How Much Did oOh!media's(ASX:OML) Shareholders Earn From Share Price Movements Over The Last Three Years?

oOh!media Limited (ASX:OML) shareholders should be happy to see the share price up 15% in the last quarter. But that is small recompense for the exasperating returns over three years. In that time, the share price dropped 66%. So the improvement may be a real relief to some. While many would remain nervous, there could be further gains if the business can put its best foot forward.

See our latest analysis for oOh!media

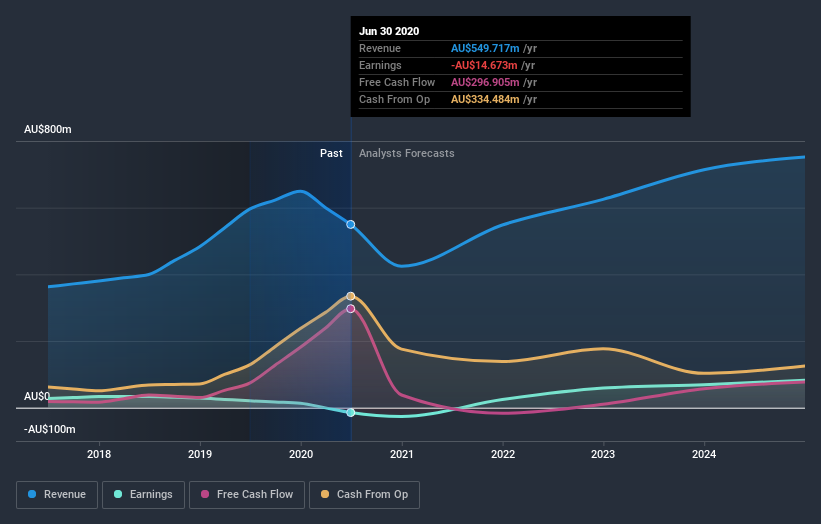

Because oOh!media made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over three years, oOh!media grew revenue at 20% per year. That's well above most other pre-profit companies. In contrast, the share price is down 18% compound, over three years - disappointing by most standards. It seems likely that the market is worried about the continual losses. When we see revenue growth, paired with a falling share price, we can't help wonder if there is an opportunity for those who are willing to dig deeper.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free report showing analyst forecasts should help you form a view on oOh!media

What about the Total Shareholder Return (TSR)?

We've already covered oOh!media's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for oOh!media shareholders, and that cash payout explains why its total shareholder loss of 53%, over the last 3 years, isn't as bad as the share price return.

A Different Perspective

While the broader market gained around 3.5% in the last year, oOh!media shareholders lost 47%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 8% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 2 warning signs we've spotted with oOh!media (including 1 which doesn't sit too well with us) .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you’re looking to trade oOh!media, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if oOh!media might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:OML

oOh!media

Engages in the outdoor media, and production and advertising businesses in Australia and New Zealand.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives