- Australia

- /

- Entertainment

- /

- ASX:PLY

Revenues Tell The Story For PlaySide Studios Limited (ASX:PLY) As Its Stock Soars 30%

PlaySide Studios Limited (ASX:PLY) shares have continued their recent momentum with a 30% gain in the last month alone. The last month tops off a massive increase of 119% in the last year.

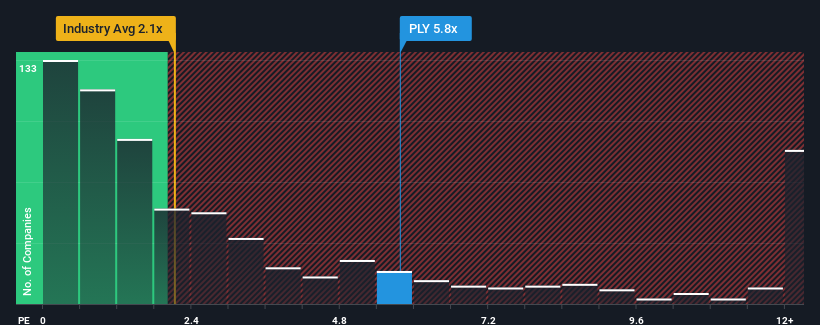

Since its price has surged higher, you could be forgiven for thinking PlaySide Studios is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 5.8x, considering almost half the companies in Australia's Entertainment industry have P/S ratios below 1.7x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for PlaySide Studios

What Does PlaySide Studios' Recent Performance Look Like?

PlaySide Studios certainly has been doing a good job lately as it's been growing revenue more than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think PlaySide Studios' future stacks up against the industry? In that case, our free report is a great place to start.How Is PlaySide Studios' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as PlaySide Studios' is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 60% last year. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 16% per year during the coming three years according to the three analysts following the company. With the industry only predicted to deliver 9.4% per year, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why PlaySide Studios' P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does PlaySide Studios' P/S Mean For Investors?

The strong share price surge has lead to PlaySide Studios' P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into PlaySide Studios shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Having said that, be aware PlaySide Studios is showing 1 warning sign in our investment analysis, you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:PLY

PlaySide Studios

Develops and sells mobile, PC, and console video games in Australia.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives