- Australia

- /

- Healthtech

- /

- ASX:AYA

High Growth Tech Stocks in Australia for November 2025

Reviewed by Simply Wall St

The Australian market has been navigating a period of uncertainty, with key indices fluctuating due to geopolitical events and rising inflation, while sectors like materials have shown resilience amidst these challenges. In this environment, identifying high growth tech stocks requires focusing on companies that demonstrate robust adaptability and innovation to thrive despite broader market volatility.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Pureprofile | 10.51% | 37.56% | ★★★★★☆ |

| Infomedia | 7.00% | 20.05% | ★★★★★☆ |

| Pro Medicus | 19.44% | 20.97% | ★★★★★☆ |

| Kinatico | 13.27% | 42.29% | ★★★★☆☆ |

| Clinuvel Pharmaceuticals | 22.04% | 26.15% | ★★★★★☆ |

| Immutep | 104.12% | 46.46% | ★★★★★☆ |

| BlinkLab | 104.90% | 101.40% | ★★★★★★ |

| Artrya | 49.60% | 61.45% | ★★★★★☆ |

| PYC Therapeutics | 10.34% | 24.40% | ★★★★★☆ |

| FINEOS Corporation Holdings | 9.22% | 57.85% | ★★★★☆☆ |

Click here to see the full list of 21 stocks from our ASX High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Artrya (ASX:AYA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Artrya Limited is a medical technology company focused on developing and commercializing an artificial intelligence platform for detecting, diagnosing, and addressing coronary artery disease in Australia, with a market cap of A$497.67 million.

Operations: The company generates revenue primarily from the development of AI-driven CCTA image analysis technology, amounting to A$0.03 million.

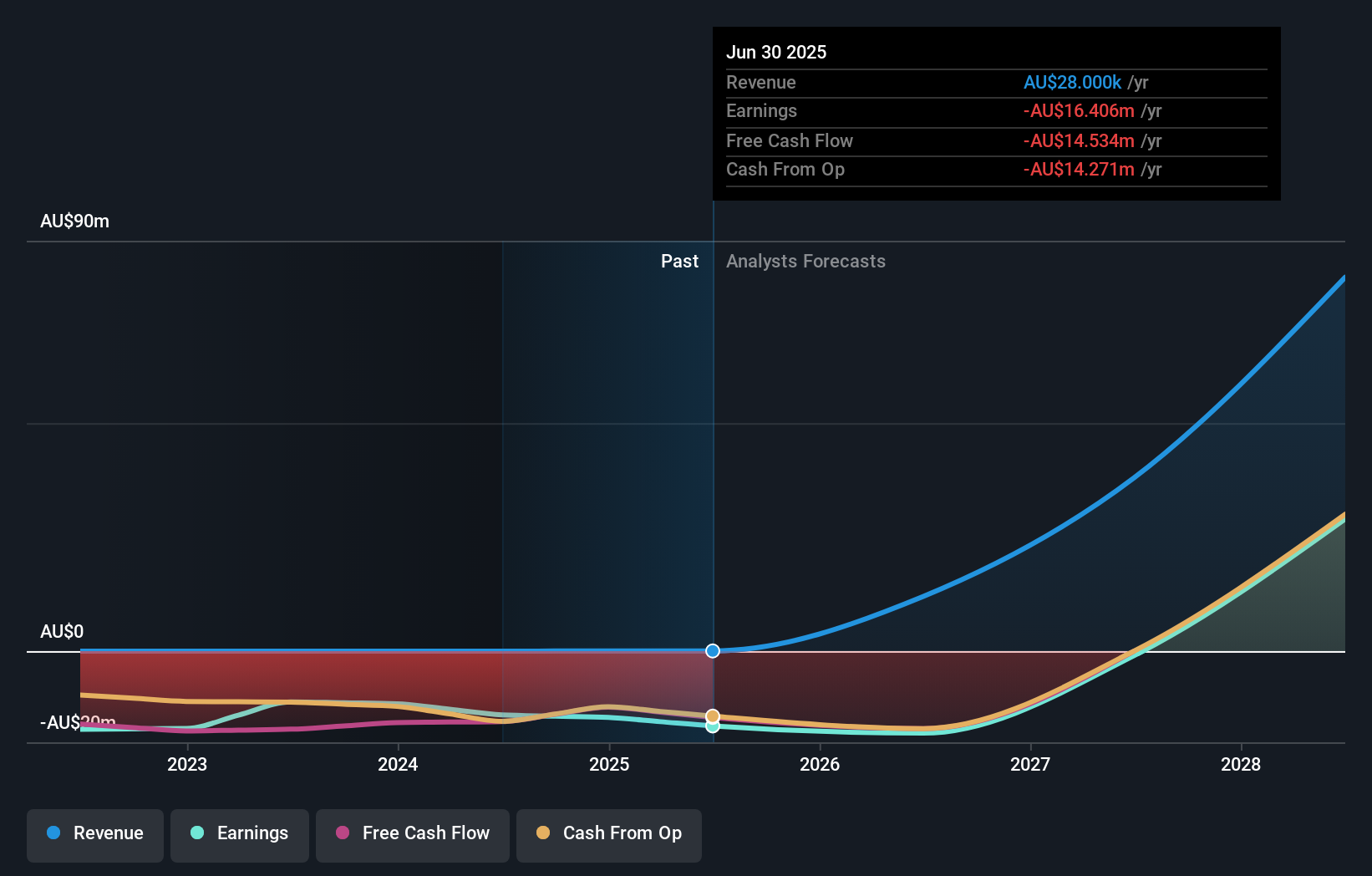

Artrya, a pioneer in AI-driven healthcare technologies, recently secured FDA 510(k) clearance for its Salix® Coronary Plaque module, marking a significant stride in its U.S. market expansion. This approval enhances the company's product suite, enabling rapid point-of-care assessments crucial for detecting high-risk coronary plaques—a key predictor of heart attacks. Despite reporting a net loss of AUD 16.41 million and minimal revenue of AUD 0.028 million in the last fiscal year, Artrya is poised for substantial growth with projected annual revenue increases of 49.6% and earnings growth forecast at 61.45%. The recent equity offerings totaling over AUD 85 million signify robust financial backing to support these ambitious expansion plans into lucrative markets like the U.S., where each Salix® assessment could generate USD $950 under current reimbursement rates.

- Dive into the specifics of Artrya here with our thorough health report.

Assess Artrya's past performance with our detailed historical performance reports.

Clinuvel Pharmaceuticals (ASX:CUV)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Clinuvel Pharmaceuticals Limited is a biopharmaceutical company that develops and commercializes treatments for genetic, metabolic, systemic, and life-threatening disorders across Australia, Europe, the United States, Switzerland, and other international markets with a market cap of A$543.67 million.

Operations: Clinuvel Pharmaceuticals derives its revenue primarily from the biopharmaceutical sector, generating A$95.02 million. The company operates internationally, focusing on treatments for various disorders across multiple regions.

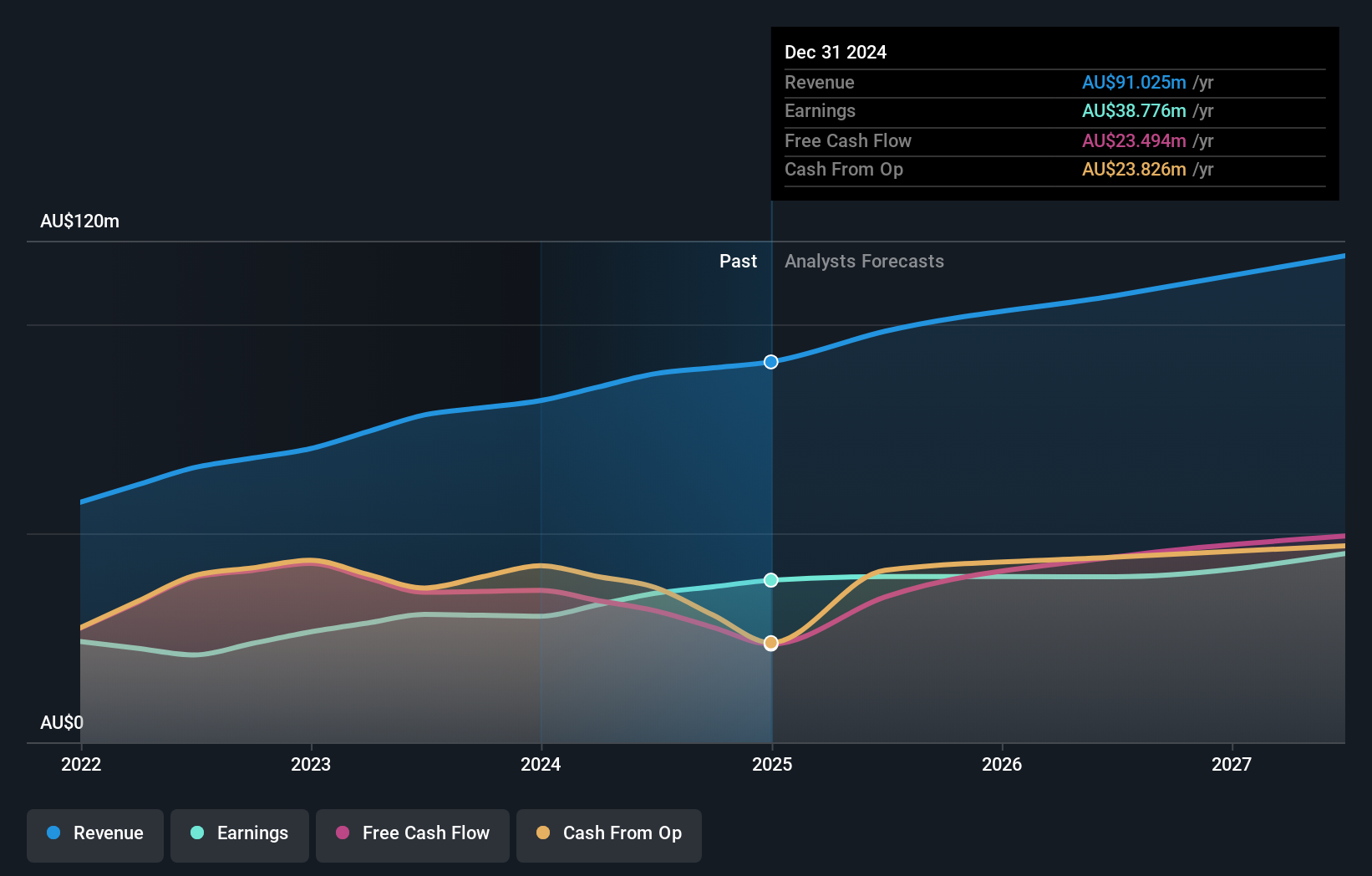

Clinuvel Pharmaceuticals, demonstrating resilience and strategic growth, reported a robust revenue increase to AUD 105.3 million this year, up from AUD 95.31 million last year, reflecting a sustained upward trajectory with an annualized revenue growth of 22%. The company's commitment to innovation is underscored by its R&D investments which are integral to maintaining competitive advantage in the biotech sector. Despite exploring acquisitions in North America without success, Clinuvel continues to prioritize capital deployment into high-conviction projects while maintaining operational efficiency as evidenced by a ninth consecutive year of profitability. With earnings forecasted to grow at an impressive rate of 26.2% annually, the firm is well-positioned for future expansions and leveraging opportunities in global markets.

- Click here and access our complete health analysis report to understand the dynamics of Clinuvel Pharmaceuticals.

Understand Clinuvel Pharmaceuticals' track record by examining our Past report.

Infomedia (ASX:IFM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Infomedia Ltd is a technology company that develops and supplies electronic parts catalogues, service quoting software, and e-commerce solutions for the automotive industry worldwide, with a market cap of A$637.69 million.

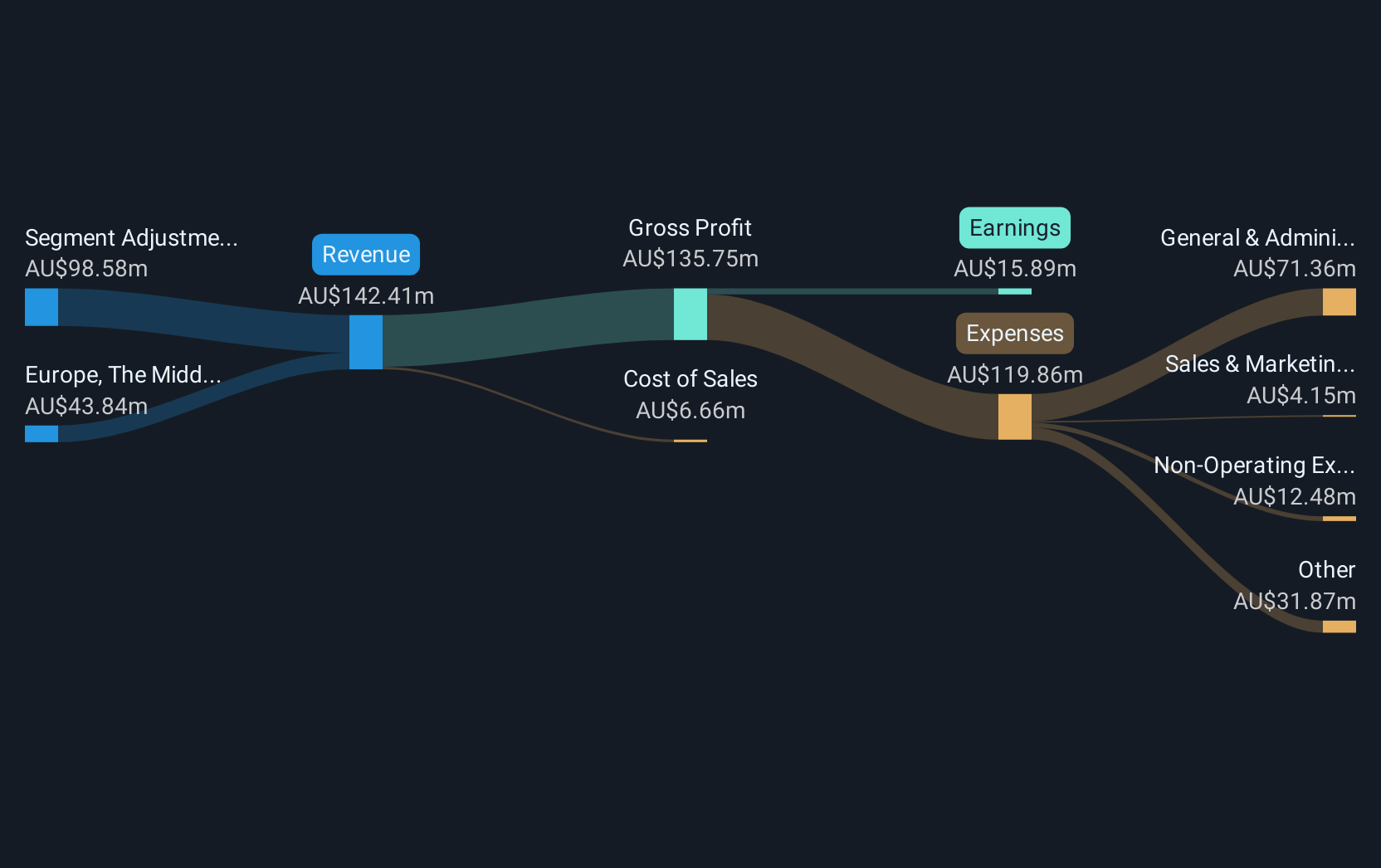

Operations: Infomedia Ltd generates revenue primarily through its publishing of electronic parts catalogues and service quoting software, with a reported income of A$146.51 million from these activities.

Infomedia, a frontrunner in the Australian tech sector, is demonstrating robust growth with a notable 7% annual revenue increase and an impressive 20% expected annual earnings growth. The company's commitment to innovation is evident from its strategic R&D investments, aligning with industry trends towards enhanced software solutions. Recently, Infomedia has also shown proactive corporate governance by updating its executive team and maintaining shareholder value through consistent dividend payments. With these developments, Infomedia is well-positioned to capitalize on expanding market opportunities and sustain its upward trajectory in the competitive tech landscape.

- Click to explore a detailed breakdown of our findings in Infomedia's health report.

Evaluate Infomedia's historical performance by accessing our past performance report.

Key Takeaways

- Reveal the 21 hidden gems among our ASX High Growth Tech and AI Stocks screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AYA

Artrya

A medical technology company, engages in the development and commercialization of artificial intelligence platform that detects, diagnoses, and address coronary artery disease in Australia.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives