We Wouldn't Rely On Ecofibre's (ASX:EOF) Statutory Earnings As A Guide

Broadly speaking, profitable businesses are less risky than unprofitable ones. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it's not always clear whether statutory profits are a good guide, going forward. In this article, we'll look at how useful this year's statutory profit is, when analysing Ecofibre (ASX:EOF).

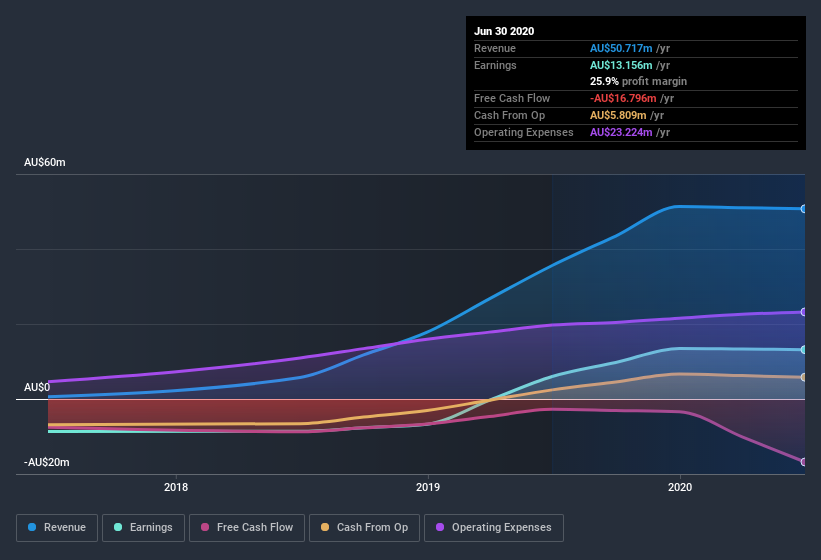

We like the fact that Ecofibre made a profit of AU$13.2m on its revenue of AU$50.7m, in the last year. The good news is that the company managed to grow its revenue over the last three years, and also move from loss-making to profitable.

Check out our latest analysis for Ecofibre

Of course, it is only sensible to look beyond the statutory profits and question how well those numbers represent the sustainable earnings power of the business. Therefore, today we'll take a look at Ecofibre's cashflow, share issues and unusual items with a view to better understanding the nature of its statutory earnings. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Examining Cashflow Against Ecofibre's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. The ratio shows us how much a company's profit exceeds its FCF.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

Ecofibre has an accrual ratio of 0.82 for the year to June 2020. Statistically speaking, that's a real negative for future earnings. And indeed, during the period the company didn't produce any free cash flow whatsoever. In the last twelve months it actually had negative free cash flow, with an outflow of AU$17m despite its profit of AU$13.2m, mentioned above. Coming off the back of negative free cash flow last year, we imagine some shareholders might wonder if its cash burn of AU$17m, this year, indicates high risk. However, that's not the end of the story. We can look at how unusual items in the profit and loss statement impacted its accrual ratio, as well as explore how dilution is impacting shareholders negatively.

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. Ecofibre expanded the number of shares on issue by 8.5% over the last year. Therefore, each share now receives a smaller portion of profit. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. You can see a chart of Ecofibre's EPS by clicking here.

How Is Dilution Impacting Ecofibre's Earnings Per Share? (EPS)

Ecofibre was losing money three years ago. The good news is that profit was up 118% in the last twelve months. On the other hand, earnings per share are only up 93% over the same period. So you can see that the dilution has had a bit of an impact on shareholders. Therefore, the dilution is having a noteworthy influence on shareholder returns. And so, you can see quite clearly that dilution is influencing shareholder earnings.

In the long term, earnings per share growth should beget share price growth. So it will certainly be a positive for shareholders if Ecofibre can grow EPS persistently. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

The Impact Of Unusual Items On Profit

Given the accrual ratio, it's not overly surprising that Ecofibre's profit was boosted by unusual items worth AU$1.6m in the last twelve months. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. And, after all, that's exactly what the accounting terminology implies. If Ecofibre doesn't see that contribution repeat, then all else being equal we'd expect its profit to drop over the current year.

Our Take On Ecofibre's Profit Performance

Ecofibre didn't back up its earnings with free cashflow, but this isn't too surprising given profits were inflated by unusual items. Meanwhile, the new shares issued mean that shareholders now own less of the company, unless they tipped in more cash themselves. On reflection, the above-mentioned factors give us the strong impression that Ecofibre'sunderlying earnings power is not as good as it might seem, based on the statutory profit numbers. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. For example, Ecofibre has 3 warning signs (and 1 which shouldn't be ignored) we think you should know about.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

When trading Ecofibre or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Ecofibre might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:EOF

Ecofibre

Engages in the polymer, health care, and hemp seed genetics businesses in the United States and Australia.

Slight and slightly overvalued.

Market Insights

Community Narratives