Getting In Cheap On Domain Holdings Australia Limited (ASX:DHG) Might Be Difficult

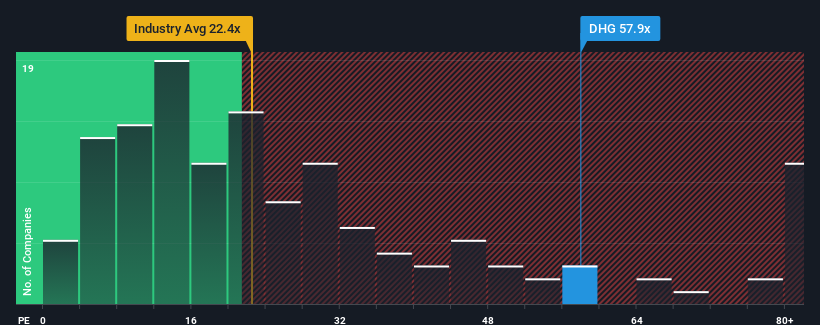

With a price-to-earnings (or "P/E") ratio of 57.9x Domain Holdings Australia Limited (ASX:DHG) may be sending very bearish signals at the moment, given that almost half of all companies in Australia have P/E ratios under 18x and even P/E's lower than 9x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Domain Holdings Australia has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. If not, then existing shareholders may be very nervous about the viability of the share price.

See our latest analysis for Domain Holdings Australia

Is There Enough Growth For Domain Holdings Australia?

Domain Holdings Australia's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 5.8%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the twelve analysts covering the company suggest earnings should grow by 30% each year over the next three years. That's shaping up to be materially higher than the 17% each year growth forecast for the broader market.

In light of this, it's understandable that Domain Holdings Australia's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Domain Holdings Australia's P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Domain Holdings Australia's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Domain Holdings Australia with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Domain Holdings Australia, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:DHG

Domain Holdings Australia

Engages in the real estate media and technology services business in Australia.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives