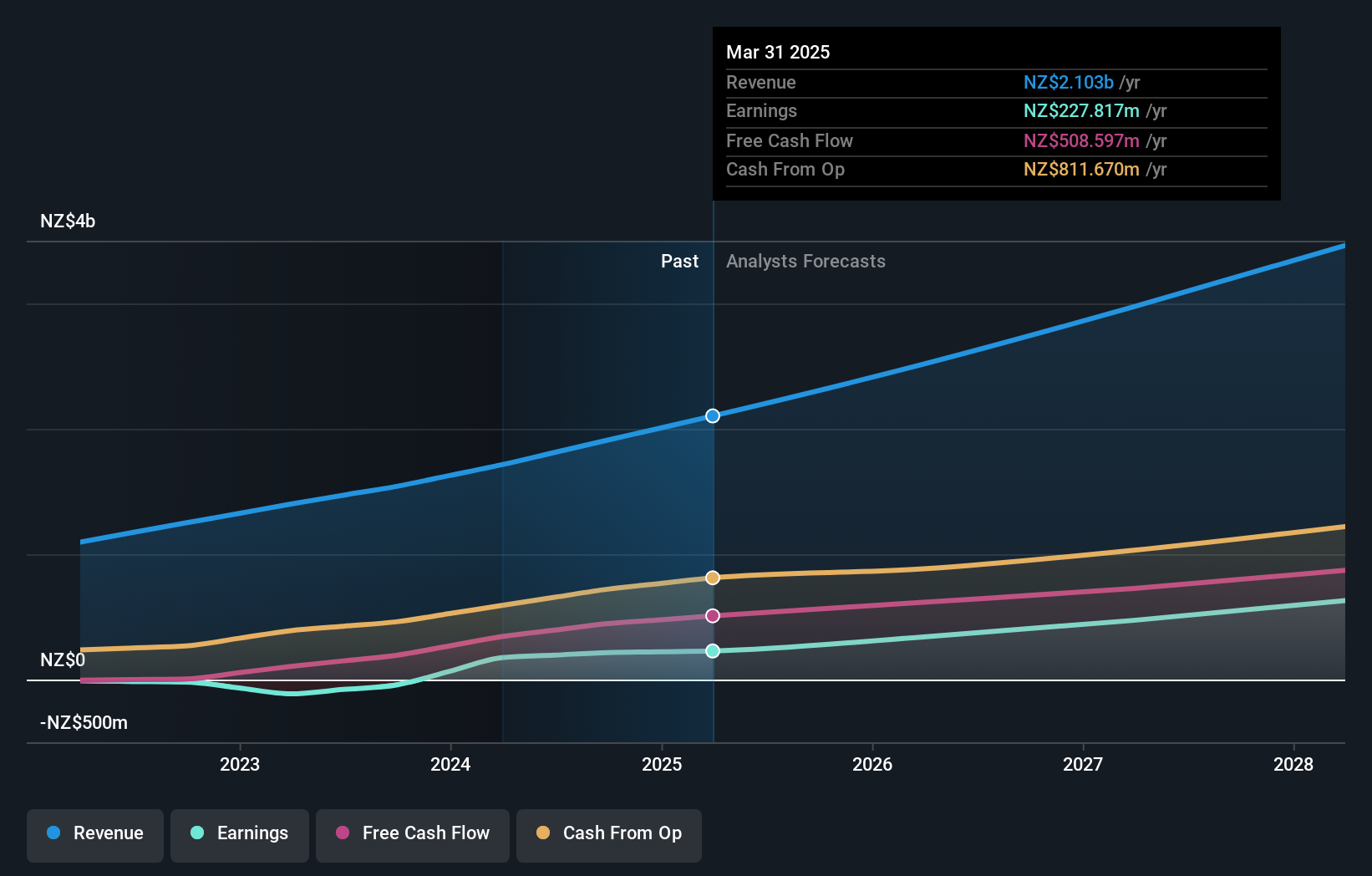

Xero's trajectory in the tech sector is marked by robust growth, with earnings surging 24% over the past year, outpacing its industry's average of 20.3%. This growth is underpinned by a significant annual revenue increase of 18.1%, which exceeds Australia's market average of 5.9%. The company also reported a strong half-year performance with revenue reaching NZD 1.19 billion, up from NZD 995.87 million, and net income climbing to NZD 134.78 million from NZD 95.09 million previously. Xero continues to invest heavily in innovation, as evidenced by its substantial R&D efforts aimed at enhancing product offerings and securing its competitive edge in the rapidly evolving software landscape.

- Dive into the specifics of Xero here with our thorough health report.

Assess Xero's past performance with our detailed historical performance reports.

Key Takeaways

- Gain an insight into the universe of 22 ASX High Growth Tech and AI Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PYC

PYC Therapeutics

A drug-development company, engages in the discovery and development of novel RNA therapeutics for the treatment of genetic diseases in Australia.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success