- Australia

- /

- Basic Materials

- /

- ASX:WGN

Undiscovered Gems In Australia Top Stocks For November 2025

Reviewed by Simply Wall St

The Australian market kicked off the week on a positive note, with most sectors in the green and Information Technology leading with a 2.5% intraday gain, reflecting an optimistic sentiment among investors. As the European Union's potential investment in Australian critical mineral projects looms on the horizon, small-cap companies may find themselves uniquely positioned to benefit from this upcoming catalyst. In this environment, identifying undiscovered gems involves looking for stocks that not only show resilience amid macroeconomic challenges but also have growth potential aligned with emerging opportunities like critical minerals.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 10.00% | 9.57% | ★★★★★★ |

| Spheria Emerging Companies | NA | -1.31% | 0.28% | ★★★★★★ |

| Hearts and Minds Investments | NA | 56.27% | 59.19% | ★★★★★★ |

| Euroz Hartleys Group | NA | 1.82% | -25.32% | ★★★★★★ |

| Focus Minerals | NA | 75.35% | 51.34% | ★★★★★★ |

| Djerriwarrh Investments | 2.39% | 8.18% | 7.91% | ★★★★★★ |

| Energy World | NA | -47.50% | -44.86% | ★★★★★☆ |

| Zimplats Holdings | 5.44% | -9.79% | -42.03% | ★★★★★☆ |

| Australian United Investment | 1.90% | 5.23% | 4.56% | ★★★★☆☆ |

| Reef Casino Trust | 19.84% | 6.96% | 10.88% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Hearts and Minds Investments (ASX:HM1)

Simply Wall St Value Rating: ★★★★★★

Overview: Hearts and Minds Investments (ASX:HM1) is an Australian investment company with a market cap of A$723.58 million, focusing on generating returns through strategic investment activities.

Operations: Hearts and Minds Investments generates revenue primarily from investment activities, amounting to A$161.68 million. The company's market cap stands at A$723.58 million.

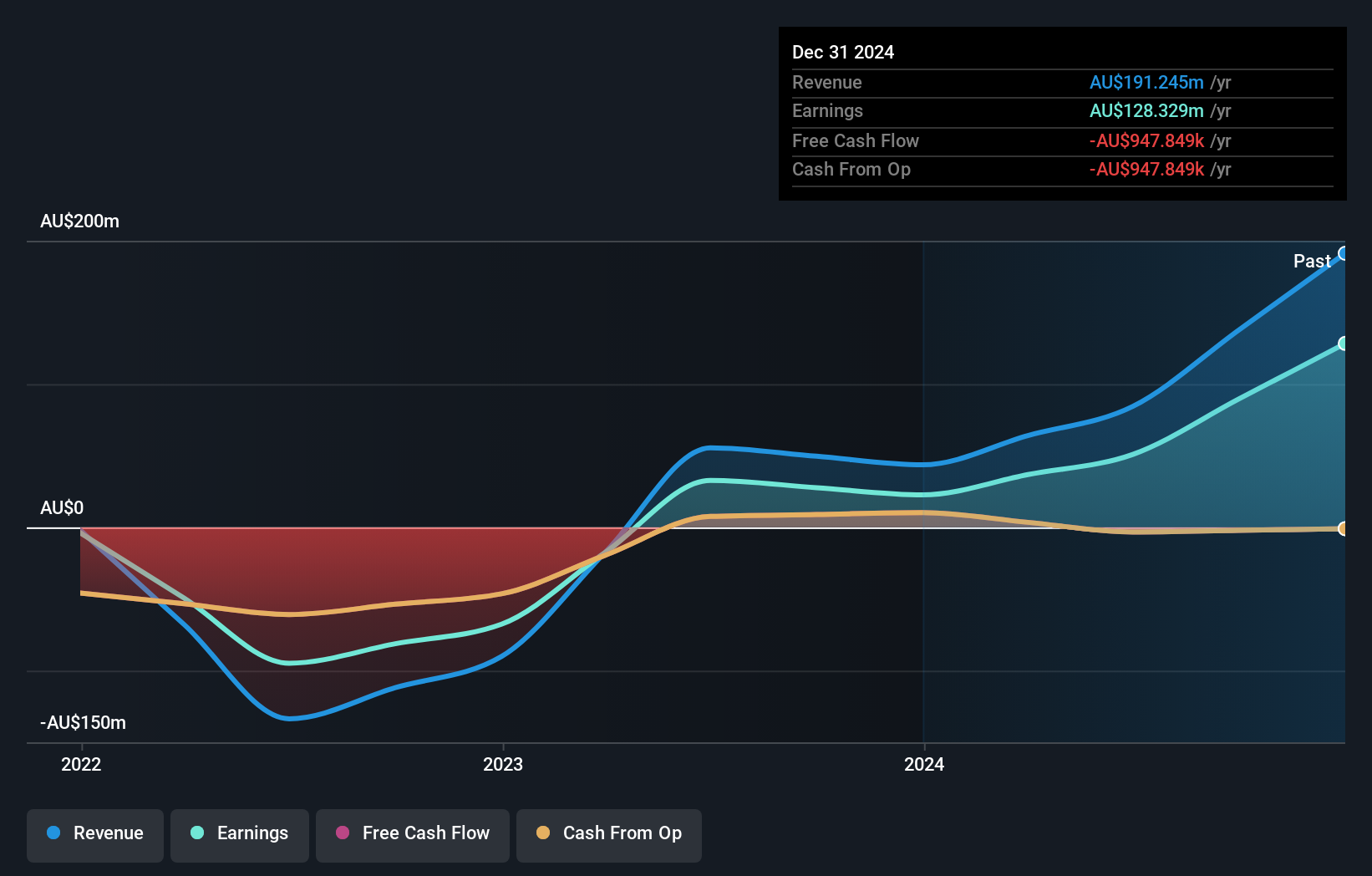

Hearts and Minds Investments, with its nimble market presence, showcases robust financial health. The company has been debt-free for five years, reflecting prudent management. Earnings surged by 109.7% over the past year, outpacing the Capital Markets industry growth of 12.7%. Its price-to-earnings ratio stands at a competitive 6.8x compared to the broader Australian market's 20.5x, suggesting potential value for investors. Recent earnings results show net income climbed to A$106.82 million from A$50.93 million last year, while dividends increased to A$0.09 per share, indicating strong cash generation despite negative free cash flow in recent quarters.

- Dive into the specifics of Hearts and Minds Investments here with our thorough health report.

Understand Hearts and Minds Investments' track record by examining our Past report.

Peet (ASX:PPC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Peet Limited is an Australian company that focuses on acquiring, developing, and marketing residential land, with a market capitalization of approximately A$941 million.

Operations: Peet generates revenue primarily through its Company Owned Projects, which contribute A$313.24 million, followed by Funds Management at A$56.39 million and Joint Arrangements at A$51.88 million.

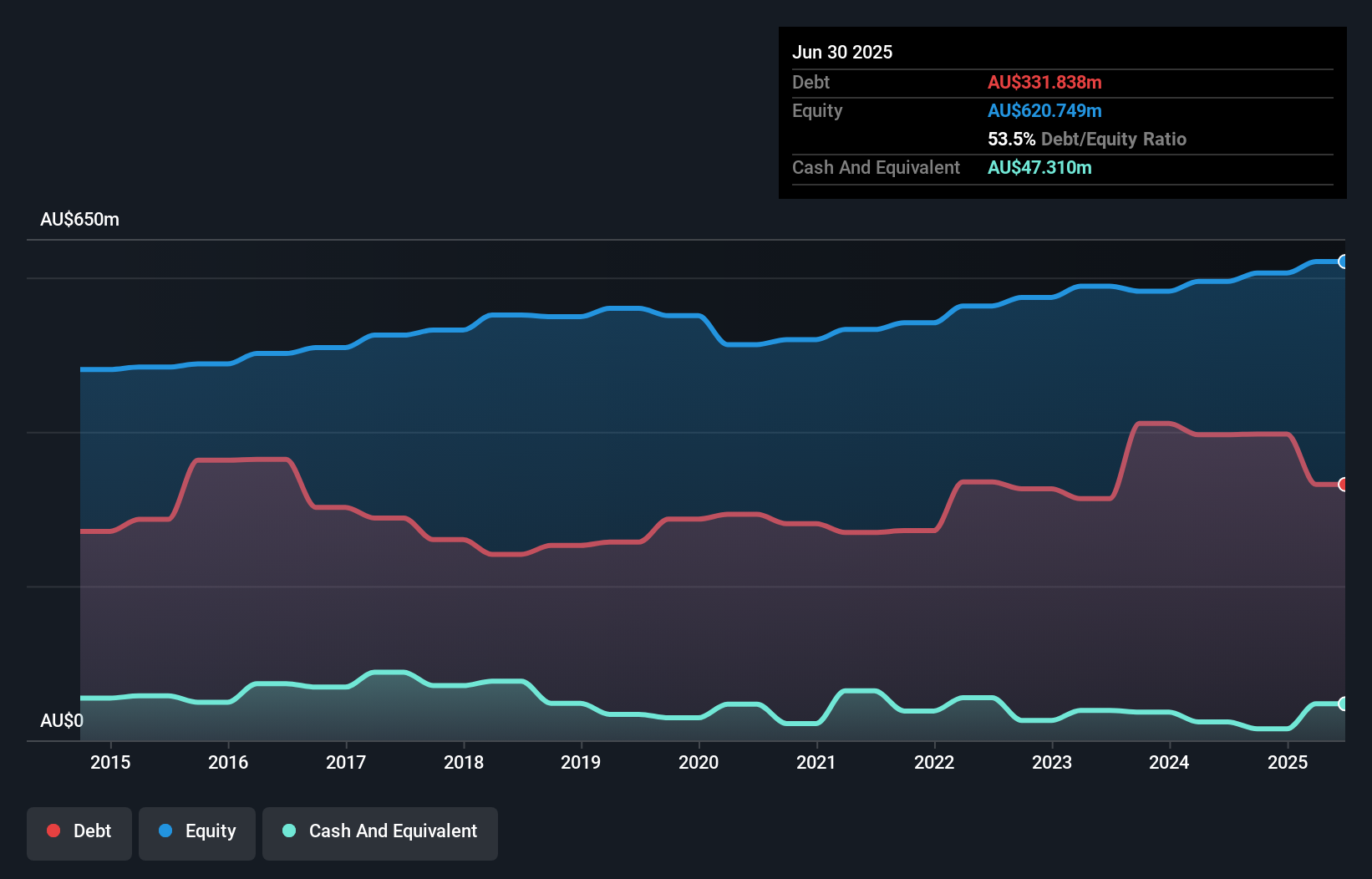

Peet, a notable player in the Australian real estate sector, has demonstrated robust earnings growth of 60% over the past year, outpacing the industry average of 31.8%. Despite its high net debt to equity ratio at 45.8%, Peet's interest payments are well covered by EBIT at a solid 10.7 times coverage. The company's financial health is further supported by positive free cash flow and a reduction in its debt to equity ratio from 57.1% to 53.5% over five years. Recent executive changes include Mr. Tony Gallagher's departure amid an organizational restructure, reflecting strategic shifts within Peet's management framework.

- Click here to discover the nuances of Peet with our detailed analytical health report.

Gain insights into Peet's past trends and performance with our Past report.

Wagners Holding (ASX:WGN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Wagners Holding Company Limited operates in the production and sale of construction materials and related building materials across several countries, including Australia, the United States, and New Zealand, with a market capitalization of A$697.04 million.

Operations: Wagners generates revenue primarily from Construction Materials (A$257.69 million), Project Services (A$105.71 million), and Composite Fibre Technology (A$68.45 million). The company focuses on these segments to drive its financial performance across multiple regions.

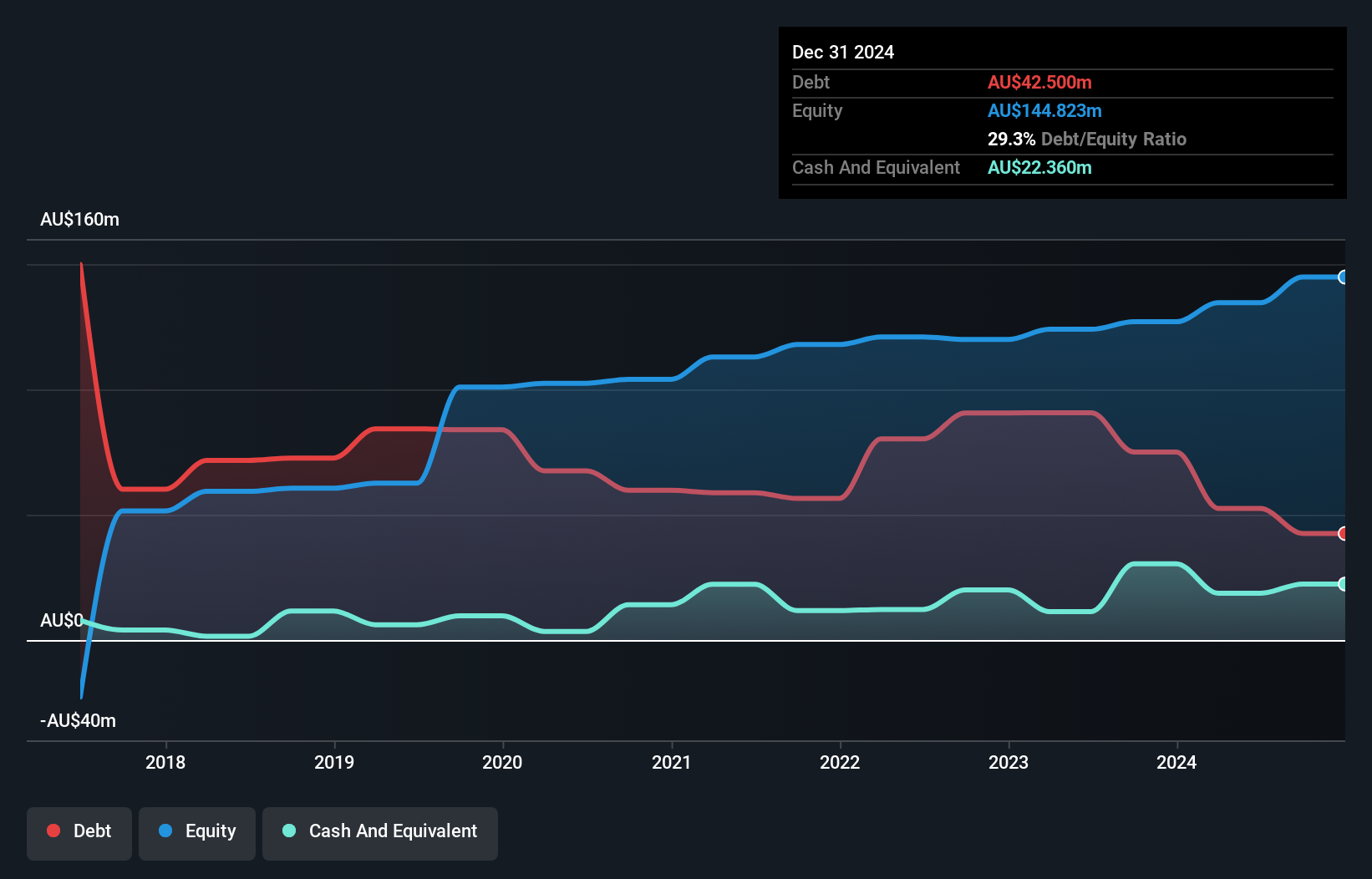

Wagners Holding has shown impressive growth, with earnings surging by 121% over the past year, outpacing the industry’s 3%. The company’s debt to equity ratio improved significantly from 65.9% to 27.5% in five years, indicating effective debt management. Despite significant insider selling recently, Wagners remains free cash flow positive and its interest payments are well covered by EBIT at a ratio of 3.9x. Recent inclusion in the S&P/ASX Emerging Companies Index and a successful A$30 million follow-on equity offering highlight its potential for further growth, though dependence on regional construction poses risks amidst expanding operations.

Seize The Opportunity

- Click this link to deep-dive into the 54 companies within our ASX Undiscovered Gems With Strong Fundamentals screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wagners Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WGN

Wagners Holding

Engages in the production and sale of construction materials and related building materials in Australia, the United States, New Zealand, the United Kingdom, Papua New Guinea, and Malaysia.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives