- Australia

- /

- Metals and Mining

- /

- ASX:TKM

3 Promising ASX Penny Stocks With Market Caps Over A$10M

Reviewed by Simply Wall St

As the ASX200 shows signs of optimism with a projected rise, investors are keeping a close eye on market movements influenced by global events like the US elections and China's National People's Congress. Amid these developments, penny stocks continue to capture attention for their unique blend of affordability and growth potential. Despite being considered an outdated term, these stocks represent smaller or newer companies that might offer compelling opportunities when backed by strong financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.595 | A$69.75M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.765 | A$287.37M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.52 | A$322.48M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.63 | A$798.83M | ★★★★★☆ |

| Perenti (ASX:PRN) | A$1.155 | A$1.07B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.14 | A$61M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$3.19 | A$141.71M | ★★★★★★ |

| Joyce (ASX:JYC) | A$4.33 | A$129.2M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.885 | A$104.27M | ★★★★★★ |

Click here to see the full list of 1,035 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

CTI Logistics (ASX:CLX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: CTI Logistics Limited, along with its subsidiaries, offers transport and logistics services in Australia and has a market cap of A$152.51 million.

Operations: The company generates revenue primarily from its Transport segment at A$225.42 million and Logistics segment at A$118.28 million, with additional income from the Property segment amounting to A$6.37 million.

Market Cap: A$152.51M

CTI Logistics Limited, with a market cap of A$152.51 million, primarily generates revenue from its Transport and Logistics segments. Despite a seasoned management team and high-quality earnings, the company faces challenges such as declining net profit margins and negative earnings growth over the past year. Debt is well-managed with operating cash flow covering 105% of it, though short-term assets fall short of covering both short- and long-term liabilities. Trading at 55.6% below estimated fair value may indicate potential undervaluation. Recent results show slight sales growth but decreased net income compared to the previous year, alongside an affirmed dividend payout.

- Navigate through the intricacies of CTI Logistics with our comprehensive balance sheet health report here.

- Assess CTI Logistics' previous results with our detailed historical performance reports.

NICO Resources (ASX:NC1)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: NICO Resources Limited focuses on the acquisition, exploration, and development of mineral properties in Australia with a market cap of A$13.13 million.

Operations: NICO Resources Limited currently does not report any revenue segments.

Market Cap: A$13.13M

NICO Resources Limited, with a market cap of A$13.13 million, is pre-revenue and currently unprofitable, reporting a net loss of A$3.62 million for the year ended June 30, 2024. The company benefits from being debt-free and having short-term assets (A$5.1M) that comfortably cover its short-term liabilities (A$712.5K). However, it faces challenges with high weekly volatility compared to most Australian stocks and an inexperienced board averaging 1.6 years in tenure. Additionally, NICO has less than one year of cash runway based on current free cash flow trends without significant revenue streams to offset ongoing losses.

- Dive into the specifics of NICO Resources here with our thorough balance sheet health report.

- Evaluate NICO Resources' historical performance by accessing our past performance report.

Trek Metals (ASX:TKM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Trek Metals Limited, along with its subsidiaries, focuses on the exploration and development of mineral properties in Australia, with a market cap of A$15.92 million.

Operations: Trek Metals Limited has not reported any revenue segments.

Market Cap: A$15.92M

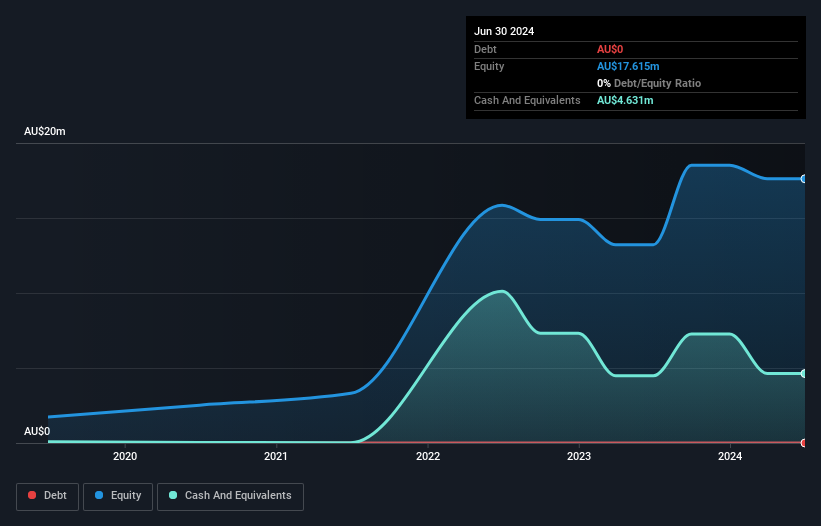

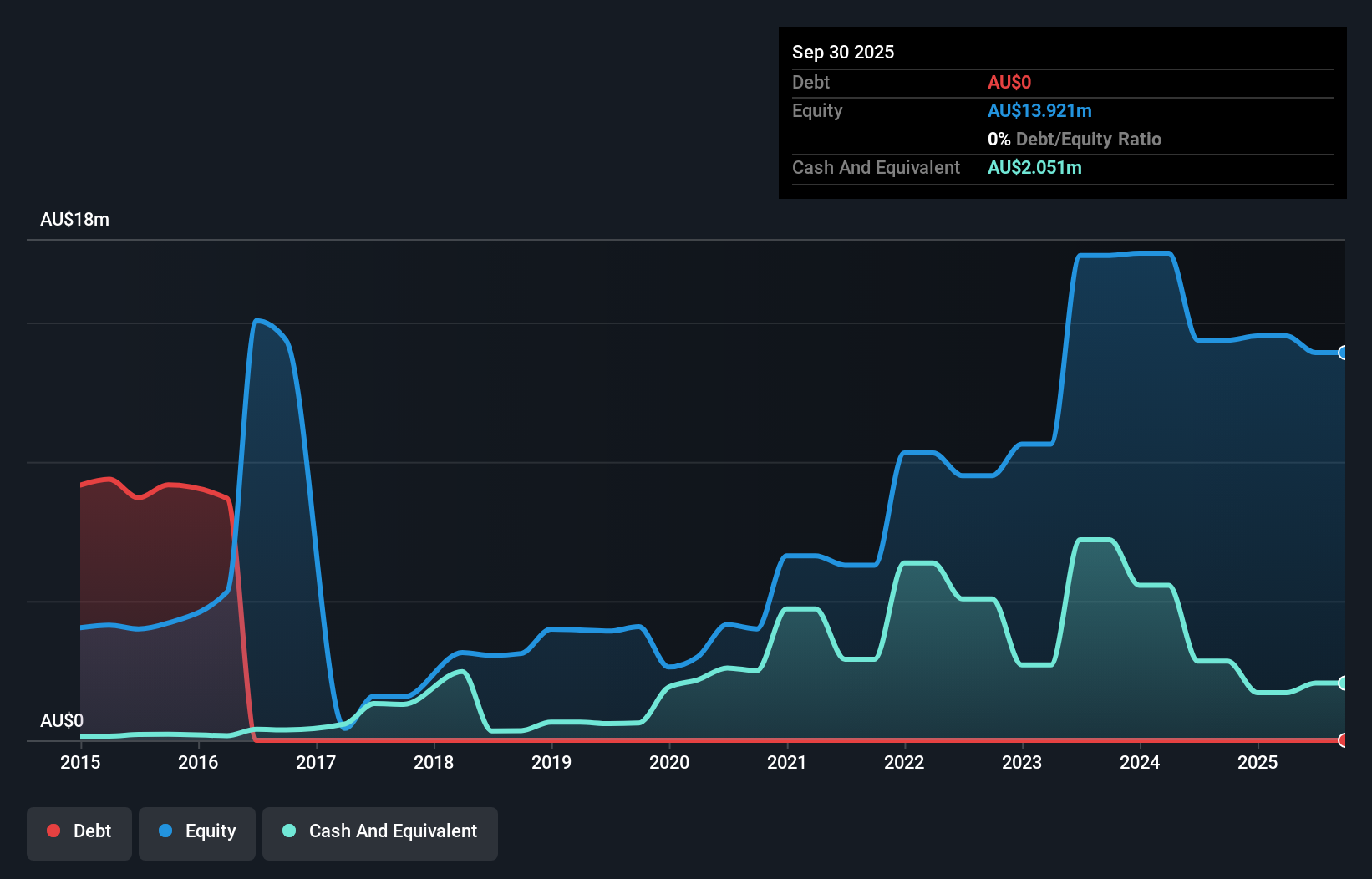

Trek Metals Limited, with a market cap of A$15.92 million, is pre-revenue and currently unprofitable. The company benefits from being debt-free and having short-term assets (A$5.7M) that exceed both its short-term (A$1.0M) and long-term liabilities (A$35.6K). Despite shareholder dilution over the past year, Trek's board has seasoned experience with an average tenure of 4.2 years. However, the stock experiences high volatility compared to other Australian stocks and faces challenges with declining earnings over five years at 14.2% per annum, though it maintains a cash runway for more than a year under current conditions.

- Jump into the full analysis health report here for a deeper understanding of Trek Metals.

- Gain insights into Trek Metals' historical outcomes by reviewing our past performance report.

Where To Now?

- Explore the 1,035 names from our ASX Penny Stocks screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trek Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TKM

Trek Metals

Engages in the exploration and development of mineral properties in Australia.

Flawless balance sheet moderate.