FDA Review of Opioid-Reduction Data Could Be a Game Changer for Mesoblast (ASX:MSB)

Reviewed by Sasha Jovanovic

- Mesoblast Limited recently announced that the U.S. FDA has scheduled a December meeting to review Phase 3 data on opioid reduction and cessation for its investigational therapy rexlemestrocel-L in patients with chronic low back pain (CLBP), following a trial showing higher opioid cessation rates compared to controls.

- This FDA engagement comes amid new guidance promoting non-opioid pain treatments, highlighting the therapy's potential role in addressing the U.S. opioid crisis.

- We'll explore how the scheduled FDA review of rexlemestrocel-L's opioid-sparing effect could influence Mesoblast's investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Mesoblast's Investment Narrative?

The big picture for Mesoblast shareholders hinges on belief in the company’s ability to capitalize on late-stage therapies for large, unmet medical needs, including chronic low back pain and pediatric graft-versus-host disease. The recent news of a scheduled FDA meeting in December to review Phase 3 results for rexlemestrocel-L, specifically its opioid reduction effect, could reframe near-term catalysts. Previously, the key catalyst was further enrollment in the confirmatory trial for rexlemestrocel-L and commercial uptake of Ryoncil, but direct FDA engagement on opioid-sparing endpoints, and the therapy's RMAT designation, may bring regulatory and commercial milestones forward if the data is well-received. However, the risk profile remains significant: Mesoblast is still unprofitable (net loss of US$102.14 million), is drawing from recently raised convertible debt, and faces execution risks in both regulatory approvals and scaling revenue. A material near-term shift now depends on FDA outcomes and evolving reimbursement dynamics.

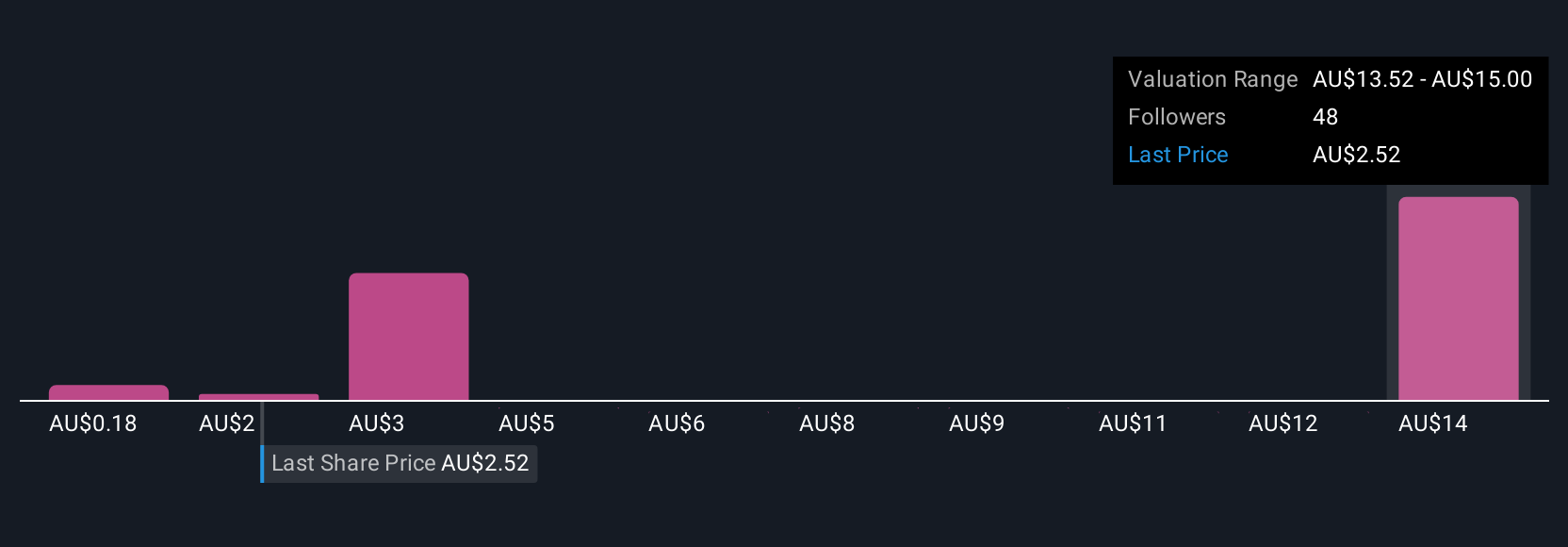

But there are uncertainties around profitability and capital needs that investors should not ignore. Despite retreating, Mesoblast's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 21 other fair value estimates on Mesoblast - why the stock might be a potential multi-bagger!

Build Your Own Mesoblast Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mesoblast research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Mesoblast research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mesoblast's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MSB

Mesoblast

Engages in the development of regenerative medicine products in Australia, the United States, Singapore, and Switzerland.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Community Narratives